The speed bumps that will slow a rate rise

The cash rate remained at 2.5 per cent in November -- the 14th consecutive meeting without a rate move -- and the Reserve Bank of Australia (RBA) has yet again signalled a period of stability.

But the Australian economy continues to face a number of stiff challenges and the next rate move -- whether up or down -- is far from certain.

Low interest rates continue to support the Australian economy and growth continues to rebalance towards the non-mining sector. For example, household spending over the past year has been almost entirely concentrated within New South Wales and Victoria (Don't count on a lasting retail recovery; November 4), while residential construction continues to pick up.

Nevertheless, there remain a number of issues that will encourage the RBA to leave rates unchanged -- or perhaps even lower them further. The conditions which sparked Australia's unprecedented period of economic growth are now in reverse and that will be difficult to overcome in the medium term.

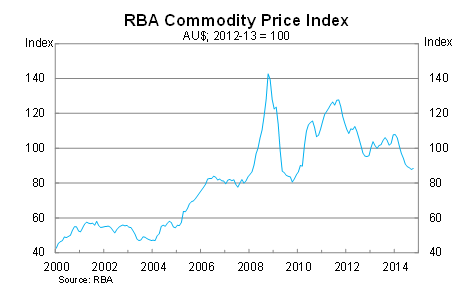

At the centre sits the mining sector and the unfortunate combination of falling investment and commodity prices. So far the rise in exports volumes has been insufficient to adequately offset the decline in commodity prices, with the value of exports incredibly weak over the past six months.

Iron ore producers are struggling and low prices represent an existential threat to a number of them. The RBA hasn't shied away from that fact, acknowledging in its August Statement on Monetary Policy that “the outlook for prices will depend on what proportion of these mines is shut down” (Prepare for more Australian miners to crumble; August 11).

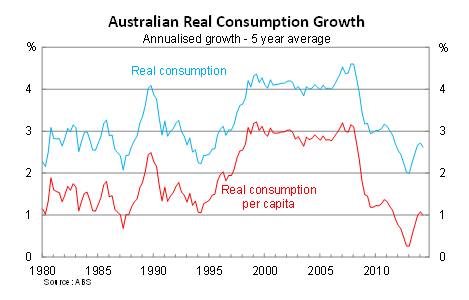

The non-mining implications of these developments are also significant. The mining boom ushered in a period of unprecedented income growth -- which proved beneficial to the mining and non-mining sectors alike -- but the effects are symmetrical: the decline in the terms-of-trade will not simply create difficulties for the mining sector but weigh on income growth for the entire economy.

That process has already begun and a casual glance at real consumption per capita highlights the extent to which aggregate activity is now driven by population growth rather than a higher standard of living. Soft consumption growth per household and weaker income growth are, unfortunately, here to stay.

According to new estimates from the ABS, the unemployment rate now sits at 6.2 per cent -- its highest level in 12 years -- while the participation rate continues to ease. Migration rates have slowed -- from historically high levels -- which may reduce some pressure on domestic (particularly youth) unemployment in the medium term. Of course, at the moment that may all be for naught given the economy is creating insufficient jobs and employment has barely climbed in six months.

At the very least we won't have to worry about inflation, which -- according to the RBA -- is of no immediate concern. It expects annual inflation to remain within the bank's target of 2 to 3 per cent for the foreseeable future.

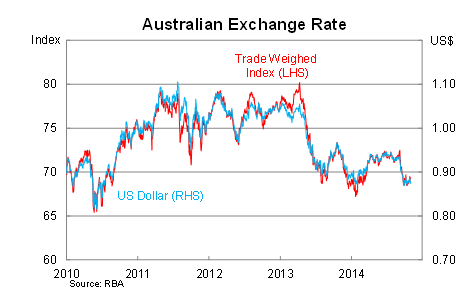

A lower exchange rate is the factor most likely to cause a surge of inflation -- by increasing the cost of imports -- but the RBA notes that with “growth in wages … expected to remain relatively modest over the period ahead”, inflation should remain “consistent with the target even with lower levels of the exchange rate.”

The exchange rate itself has eased in recent months but according to the RBA “remains above most estimates of its fundamental value, particularly given the further declines in key commodity prices in recent months.”

The Australian dollar has historically been tied to commodity prices but appears to have decoupled somewhat more recently; I'd be surprised if that persisted long-term though and fully expect the dollar to ease significantly against the US dollar and the trade-weighted-index in the year ahead.

The outlook for policy has changed little in recent months, although the argument for lifting rates has arguably eased.

It's important to remember that the RBA takes a forward-looking approach to monetary policy, which often involves setting policy for economic conditions 12 to 18 months from now. The economy is travelling at a moderate pace, but even the RBA would admit that the biggest challenges lay ahead of us.

With those challenges -- most notably the collapse in mining investment and the decline in the terms-of-trade -- set to take place over a number of years, it is possible that low rates will remain a feature of Australia's economy for a number of years before the RBA considers policy normalisation.