The shaky foundations of the housing construction boom

The housing construction boom has finally begun. Approvals to build have finally transitioned to the construction stage and that will be welcome news for the Reserve Bank of Australia and the Australian economy. But with mining investment beginning to contract will that be enough to keep the Australian economy on track?

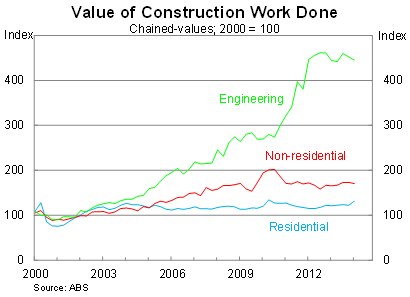

Construction work done rose by 0.3 per cent in the March quarter, beating market expectations of a modest fall, to be 2.6 per cent higher over the year. A sharp rise in residential construction more than offset a fall in engineering and non-residential construction.

Residential construction rose by 6.8 per cent in the March quarter, to be 8.4 per cent higher over the year. It is worth noting that alternations and additions rose only modestly in March; as a result, the actual rise in construction of new housing was 7.8 per cent higher in the quarter.

The pick-up in residential investment will come as welcome news for policy makers. Nevertheless it remains uncertain how long the boom will last or the size of the pick-up.

Building approvals have already peaked and that suggests that the boost to investment could be fairly short and sweet. Offsetting this to some extent is that much of the pick-up in building approvals was concentrated in high density units, which have longer lead times and can take a little longer to go through the production stage.

Engineering construction – which can be viewed as a proxy for mining investment – declined by 1.6 per cent in the March quarter and is now just 0.2 per cent higher over the year. This series is set to decline sharply over the next few years based on current investment intentions from the mining sector. Most notable mining projects have been completed, with the sector transitioning from investment to production, while some new projects could be in jeopardy as commodity prices and our terms-of-trade tumble.

Non-residential investment declined by 1.5 per cent in the March quarter and is now 3.1 per cent higher over the year. This largely reflects public sector non-residential investment; by comparison, private sector non-residential investment rose by 3.7 per cent in the March quarter.

I have a set of simple models that track how construction activity feeds through to real GDP growth using current and lagged construction spending. Based on these models, private residential investment in the national accounts is set to rise by around 4.7 per cent in the March quarter, while private non-residential investment is set to climb by 3.9 per cent. On the basis of this data, analysts will need to upgrade their forecasts for the March quarter.

At the state level, growth was driven by New South Wales and Victoria and was concentrated among residential investment. Construction declined noticeably in Queensland and South Australia.

Tomorrow the ABS releases its Capex survey, which will provide a second look at investment expectations for the 2014/2015 financial year. Current expectations are that mining investment will drop off sharply over that period, creating a significant hole in GDP growth that the likes of exports, consumption and residential investment are expected to fill.

The survey will provide some insight into whether the RBA has done enough to provide a smooth transition for the Australian economy. If the expectations are considerably weaker than those provided three months ago then it could be the trigger than encourages the RBA to push rates lower -- particularly if momentum continues to slow in the housing market.