The RBA's case for intervention gains currency

If there is any remaining doubt over the need for the Australian dollar to fall, a quick gander at gross domestic product over the past year should set you straight.

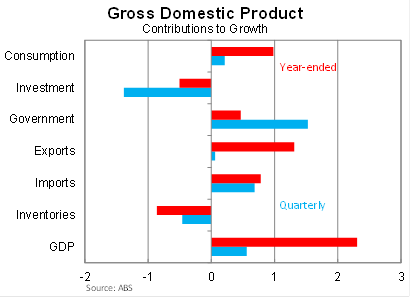

Growth in the September quarter was weaker than the market expected, with the economy 2.3 per cent higher over the year (compared with expectations of 2.6 per cent higher).

There are a few points worth noting.

First, the strong contribution from net exports reflects declining imports rather than export growth. Part of this is due to the Australian dollar depreciating during the September quarter but it may also reflect subdued domestic demand.

Second, businesses ran down their inventories further during the September quarter – a trend that has occurred throughout 2013. Often this occurs when sales exceed business expectations. But this narrative though doesn’t really fit with current domestic conditions. I find it surprising that businesses were caught out in the September quarter, unless businesses expected domestic demand to be even weaker. A positive though is that growth will be boosted when businesses begin to replenish their inventories.

Third, the strong growth in government expenditure reflects a one-off boost to fixed capital investment by state and local governments due to an asset transfer to the private sector. This factor also resulted in a corresponding decline in private non-residential investment.

The net effect of this transaction on GDP is negligible, but September quarter growth for these components is misleading and will continue to be for another three quarters, until the June quarter 2012 falls out of the annual data.

I estimate that the actual quarterly contribution of government expenditure was 0.2 percentage points (compared with official estimates of 1.5 percentage points) and for investment was -0.1 percentage points (compared with -1.4 percentage points) in the September quarter.

Fourth, the mining sector continues to be the biggest contributor to economic growth. Meanwhile, the manufacturing and wholesale trade sectors – two sectors the Reserve Bank needs to fill in the slack left by the mining sector – both contracted in the quarter.

On the whole, the September quarter GDP outcome highlights the importance of the external sector in supporting growth. This needs to continue over the next year or two as business investment declines and the economy adjusts away from a reliance on the mining sector and business investment.

Thankfully, the exchange rate is down a further 2.5 per cent since the end of September and that should boost exports and reduce imports a little more in the December quarter. But as the Reserve Bank has frequently said, the exchange rate remains “uncomfortably high”. To help boost the non-mining sector the Australian dollar will need to drop by at least another 5 per cent against its major trading partners.

But domestic demand is clearly struggling, with output consistent with slowing employment growth. The reality is that the government will have to continue to support the economy. ‘Stop the debt’ might be a useful slogan, but right now the economy cannot afford an additional headwind.

But there are some tentative signs that the economy has improved since September – and that is more important than today’s backwards-looking data. Interest rates are gaining some traction across the economy following positive data on retail sales and building approvals.

Consumers are beginning to spend a little more, painting the picture of a household sector that is finally becoming a little less cautious and more willing to open up their wallets. But there are some obvious concerns for the household sector, with the unemployment rate trending upwards and the terms of trade declining.

Overall, economic conditions confirmed what many of us already knew: the exchange rate is important. But we shouldn’t dwell on the past.

In the near-term it will be necessary for the Reserve Bank to continue its verbal war against the dollar, but they shouldn’t be afraid to intervene if the dollar remains “uncomfortably high”. The currency is obviously of paramount importance to Australia’s growth prospects and the Reserve Bank should be willing to do more to help facilitate the adjustment if necessary. A lot will depend on whether the Fed begins to taper and, for Australia, we hope that process begins as soon as possible. If not, then the Reserve Bank must consider the possibility of intervention.