The RBA must shift out of neutral

The Reserve Bank of Australia continues to take a neutral stance on policy but, with more timely data showing that the economy continues to slow, it is time that the RBA gave serious consideration to cutting rates further.

The RBA monthly board minutes are often a mixed bag. They occasionally provide additional insight into our central bank’s thinking, insight that hasn’t necessarily been communicated in its board statement or other speeches. But more often than not, they communicate a dated view of the economy.

The minutes this month were unfortunately of the latter variety. Of more interest is the data since the meeting, which has been fairly dreadful, suggesting that the economy has lost some momentum since the RBA met on July 1.

Arguably the three most important indicators this month have been retail sales, international trade and the labour market. All three suggest that activity has softened or will continue to slow in the months ahead.

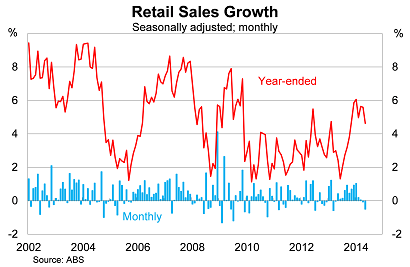

Retail sales fell by 0.5 per cent in May, to be 4.6 per cent higher over the year (A household spending slowdown is squeezing the economy, July 3). Spending in April and May is 0.2 per cent is below the March quarter average, and that reflects the value rather than the volume of goods purchased. Even with a strong outcome in June, which seems unlikely, it appears almost certain that household consumption will subtract from real GDP growth in the June quarter.

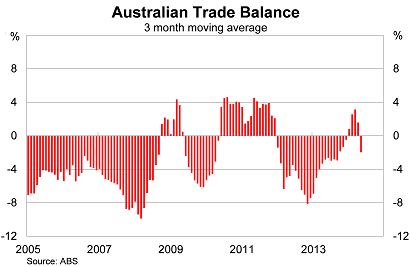

Also weighing on growth, our trade deficit blew out to $1.9bn in May -- the biggest deficit since January 2013 -- and suggests that trade may subtract from growth in the June quarter (Making sense of a trade deficit blowout, July 2). Net exports were one of our few over-performers in the first quarter, leaving growth in the June quarter particularly vulnerable.

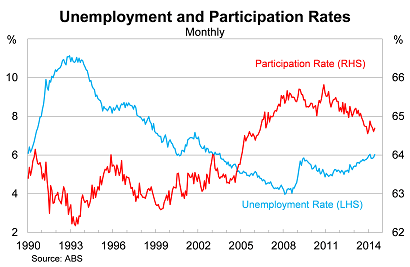

The labour market didn’t necessarily decline further but there is little evidence that it is improving. There is also cause for concern, with ANZ recently suggesting that the mining sector could lose up to 75,000 jobs over the next couple of years -- jobs that will not be easily absorbed into the broader economy (The jobs picture is starting to look ugly, July 2).

The unemployment rate rose to 6.0 per cent in June but that was largely offset by a modest rise in the participation rate. As a result, labour market conditions were largely unchanged. But with household spending softening and the mining sector losing jobs, the labour market is set to deteriorate further before it begins to recover.

These factors may simply reflect a short-term decline in the pace of growth but with mining investment set to collapse in the coming quarters, the timing couldn’t be worse. To successfully navigate the fall in resource investment and rebalance the Australian economy, we need strong growth in household spending, net exports and housing construction.

Housing construction, by far the least important component, is set to rise strongly over the next few years but is simply too small to make much of a difference. The outlook for exports is particularly sensitive to conditions in China but is expected to perform strongly. However, there are considerable risks, particularly since Chinese authorities are attempting to ease excess capacity in their steel sector.

The outlook for the household sector is fairly weak, driven by negative real wages and budget cuts that target our most vulnerable citizens. Coupled with rising indebtedness, which is reducing our purchasing power, the outlook for consumption is far from pretty.

The Australian economy faces a number of headwinds over the next few years and the data in July so far suggests that the economy may be weaker than many expect when we finally face these challenges. The decline in mining investment has so far been fairly minor, and a mere drop in the water compared to the eventual decline that will occur over the next few years.

The RBA minutes state that “the most prudent course was likely to be a period of stability in interest rates”, but after the last month I’d be shocked if it didn’t incorporate more dovish language when it meets next month. It should give serious consideration to lowering rates before the end of the year.