The RBA could face an inflation quandary

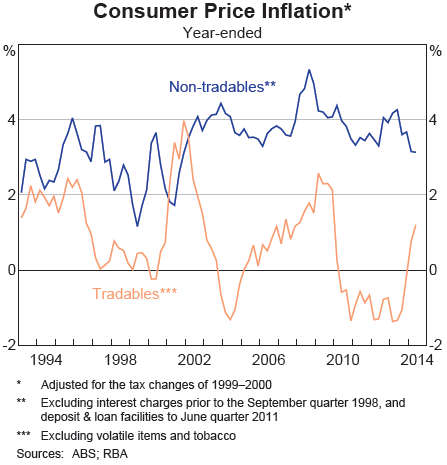

Does Australia have an inflation problem? It’s not bad enough to warrant a rate hike -- at least not yet -- but it may create a conundrum for the Reserve Bank of Australia down the track. I am talking about inflation on Australia’s non-tradable goods, which for years has been obscured (and admittedly partly caused) by our strong terms of trade and high Australian dollar.

Understanding and forecasting inflation has always required an intimate knowledge of inflation on tradable and non-tradable goods. Recent research by the RBA reiterates this point and provides greater insight into the factors driving non-tradable inflation.

Non-tradable goods face little international competition and typically reflect services that can only be delivered domestically. As such, inflation on non-tradable goods largely reflects domestic factors such as wage growth.

By comparison, prices on tradable goods are largely dictated by international competition. It should come as little surprise that the RBA has never had much success trying to curb imported inflation from tradable goods.

While the RBA targets annual inflation of between 2 and 3 per cent over the cycle, inflation on tradable and non-tradable goods can fluctuate wildly. Inflation on non-tradable goods is clearly more stable but has also increased at an annual rate of 3.7 per cent over the past decade. Just as clearly, international forces have, on average, weighed on domestic inflation for over a decade now.

Non-tradable items account for about 60 per cent of household spending and their share of consumption has increased significantly over the past couple of decades. This in part reflects the higher prices for non-tradable goods but also an increasing preference for these goods -- household spending is increasingly dominated by non-tradable services.

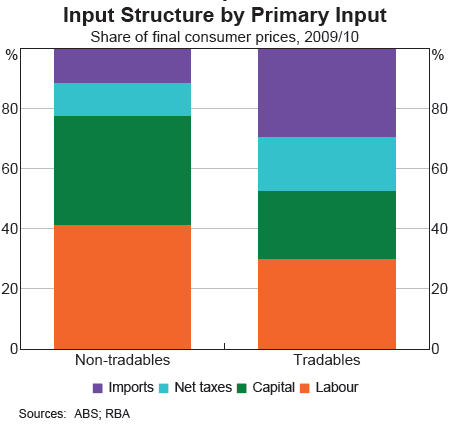

According to the RBA, about 90 per cent of the price of non-tradable goods is determined by domestic factors. These include wages, return on capital and net taxes. Imports -- as inputs into production -- account for just 10 per cent of the final price.

As a result, the exchange rate has a relatively small direct impact on the price of non-tradable goods, although the RBA acknowledges that this may understate the true effect of the dollar on prices. It notes that "a depreciation is likely to induce consumers to spend less on tradable items … and more on non-tradable items … providing scope for sellers to raise their prices".

There are a number of supply and demand factors that may help to explain these trends.

On the supply side, productivity growth has been much stronger in the tradables sector but higher wage demands have spilled over to the broader economy. As a result, unit labour costs have increased significantly in the less productive non-tradables sector.

We also shouldn’t discount the effect of Chinese growth on the composition of goods traded internationally. By sheer virtue of its size -- and relatively low wages -- this has placed downward pressure on the price of some internationally trade goods.

But high prices on non-tradable goods may also reflect higher demand for these goods. Traditionally higher wealth and income is tied with greater consumption of services compared with tradable goods.

Australia has benefited from an unprecedented once-in-a-lifetime terms-of-trade boom, which pushed the exchange rate up and lowered the price of tradable goods. It also increases the purchasing power of household incomes and, as noted above, encouraged greater spending on domestic services.

The gains from our terms-of-trade boom are beginning to unwind and the exchange rate is showing tentative signs of normalisation. The effect of this will take some time to materialise in domestic inflation, but they could be significant.

First, inflation on tradable goods may moderate in the near-term but will increase significantly over the next couple of years. If the dollar declines to around US80c, then the imported component of tradable goods -- around 30 per cent of the total cost -- would contribute around 3.75 percentage points to tradable inflation spread over a couple of years.

Second, a lower terms of trade will weigh on domestic wages and will reduce the purchasing power of those incomes. This process is already underway -- combined with higher unemployment and rising spare capacity -- but has yet to completely feed through to domestic inflation.

I noted at the beginning of the article that the RBA might face a conundrum. We cannot discount the possibility that in the short-term inflation may surge -- driven by the exchange rate -- while growth remains below trend.

Would the RBA raise rates in this circumstance? History says yes, but I wonder if the RBA has learned anything from its unsuccessful efforts to curb imported inflation during 2007-08? Perhaps this time it will wait for the exchange rate to settle -- tolerating temporary higher inflation -- in the knowledge that domestic wages are gradually moderating.