The power of regular contributions over the long term

When it comes to building wealth, one of the most effective strategies is surprisingly simple: investing regularly. Whether you're putting away $50 a week or $500 a month, consistently adding to your investment portfolio can make a huge difference over time.

This approach turns investing into a habit - not something you have to overthink each time. And if you automate it, even better. Once it's set up, you can more or less set and forget. No need to guess the perfect time to buy or stress over what the market's doing.

So, how does regular investing actually help you build wealth - and why does it work so well? Let's break it down.

The benefits of regular investing

Compound interest: Regular contributions can supercharge your wealth

One of the biggest perks of regular investing is that it taps into the magic of compound interest. In simple terms, this is when your investment earns returns - and then those returns start earning returns too.

So, every time you add more to your investment, you're not just topping up your balance, you're giving more money the chance to grow. The more often you invest and the longer you leave your money growing, the more impressive the results. You might be surprised at just how much this can add up over time.

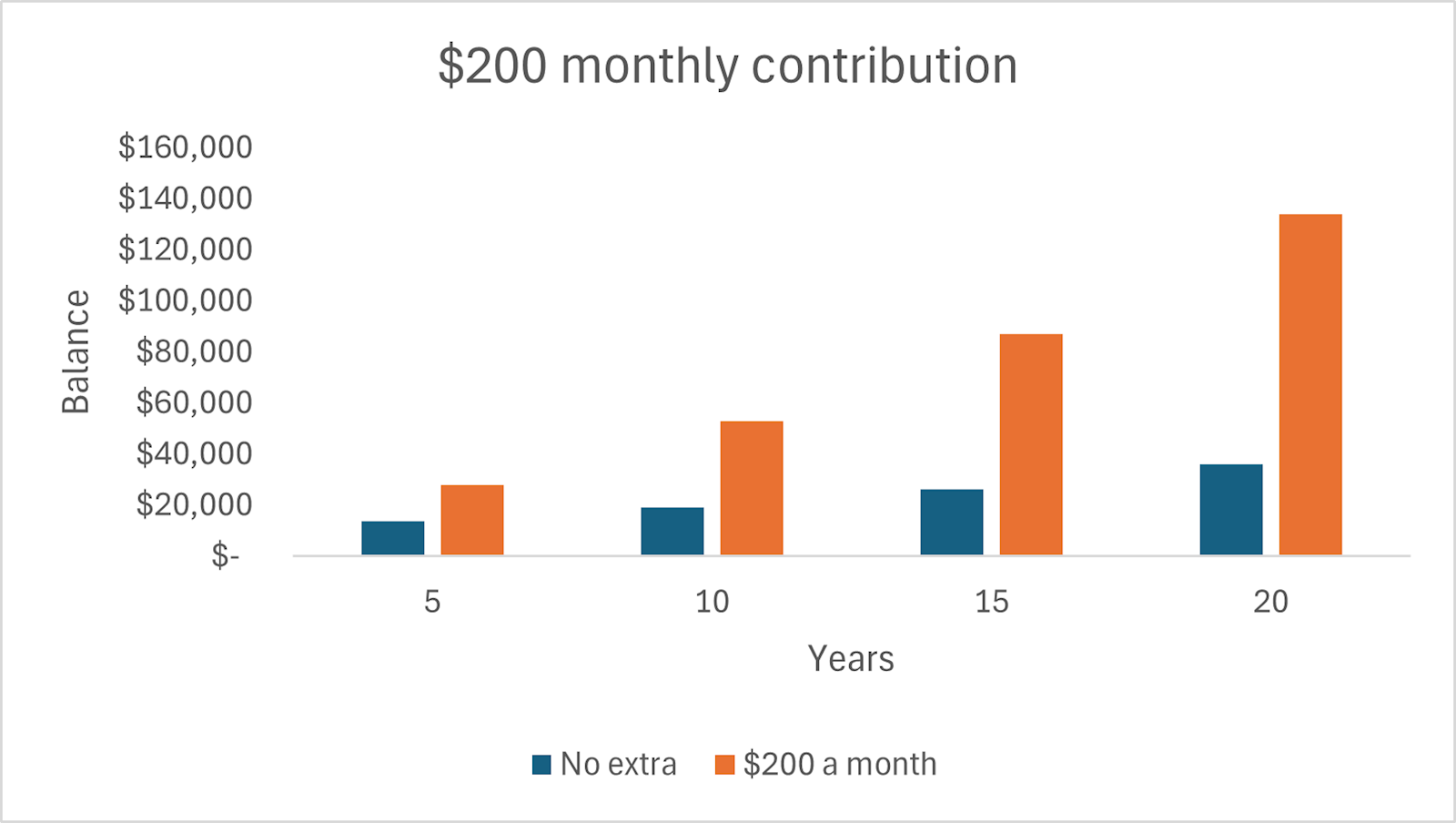

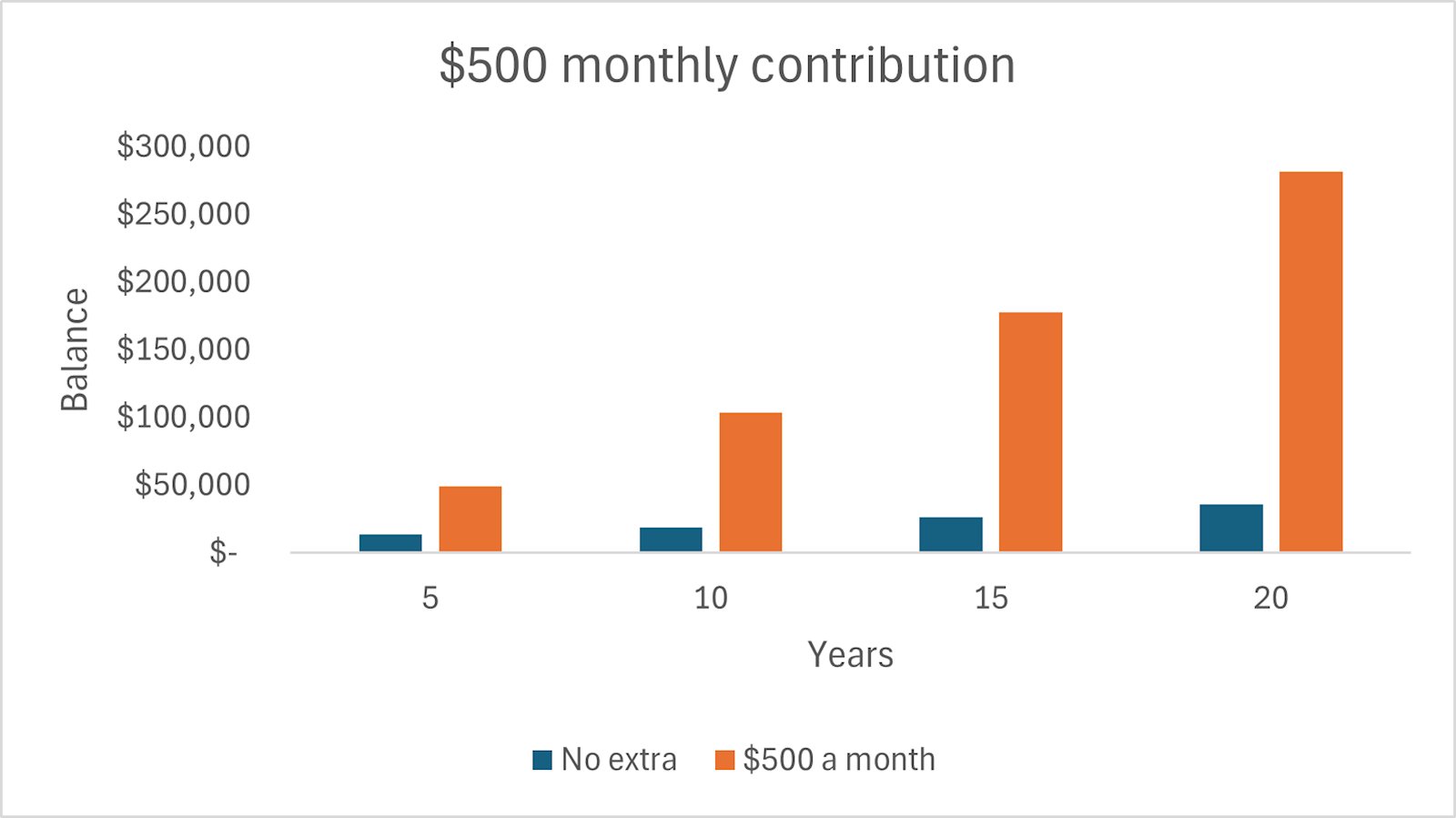

We've crunched the numbers using a simple, hypothetical example to show how regular investing can supercharge your wealth.

Let's say you invested $10,000 and didn't add anything else. After 10 years, assuming a 7% annual return, you'd end up with around $19,021. Not bad!

But if you added $200 a month to that same investment, your balance after 10 years would grow to $52,784 - an extra $33,763.

Now, $24,000 of that came from your extra contributions, but the remaining $9,763? That's pure growth from compounding.

And the longer you stick with it, the more impressive the results. After 20 years, the difference between adding nothing and continuing to top up each month jumps to nearly $98,000 - roughly half from regular contributions and half from earnings.

You can check out how different contribution amounts and timeframes stack up in the table and charts below.

The power of regular contributions

|

No additional monthly investment |

$100 monthly investment |

$200 monthly investment |

$500 monthly investment |

||||

|

Years |

Total balance |

Total invested |

Total balance |

Total invested |

Total balance |

Total invested |

Total balance |

|

5 |

$13,792 |

$16,000 |

$20,887 |

$22,000 |

$27,983 |

$40,000 |

$49,270 |

|

10 |

$19,021 |

$22,000 |

$35,903 |

$34,000 |

$52,784 |

$70,000 |

$103,429 |

|

15 |

$26,233 |

$28,000 |

$56,611 |

$46,000 |

$86,989 |

$100,000 |

$178,124 |

|

20 |

$36,179 |

$34,000 |

$85,172 |

$58,000 |

$134,164 |

$130,000 |

$281,866 |

Assumptions: $10,000 initial investment. 7% a year total return. 0.44% management fee (capped at $880 for balances over $200,000) and 0.11% admin fee. Returns reinvested. No transaction costs included. Monthly deposit received at the start of the month. Returns calculated at the end of the month. Fees calculated at the end of the month after deposit and returns.

.png)

Dollar cost averaging: A smarter way to invest through the ups and downs

Another benefit of regular investing is that it naturally uses a strategy known as dollar cost averaging. By investing the same amount at regular intervals - regardless of what the market's doing - you buy more units when prices are low and fewer when they're high. Over time, this can help lower your average cost and smooth out the bumps of market volatility.

It also removes the pressure of trying to "time the market", something even the pros get wrong. Instead of stressing about the perfect moment to jump in, you just keep investing - steadily and consistently. This helps you ride out market swings and reduce risk in the long run.

Psychological advantage: Turn investing into a habit

It's not just about the numbers - regular investing can make things feel a lot easier, too.

When you automate your investing, you remove the need to make decisions over and over again. And once it's set up, it often feels easier to keep going than to stop.

There's also a psychological payoff. Watching your portfolio grow steadily with each contribution gives you a sense of progress and motivation.

Plus, when the money is deducted automatically, you're less likely to notice it's gone. This makes it easier to stick with your plan over the long term without feeling like you're sacrificing other parts of your lifestyle.

How to get started

Getting into the habit of regular investing is easier than you might think. Start small, keep it consistent, and make it as automatic as possible. Here are some tips.

- Treat it like a subscription: One of the easiest ways to stick with regular investing is to treat it like any other subscription. Think about it - you probably don't second-guess your monthly Netflix or Spotify payment. It just happens automatically in the background. Your investment contributions can work the same way.

- Put your investing on autopilot: You can make it easy on yourself by setting up automatic regular contributions. Most platforms let you set up direct debits or auto-transfers, so a fixed amount is invested on the same day each week or month. That way it's done automatically without you having to think about it. And here's a tip: try to line up the date with your pay cycle, so you're investing before you even notice the money's gone - making it less tempting to spend.

- Reinvest your dividends: If your investment pays dividends or distributions, reinvesting them can give your portfolio an extra boost. So rather than taking them as cash, arrange for them to be automatically reinvested.

Key takeaways

Investing regularly - even small amounts - can really add up over time. Automating your contributions takes the guesswork out and makes it easy to keep going. Plus, with compound interest and dollar cost averaging working in your favor, your money has a great chance to grow steadily. The trick is to start early, stay consistent, and let your investments do their thing.

Ready to start investing? InvestSMART has a range of diversified portfolios that all come with a capped management fee. If you'd like help selecting the right style of portfolio for you, check out our free statement of advice quiz. It will show you which InvestSMART ETF portfolio may best suit your goals and investment timeframe.

Frequently Asked Questions about this Article…

Regular investing is powerful because it leverages the magic of compound interest. By consistently adding to your investment portfolio, you allow your returns to earn returns, significantly boosting your wealth over time.

Dollar cost averaging benefits regular investors by allowing them to buy more units when prices are low and fewer when prices are high. This strategy helps lower the average cost of investments and smooths out market volatility, reducing the risk of trying to time the market.

Regular investing offers psychological advantages by turning investing into a habit. Automating contributions removes decision-making stress, and watching your portfolio grow steadily provides motivation and a sense of progress.

You can automate your investment contributions by setting up direct debits or auto-transfers with your investment platform. Aligning the contribution date with your pay cycle can make it easier to invest consistently without feeling the financial impact.

Compound interest plays a crucial role in regular investing by allowing your returns to generate additional returns. This exponential growth can significantly increase your wealth over time, especially when combined with consistent contributions.

Reinvesting dividends can boost your investment portfolio by using the dividends to purchase more shares, which in turn can generate additional returns. This reinvestment strategy enhances the compounding effect and accelerates portfolio growth.

To start a regular investing habit, treat it like a subscription, automate your contributions, and reinvest dividends. Starting small and keeping it consistent can help you build a sustainable investment routine.

To choose the right investment portfolio for regular contributions, consider using tools like InvestSMART's free statement of advice quiz. This can help you identify a diversified portfolio that aligns with your goals and investment timeframe.