The post-election consumer honeymoon is over

As if the opinion polls were not enough, the fall in consumer sentiment indicates the Abbott government’s honeymoon is definitely over.

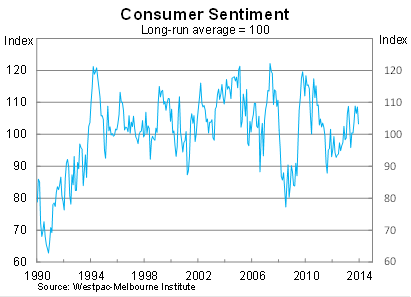

Today's Westpac-Melbourne Institute consumer sentiment survey showed sentiment in December has returned to its pre-election level, falling by 4.8 per cent, but remains above its long-run average. In addition, confidence surrounding the economic outlook deteriorated sharply in the month.

Consumer sentiment has been fairly consistent with retail sales in recent months. Nominal retail spending increased by 7.75 per cent in annualised terms over the three months to October, roughly the same pace as earlier in 2013 when consumer sentiment also spiked.

The decline has been attributed to the euphoria surrounding the Coalition victory fading in December, but that was always going to be short-lived before reality kicked in. Though it improved sentiment, I expect the Coalition victory had as much impact on consumer spending as it had on the number of boats arriving or debt accumulation.

Consumers respond to financial markets, to interest rate cuts and unemployment. Rising house prices might fill them with optimism, so do falling petrol prices. Governments on the other hand have more limited impact. Unless they are actively stimulating the economy or cutting expenditure, then they are not affecting retail spending a great deal.

As a result, I doubt that this decline in consumer sentiment will have a significant effect on spending in December. There remains the possibility that growth might slow, following several strong months, but even if that occurs, consumption growth is set to be solid in the December quarter.

The outlook for retail spending next year though is not so bright. Subdued income growth and rising unemployment will constrain spending to some extent, unless the dollar depreciates further. The result is likely to be below trend growth for the retail sector.

Respondents shared that pessimism regarding the economic outlook. However, I recommend that readers do not put too much weight on the month-to-month movements in the forward-looking indicators.

Evidence suggests that these outlook measures have little predictive power. Consumers are likely responding to current conditions rather than anything that has fundamentally changed regarding the outlook. In this case, if the overall index is being driven by fading optimism regarding the newly-elected government, then there is a good chance the outlook is too.

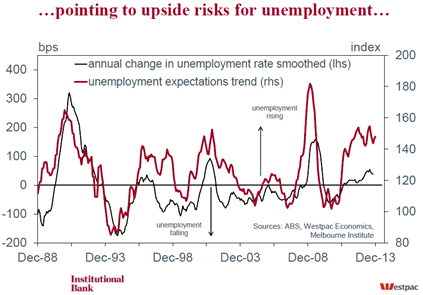

Perhaps the most interesting aspect of the Westpac-Melbourne Institute report is that unemployment expectations are again on the rise. It is clear that consumers remain highly concerned about job security (and rightly so), with Sydneysiders the most concerned and Melbournians the least.

As shown in the graph below, unemployment expectations broadly track actual changes in the unemployment rate. This suggests that the unemployment rate may rise a bit more before the non-mining sector recovers.

Tomorrow the Australian Bureau of Statistics releases its Labour Force Survey for November, which will provide further insight into where the economy is heading. Market expectations are for the unemployment rate to rise to 5.8 per cent, from 5.7 per cent in October, and for employment to expand by 10,000. Two interesting trends to keep an eye on is whether there continues to be a shift away from full-time to part-time employment and whether the participation rate continues to decline.

Overall, I’m not putting too much weight on the decline in consumer sentiment for December and I’m cynical that the change in government has had much of an effect on economic activity since September.

Obviously the household sector remains one of the keys to the non-mining sector recovery and the Reserve Bank of Australia will be watching spending patterns closely. But I doubt that this report will do much to change its outlook for the economy in 2014.