The numbers simply go against active funds most of the time

Renowned US investment consultant Charles D. Ellis wasn’t mincing his words back in 1975 when he drew attention to the fact most active fund managers don’t deliver on their promise.

“Contrary to their oft-articulated goal of outperforming the market averages, investment managers are not beating the market. The market is beating them,” Ellis said in his article “The Loser’s Game”.

More than 40 years after Ellis first penned his controversial article, in which he also advocated a strategy based on diversified low-cost index fund investing, the spotlight on active investment management returns is burning brighter than ever. Craig Lazzara, New York-based Global Head of Index Investment Strategy for S&P Dow Jones Indices, says professional investment management has become “a zero-sum game”, because the only source of outperformance for the winners is the underperformance of the losers.

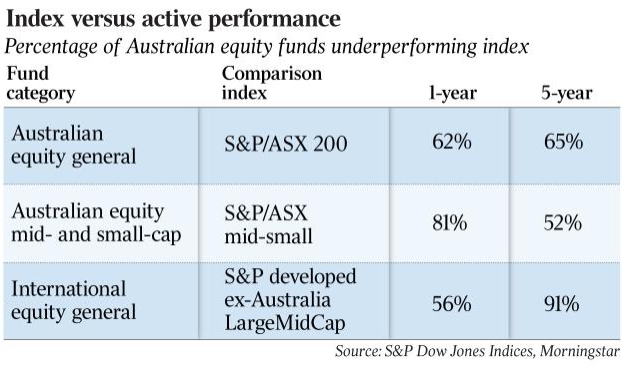

The latest S&P Indices Versus Active Scorecard report (SPIVA) published by S&P Global shows 61.69 per cent of Australian equity general funds underperformed against the S&P/ASX 200 index in the year to June 30.

The story isn’t any better over the longer term, either. Over three years, 65.69 per cent of active managers underperformed the key Australian benchmark index; over five years, 64.69 per cent missed the mark, and even over 10 years — representing the full phase of stock market activity since the global financial crisis — 75 per cent underperformed.

“Not surprisingly, as investors have been disappointed by the performance of active managers, they’ve looked for alternatives,” Lazzara said during a visit to Australia just recently. “And of course, as it happens, passive management has been able to deliver competitive returns, low fees, transparency and, depending on the structure, perhaps tax efficiencies.”

Active-passive

But should investors bother with active management strategies at all? As Wealth columnist James Gerrard argued last weekend … investors should be covering both bases, because there’s a definite place for both active and passive holdings. It all comes down to good asset allocation and discipline.

Vanguard Australia Head of Investment Strategy, Aidan Geysen, says investors deciding how to allocate their portfolios across actively managed and index investments should follow clear processes to avoid arbitrary decision-making.

“Discussions about active and index investing can draw some strong views from investors and their professional advisers, one way or the other,” he says.

“The best method for achieving a reasonable allocation is derived from a core philosophy of having clear goals, minimising costs, being diversified and maintaining discipline. We see active-passive not as a debate, but as an asset allocation decision, and this framework gives investors a clear process to help them determine the active and index allocations within their portfolio.”

A much discussed “decision-making framework”, developed by Vanguard’s global Investment Strategy Group, targets four variables to help investors consider when deciding how to implement index, active, or a combination of both, for a given asset class in their portfolio: gross alpha expectation, cost of active management, active risk, and risk tolerance.

“Investors will invariably have different goals, return requirements, time horizons and risk tolerance, and so whether or not a higher allocation to active is appropriate can differ greatly,” Geysen says.

“In some cases, a higher allocation to active may be appropriate when expected alpha outweighs management costs, when an investor is comfortable with the level of risk being taken, and when the investor has the discipline to stick with an active strategy through periods of underperformance.

“But an investor can still choose to balance that active risk with an index component in their asset class exposure, accounting for potential underperformance. In the end, choosing between active and index isn’t a philosophical decision — it’s part of the asset allocation process,” he explains.

ETF drivers

Meanwhile, Lazzara says the huge inflows of retail investor capital into passive exchange-traded index funds is a direct reflection of the disappointing performance of active managers. He says the growing sophistication of retail investors and ETF products, including the rise of factor-based “smart beta” funds that use stock screening criteria to mimic the strategies of active managers, is making it increasingly harder for active fund managers to outperform.

Another factor he highlights is the low level of dispersion in the stock market between the best and worst-performing stocks. Dispersion is a measure of the breadth of performance in the market. A good active manager will benefit in a high dispersion environment because it is relatively easier to pick stocks that will outperform. If the better stocks are outperforming the worst stocks by a large margin, the manager’s overall fixed costs will be easily covered.

“One of the things that has made active management particularly difficult over the past six to eight years is that dispersion has been quite low,” Lazzara says. “An active manager’s skill level does not depend on dispersion. But the value of skill is higher when dispersion is higher.”

Vanguard’s Geysen says a decision-making framework can help investors work out whether an active or index strategy is right for their circumstances.

“But patience is the key,” he says. “For those Australian managed funds that outperformed over the past 15 years, 97 per cent still experienced three or more individual years of underperformance, with 60 per cent experiencing six or more. A framework like this might not always deliver investors the ‘just right’ Goldilocks combination of index and active, but it can help keep their investment goals at the forefront of their decision-making, ensuring that they choose the right funds or investment strategies for the right reasons.”

Tony Kaye is the editor of Eureka Report, which is owned by financial services group InvestSMART.