The next best thing to super

Summary: It's clear that changes are looming for SMSFs, family trusts can be complex and expensive and private companies can also have limitations for investors. In this context, insurance bonds combine the best aspects of private companies with an extra tax benefit. Insurance bonds can be used for tax planning, financial planning, estate planning, supplements to an SMSF, child advancement and investment gearing. |

Key take-out: Tax rates within an insurance bond are capped at 30 per cent pa and if the bond is held for more than 10 years there is no additional tax payable on withdrawals. |

Key beneficiaries: General investors. Category: Investment portfolio construction. |

Insurance bonds are a long established form of tax effective investment vehicle that provide great investment flexibility and planning opportunities. They can be used to supplement super and are especially useful for investors with high marginal tax rates who are in their 30s or 40s, who don't wish to lock up their wealth until retirement age.

They are also powerful endowment and estate planning vehicles, overcoming the uncertainty of traditional wills, which can be a lottery when challenged in the context of family law disputes eg in the case of blended families. The three main providers of insurance bonds (Austock Life, IOOF and Lifeplan) have morphed their offerings to allow for construction of well diversified portfolios within their bonds, so serious consideration of these products is warranted.

Listening to senior Government ministers it's clear that changes are looming for SMSFs to prevent their use as estate planning vehicles. Government is listening to welfare bodies and the large institutions that dominate the non-SMSF sector, as well as trying to reduce super-related Budget costs, and formulating ways to limit the amount that can be invested into SMSFs. That could be by capping the size of SMSFs or by penalty taxes on earnings above a certain level.

Money already in an SMSF should be grandfathered from any such changes, but going forward investors will need to understand how to use non-super vehicles for wealth accumulation.

The problem with family trusts and investment companies

Many accountants favour establishing a family trust for non-super investing. That's a recipe for complexity, expense and tax inefficiency. Family trusts require a trust deed and typically use a trustee company – ASIC fees, BAS, audit and tax returns can add around $1000 pa to the basic costs of running family trusts. Income must be distributed to beneficiaries and taxed at their top marginal rates – just adding to the individual's tax bill, even if the income is from franked dividends (because “top up” tax is payable).

More astute advisers recommend using a private company for investing outside super, especially if the investments are designed as part of a wealth accumulation strategy. Dividend income from share investments is tax free when received by the private company (franking credits on dividends offset company tax, assuming the dividends are fully franked). Rental income is taxable but that tax generates franking credits for the private company.

All investment income can be retained within the private company and hence does not increase shareholders' income or marginal tax rate. Earnings can accumulate within the private company for payment to the investor at a time of their choice (which may be many years hence when the investor's marginal tax rate is low).

The trade off for this tax efficiency on earnings is that companies don't enjoy concessional CGT treatment. Assuming there is low turnover within the family company investment portfolio, little CGT is payable – limiting the problem (and tax paid generates franking credits which can attach to dividends paid).

Like family trusts, private companies have compliance costs which may run to $1000 pa or more depending on the complexity of the entity and its portfolio.

How do insurance bonds work?

Insurance bonds combine the best aspects of private companies (tax rates within the bond are capped at 30 per cent pa, income is re-invested within the bond and doesn't form part of the investor's assessable income) with the additional tax benefit that there is no additional tax payable by the investor on withdrawals if the insurance bond is held for more than 10 years.

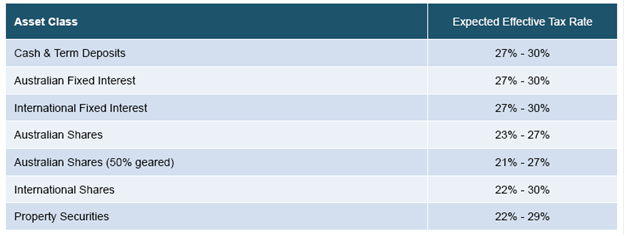

Actual tax rates on investments held within insurance bonds may be less than 30 per cent if franking credits or other tax offsets are applicable. Table 1 below shows that research house Zenith Investments estimates the applicable tax rates as ranging between 21 per cent to 30 per cent pa:

Table 1: Expected effective tax rates for different asset classes

Source: Zenith Investment Partners, August 2015

Unlike investment companies, tax is paid within insurance bonds on both income as well as accrued capital gains. There is a smoothing mechanism to give credit in capital loss years, and compared to the concessional CGT rate of 24.5 per cent pa (based on the current top marginal tax rate of 49 per cent pa including Medicare and budget repair levy), the insurance bond tax rate of 23 per cent to 27 per cent on Australian shares is almost on par.

The benefit of this tax efficiency is magnified through the internal re-investment mechanism within insurance bonds; insurance bonds are a much more tax effective vehicle than family trusts when investment earnings are re-invested for long-term wealth accumulation.

Insurance bond tax rules work such that any withdrawals after 10 years are completely free of tax at the investor level; withdrawals prior to 10 years are taxable to the investor but carry with them tax credits reflecting the tax already paid within the bond.

Insurance bonds are “owned” by nominated beneficiaries who are termed the “life insured”. If the life insured passes away within the first 10 years of the term of the bond, the payout proceeds are completely free of tax to any co-owners of the bond or to the beneficiaries of the estate of the life insured.

Modern innovations

The insurance bond sector currently holds over $7 billion in funds under management, with 10 different providers. Of these, there are three leading providers actively promoting modernised investment bond offerings which look and feel more like investment platforms – allowing for self-directed creation of portfolios from all major asset classes (although the “alternatives” menu for these three is severely limited). Interestingly, when switching between investments (which is freely permitted), no additional tax is payable on any underlying gain (reflecting the “tax paid” concept of insurance bonds).

The wide investment menus available for the three active promoters can be viewed at their websites:

- http://www.austocklife.com/

- https://www.ioof.com.au/investments/products/wealthbuilder

- https://www.australianunityinvestments.com.au/our-products/lifeplan

Comparing insurance bonds

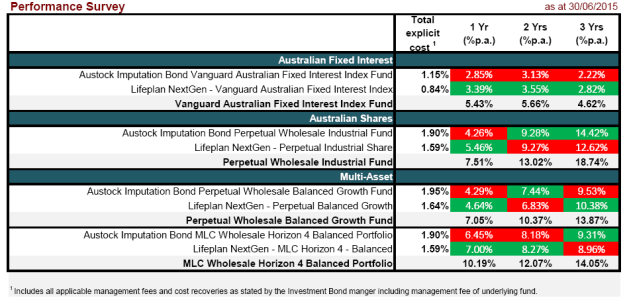

Because insurance bonds are regulated as insurance products, there is no material difference in how they operate between providers. Investment menus differ, and as you will note when you compare providers, the costs associated with insurance bonds vary depending on the selection of investments. Each insurance bond provider includes an “expense recovery” component as part of its fees, and the best way to identify the real costs of insurance bonds is to compare their net after tax returns with those applicable to the underlying investments themselves. Table 2 below shows the net after tax returns for the three active insurance bond providers and identifies the impact of “implicit” costs (eg expense recovery) over and above the explicit costs quoted for various investment options.

Table 2: Net after tax returns showing explicit and implicit fees and taxes

Source: Zenith Investment Partners

Strategies using insurance bonds

After considering the tax effectiveness of insurance bonds and the range of available investments, there are several scenarios in which they can deliver powerful strategic benefits:

- Tax planning: earnings and growth taxed within insurance bond (aren't included in investors taxable income), tax free after 10 years, tax credits and offsets can reduce internal tax rate below 30 per cent

- Financial planning: proceeds can be accessed prior to retirement age, no caps on amounts which can be invested into insurance bonds

- Alternative/supplement to SMSF: no superannuation exit tax for death distributions to non dependants, no age-based preservation rules

- Estate planning: designation of life insured avoids challenge under will of deceased, “immunises” insurance bond from attack eg in case of family law dispute in the case of breakdown of “blended” families

- Child advancement: insurance bond can be established to pay out a tax-free income stream to provide for education or living expenses of children, grandchildren etc

- Investment gearing: most lenders will accept insurance bonds as security for the establishment of an investment loan and interest costs will remain tax deductible so long as geared investment is income producing (does not include investment loan interest if used to purchase insurance bond).

These benefits are highly important when confronted by the complexities of life. Careful consideration of insurance bonds can help to solve the real pitfalls that beset many Australian as they take control of their financial affairs.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.