The 'new neutral' strategy that will pay dividends

As we embark on the next phase of market developments post the financial crisis, the speed and intensity of the normalisation of monetary policies around the world differ and are the key factors to focus on to evaluate potential equity market returns.

While during the crisis it seemed that governments and central banks in most developed market countries were acting in a similar fashion, the world is now experiencing a trend pointing towards a de-synchronisation of policies.

While the US is already tapering quantitative easing, Europe on the other hand just announced a series of targeted longer-term refinancing operations aimed at improving bank lending, cut its benchmark rate by 10 basis points and, historically, reduced its deposit rate into negative territory to help mitigate potential deflationary forces.

In Japan, if economic growth were to stall, we can expect the Bank of Japan to engage in additional QE.

In a world where global growth remains subdued versus historical averages and inflation remains tame, we should expect interest rate normalisation to be measured. This is actually a supportive factor for equity markets provided they remain attractively valued. In PIMCO’s new neutral view of the world, for slow growth and low inflation in a highly indebted world dictates low real rates.

From this point on, it is therefore important to look at two specific issues. First -- as we expect that there is some potential for rates to move modestly higher over the secular horizon, as monetary policy is normalised -- have equities historically underperformed in a rising interest rate environment? Should we expect this upcoming normalisation to be in line with past cycles?

Second, which equity strategy could do well in a low real rates environment?

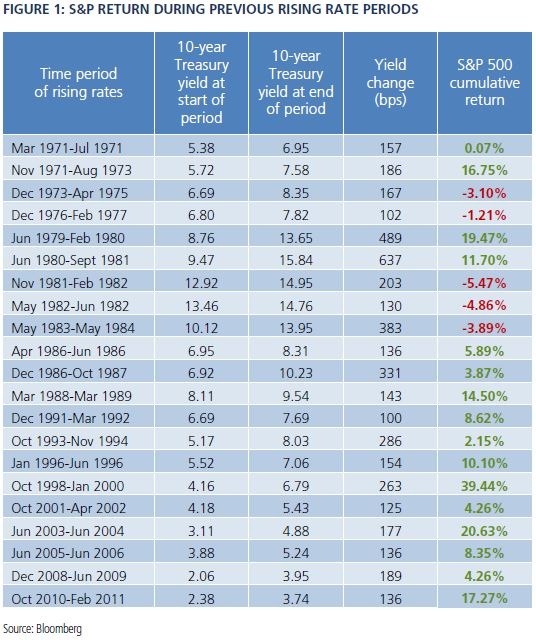

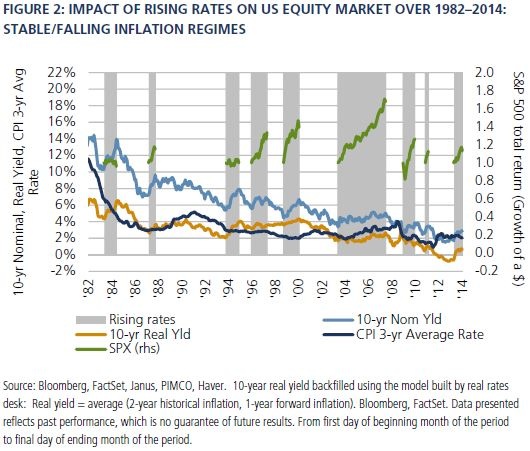

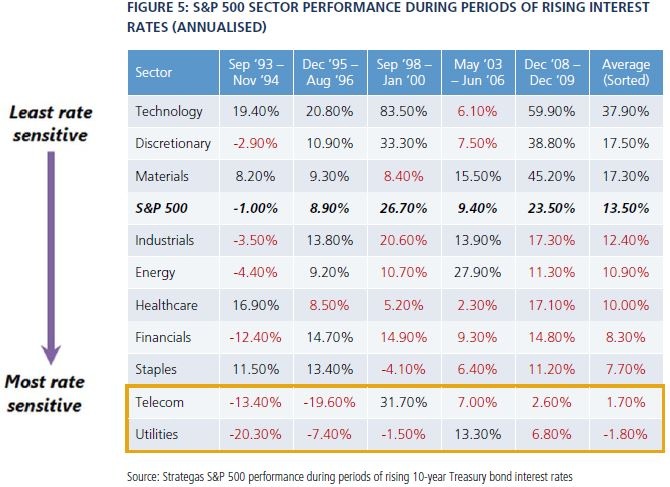

On the first point, looking at the US equity market during periods of monetary policy tightening, we see that equities have historically performed well in periods of rising rates. In fact, equity markets’ behaviour in a rising rate environment seems to be largely influenced by the level of inflation.

Rising rates have only been negative for equities in the mid-1970s and early 1980s when inflationary pressures were relatively high. Absent inflation, equities appear to do well in a rising rate environment, especially if the change in policy is a response to healthy or healthier economic growth. And, of course, PIMCO’s secular new neutral calls for low levels of growth, with only modest inflationary pressures.

Second, in such environment, how should investors consider positioning within their equities allocation?

Clearly in a world of slow monetary normalisation and low real rates, effective competition from “bank accounts”should be marginal (absent sudden shocks) and therefore we believe finding return in equities in strategies supported by dividend is an atrractive way to allocate assets.

What about specific equity strategies targeting dividend investing, so popular in recent years, but perceived to be more interest-rate sensitive?

First, it is important to differentiate between various styles of equity dividend investing. This is because there is a stark difference in performance in stocks in typical high dividend sectors and dividend stocks generally. In particular, some well-capitalised high dividend growth stocks may actually stand to benefit in rising rate environments. And, of course, performance varies by sector, country and economic sensitivity.

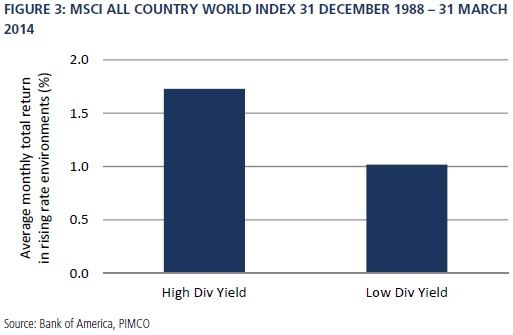

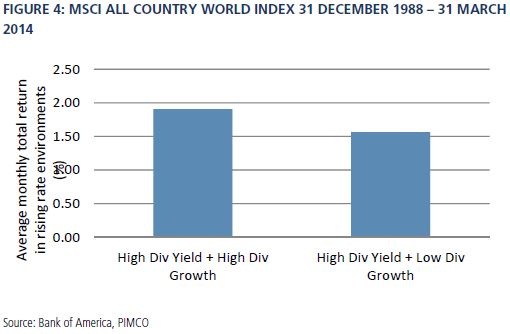

Equities with high dividend yields are often viewed as 'bond-like' because of the dividend income they provide, leading some to the conclusion that these securities too will have the same inverse pricing relationship to rising rates. While it seems intuitive, history demonstrates this generalisation is incorrect. The reality is that while the very highest-yielding equities could suffer because of their bond-like characteristics, stocks exhibiting both high dividend yield and high dividend growth have the potential to thrive in a rising rate environment.

We compared the performance of stocks with high dividend yields (defined as those with above-median dividend yields) and high dividend growth (defined as stocks with above-median 1-year dividend growth) to stocks with low dividend yields (below the median of the MSCI All Country World Index). Our sample, which dates back to 1989, covers 11 periods of rising rates. High yielding stocks outperformed low yielding stocks, and high dividend growth stocks outperformed by an even greater margin, as illustrated in Figures 3 and 4.

The data support the idea that companies that pay dividends will not underperform in a rising rate environment simply because they provide a cash stream similar to a bond. Bringing that cash return forward to shareholders can enhance the present value of their cash flows, and we believe a growing dividend typically fuelled by growing earnings demonstrates both growth and capital allocation discipline.

Dividend-paying stocks that are not analogous to bonds, but rather are “better-than-bonds” given their growing earnings-generated dividend stream, may provide superior performance in rising rate environments versus their non-dividend-paying peers.

Don’t throw the baby out with the bathwater

Not all dividends are created equal. Some stocks generate the highest dividend yield possible to attract investors searching for income. For example, over the last few years many investors have gravitated to US telecoms, MLPs, REITs, utilities and consumer staples with the belief that these 'defensive' sectors provide downside protection. Already trading at above average valuations today, investors heavy in these sectors could be at risk for underperformance or even declining prices if interest rates rise in that region, if history is a guide. We already saw this happen in 2013 when the 10-year US treasury rate rose from 1.6 per cent to 3.0 per cent. On the other hand, we see opportunities in international infrastructure like some airports and toll roads which have not been bid up to premium valuations.

So, don’t throw the baby out with the bathwater. Understand that an attractive yield, dividend growth and capital appreciation are not mutually exclusive. Instead of myopically focusing on high dividend yields, investors have the option to focus on stock selection of undervalued companies that participate in global growth while paying out a portion of their growing earnings stream as dividends. This brings forward the cash flows and increases the present value of the free cash flow stream.

Our new neutral secular outlook combined with a slowly rising rate environment may benefit not only equities in general but also dividend investing in particular. But investors need to be mindful of their dividend approach and select one that matches their objectives. It is important to understand that while the yield might look enticing today, total return is a two-way street and loss of capital can eat away even a robust dividend yield very quickly.

Many traditionally high-yielding sectors are trading at historically high valuations that could mean-revert as interest rates rise. While it is true that buying a basket of the highest-yielding stocks is a risky proposition in a rising rate environment, managers who utilise dividends in the right way can create a portfolio designed to outperform even in a rising rate environment.

Whether interests rates rise or fall in 2014, we believe that a dividend strategy focused on seeking out companies that are disciplined allocators of capital, both to internal projects that generate excess returns and to shareholders in the form of dividends, can potentially provide a reasonable yield today that may grow over time as earnings grow. Combined with capital appreciation, a dividend portfolio designed in this way has the potential to generate a total return in excess of the market.

© Pacific Investment Management Company LLC. Republished with permission. All rights reserved.