The new frontier: economies on the rise

There is a group of fast-growing low-income countries that are attracting international investor interest: frontier economies. Understanding who they are, how they are different, and how they have moved themselves to the frontier matters for the global economy because they combine huge potential with big risks.

Get to know them

Some of these countries already have moved to the lower-middle income group. While a working definition of frontier economies is subject to further discussion, broadly speaking, these countries have been deepening their financial markets, such as Bangladesh, Kenya, Nigeria, Mozambique and Vietnam.

Some also have been able to tap the international capital markets, such as Bolivia, Ghana, Honduras, Mongolia, Nigeria, Senegal, Tanzania, Vietnam and Zambia. Their markets are, however, not as deep and liquid as those of the emerging markets. But compared to the latter, they offer higher returns and the benefits of a diversified portfolio.

How they got there

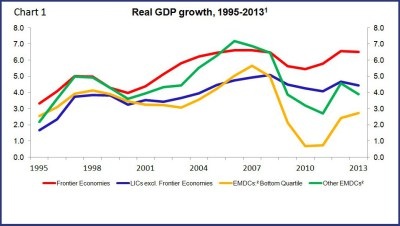

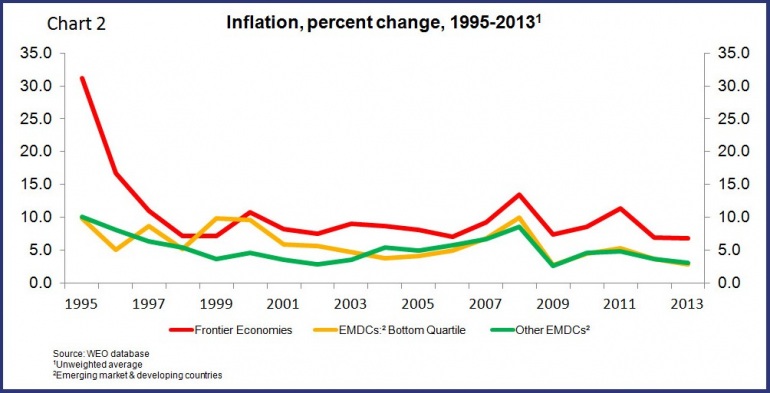

Many frontier countries are growing at a fast pace, in most cases helped by sustained efforts to achieve macroeconomic stability, and by building business-friendly institutions (chart 1). These economies have also made significant efforts to lower inflation through prudent fiscal and monetary policy (chart 2).

Most of these countries have made progress in strengthening their policy-making apparatus, reducing excessive red tape and lowering trade restrictions. Reforms to change their economic structure have helped them unlock their potential, including greater weight on the services sector, such as in Tanzania and Kenya.

In many countries, alleviation of their debt burden over the past decade has freed up money for investments in physical and human capital. Several countries received debt relief under the Highly Indebted Poor Country Initiative, but others reduced their debt outside this initiative, such as Kenya, Mongolia, Nigeria and Vietnam.

These countries have deepened their financial markets at a fast pace. They offer more domestic financial services and products than their peers.

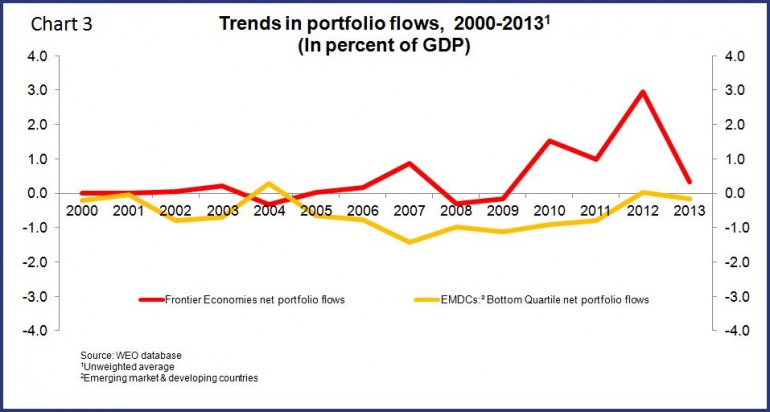

Some have attracted international investor interest in their domestic bonds market and several have issued sovereign bonds in the international capital markets (chart 3).

Access to international capital markets means these countries can attract financing to address gaps in infrastructure, such as roads and railways, which could provide a further impetus to growth. But market access also poses new financial risks that countries need to carefully manage.

Influences from outside their borders

Low interest rates combined with advanced economies shedding debt have pushed investors to search for higher returns on their investments, which has expanded their interest to invest in frontier economies.

The quest for resources by emerging economies has contributed to improved terms of trade and a surge in both domestic and foreign investment in resource-rich countries, such as Bolivia, Ghana, Nigeria, and Mongolia.

Domestic public investment has increased as the low debt burden, favorable external borrowing rates, and high commodity prices have increased access to private financing sources outside their borders.

Risks and the policies to manage them

These capital flows also mean that frontier economies face a number of risks and policy challenges. Access to external private capital has brought frontier economies greater market scrutiny and exposed more weaknesses in domestic macroeconomic policies, such as weakening fiscal and external positions. It is important that frontier economies preserve their hard-won economic stability and fiscal sustainability. Furthermore, as interest rates begin to rise in the United States and monetary policy returns to normal, capital flows into frontier economies could begin to slow down.

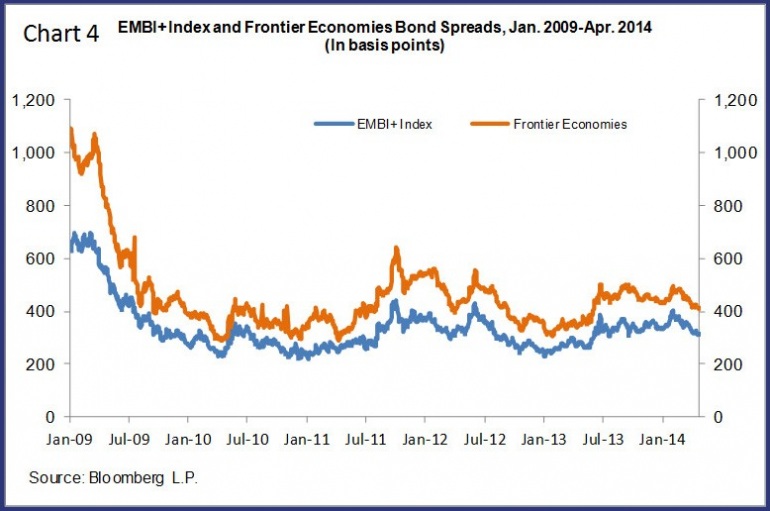

Some countries that have benefited from foreign investment in their domestic government bond markets and which also exhibit significant fiscal and current account imbalances have experienced volatile exchange rates in recent months and a rise in spreads (chart 4).

The IMF’s recent paper on managing capital flows offers a policy framework to help countries manage risks associated with these flows. The limited size and liquidity of government bonds issued by frontier economies in international capital markets mitigates the risk of a reversal in capital flows. But new issuances could face higher spreads, and maturing bonds could have a hard time finding new buyers.

It is important to continue efforts to build adequate external reserves, and bolster economic and institutional fundamentals including domestic savings.

Further structural reforms, including in the labor and trade sectors as well as regulation and higher investment, would enhance productivity, and help these countries move up the value chain.

But even though frontier economies have deeper financial markets than some of their low-income peers, there are still a number of areas for improvement. This includes deepening of the domestic bonds market to allow more efficient intermediation of financial flows. We also encourage countries to monitor the build-up in risks and to preserve fiscal and debt sustainability. Countries should use the proceeds of government bonds for high yielding projects, whether issued domestically or in international capital markets.

Frontier economies show great promise, and reforms to their policies and institutions are central to their continued success. They need to remain committed to macroeconomic stability, fiscal and external sustainability, and continued improvements in investor-friendly institutions. Capital flows could be a double-edged sword; policymakers should optimise benefits but also take actions to address related risks.

This article was originally published at iMFdirect. Reproduced with permission.