The mining sector's last hurrah

Construction expenditure was stronger than anticipated in the September quarter but there are still some big concerns about the outlook. We will know a bit more tomorrow when the ABS releases its capital expenditure survey.

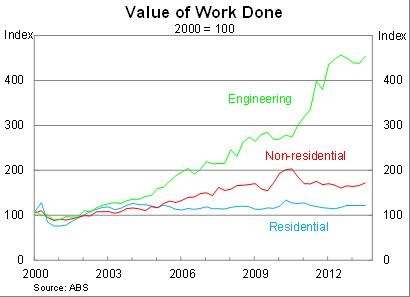

According to the Australian Bureau of Statistics (ABS), residential investment was unchanged in the September quarter, to be 2.7 per cent higher over the year. For the moment, mining investment has held up, with engineering investment rising by 3.5 per cent in the quarter. Non-residential construction rose by 3.7 per cent in the September quarter to be 7.3 per cent higher over the year. Overall the results were stronger than market expectations.

Utilising some fairly simple modelling, based on the relationship between the private construction data and investment in the national accounts, we can estimate the likely rise in investment spending in the national accounts for the September quarter (due for release on 4 December 2013).

The model for residential construction suggests that the national accounts measure of residential investment will rise by 0.2 per cent in the September quarter. This is a bit stronger than the flat result in today’s construction data but the model has historically had a strong level of explanatory power so I’m confident in today’s result coming out a little stronger in the national accounts.

For non-residential investment, my simple model points to non-residential construction growth of 1.0 per cent in the September quarter. As a result, both residential and non-residential investment is likely to contribute modestly to growth in the September quarter GDP data. This may not sound impressive – and it really isn’t – but it nevertheless represents an improvement from the June quarter when both residential and non-residential building construction contracted from GDP growth.

The rise in total construction activity was dominated by engineering construction. This in turn reflected strength in the resource-rich states of Queensland and Western Australia. To some extent the data today looks like a last gasp from the mining sector as we head over the mining investment cliff. By comparison, construction work done in New South Wales and Victoria has fallen for the last three and four quarters respectively.

The data today does not tell us a lot that we didn’t already know but does help to clarify a few things. First, that capital expenditure on the mining sector still has a little left to give but not much. Second, residential investment – which it is hoped will help fill the void left by mining investment – has done nothing this year to fill us with confidence. Third, there will be a sizable gap in investment expenditure when mining investment begins to decline.

Conventional wisdom is that rising house prices and investment opportunities should boost investment in residential markets. But as I suggested on Monday, the most recent house price boom is only a Sydney-centric affair (A Sydney-centric housing boom, November 25).

Building approvals have picked up in most states except Victoria and these point towards a pick-up in residential investment. But if house price growth remains contained in the other capital cities then investors in new buildings may begin to lose some confidence.

The outlook for business investment will become a little clearer tomorrow when the ABS releases its quarterly Capex data, which shows capital expenditure for the September quarter and capital expenditure intentions for 2013/2014. Current market expectations for capital expenditure in the September quarter are a fall of 1.2 per cent. But given today’s construction data exceeded expectations don’t be surprised if tomorrow’s data is a little stronger than anticipated.

Overall, this data highlights the task required to rebalance the Australian economy. Engineering construction accounts for over 60 per cent of total construction expenditure and its share has increased by 15 percentage points over the past three years. When engineering investment begins to decline it will leave a sizable gap in the Australian economy and at this point in time it is questionable what will fill it.