The method behind Germany's policy muddle

The short history of the eurozone has been remarkable and unprecedented – the euro project has moved from the planning board to a vibrant currency within less than ten years. Otmar Issing’s optimistic speech in 2006 reflects well the buoyant assessment of the first decade of the euro: an unprecedented formation of a new currency without a state.

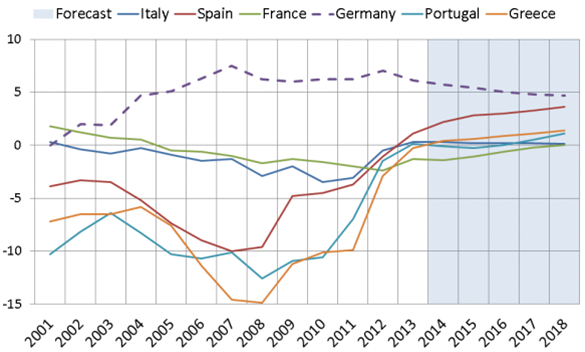

Observers viewed the rapid acceptance of the euro as a viable currency and the deeper financial integration of the eurozone and the EU countries as stepping stones toward a stable and prosperous Europe. The growing current-account deficits of GIIPS (Greece, Ireland, Italy, Portugal, and Spain) in the early 2000s supported their growing borrowing at declining sovereign spreads.

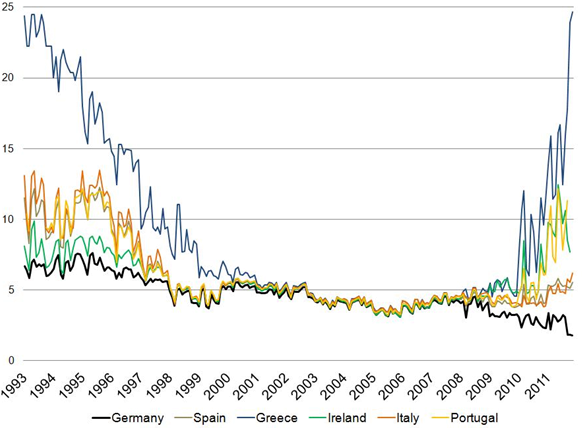

Intriguingly, GIIPS bonds’ interest rates dramatically converged during the 1990s to the German rate (see Figures 1 and 2). Observers viewed emerging Europe’s large current-account deficits as a validation of the gains associated with ‘capital flowing downhill’, possibly dispelling concerns about the limited benefits of importing foreign savings as a means of financing domestic growth. The celebratory assessment of the euro continued well into its tenth-year anniversary, only to crash with the unfolding events of the eurozone crisis.

Figure 1. GIIPS and German government bond rates

Sources: ECB, Bloomberg, http://iuwest.wordpress.com/

Figure 2. GIIPS and German current account/GDP

Source: Gavyn Davies, Financial Times

German dominance of the Eurozone

In Aizenman (2014), I look at the short history of the Eurozone through the lens of an evolutionary approach to forming new institutions. This lens provides a useful perspective on the formation of global exchange-rate regimes, currency unions, and the like. It suggests that Issing’s optimism on “The euro as a currency without a state” overstates the evidence.

At best, the euro is a currency without a state, under the dominance of Germany. This statement by itself may be good news: Cohen (1994) identified the presence of a dominant state “willing and able to use its influence to keep a currency union functioning effectively” as a key condition for the stability of a union. The growing dominance of Germany in the eurozone suggests that it may meet Cohen’s condition.

Yet, Germany would only stabilise the eurozone as long as it does not shirk its growing responsibility for the euro’s future. This would require Germany to invest more in upgrading eurozone institutions and balancing its dominance gains with the economic and political responsibilities that come with it.

The Eurozone crisis put an end to the euro honeymoon, bringing to the fore the key importance of Germany’s economic and political decisions in determining the eurozone’s viability and future. The challenges associated with managing the growing fragility of the euro may induce a reluctant Germany to face an upcoming stark tradeoff: the vibrant growth of Germany, while running large current account surpluses under a pegged exchange rate with the other eurozone countries, may come to an abrupt end if the eurozone unravels.

Germany has not yet been exposed to the full costs of the macro straitjacket associated with the euro. The economic benefits of the eurozone to Germany and GIIPS were initially frontloaded. Being a member of the eurozone mitigated Germany’s real appreciation, in comparison with retaining the deutschemark.

For GIIPS, the availability of cheap borrowing at a time of growing optimism about the euro supported growing current-account deficits, and vibrant consumption and investment, which eventually contributed to unsustainable growth and real estate booms.

Similar to the experience of emerging markets that liberalised their financial systems in the 1990s under a fixed exchange rate, the increasing costs of the resultant balance-sheet exposures were below the radar screens of markets and policymakers – until an abrupt stop, which was followed by capital flight crises. This may reflect a fundamental problem with the pricing of sovereign risk in which the private sector, as the ‘interest rate taker’, overlooks the growing marginal impact of borrowing on sovereign risk.

This externality also holds under a flexible exchange rate, but has probably been magnified by the economic strength of the Eurozone core and by moral hazard: the presumption that the growing costs of unwinding the euro will induce bailouts down the road.

The eurozone crisis forced GIIPS countries to confront the costs of their excessive borrowing prior to the crisis, as it terminated their easy access to funding their current accounts and addressing their growing fiscal deficits.

The resilience of the German economy

In contrast, beyond the growing balance-sheet exposure of its financial system, Germany has not yet been fully exposed to the downside risk of higher unemployment and lower growth that has already hit most of the Eurozone countries. The resilience of the German economy probably reflects:

- The advantage of running a sizeable current account surplus under a fixed exchange rate with its eurozone counterparts,

- The relative efficiency of the German labour market, and

- The country’s specialisation in exporting advanced manufacturing products and highly demanded capital goods.

Muddling through

Germany’s resilience and dominant size within the EU may explain its ‘muddling through’ approach towards the eurozone crisis -- doing enough to prevent the unravelling of the eurozone while resisting policies that may mitigate the depth of the crisis if they involve short-run costs to Germany.

A manifestation of this approach is the revealed asymmetric bias of the ECB’s inflation targeting. The short history of the ECB reveals a strong deflationary bias, which probably reflects the well-known German aversion to moderate inflation.

So far, we have not seen the willingness of the ECB to follow symmetric inflation targeting. Observers have noted that the ECB’s revealed inflation targeting is closer to targeting Germany’s inflation rather than targeting inflation of the entire Eurozone. While this may not be a surprise considering the bargaining clout of Germany, the resultant low eurozone inflation -- approaching 0.5 per cent as the time of writing -- puts further drag on the adjustment of the GIIPS countries. The net outcome is the continuation of accelerated debt deflation, which pushes the eurozone toward the prospect of a Japanese-style lost decade.

Another manifestation of Germany’s ‘muddling through’ approach is the prevalent view of German observers that its persistent current-account surplus is a reflection of the country’s efficiency and is irrelevant to the adjustment challenges facing the global economy, the eurozone, and the GIIPS countries. Ironically, Germany’s attitude toward the eurozone resembles the attitude of the US toward the Bretton Woods system in the 1960s -- benign neglect of the growing tensions -- which led to the ultimate demise of the Bretton Woods system. Chances are that unravelling the eurozone would be much more costly than the end of the Bretton Woods regime.

Towards a more resilient and successful union?

Approaching the fifth year of the eurozone crisis, one detects green shoots that, with proper stewardship, may lead to the emergence of a more resilient and successful union. Recent output projections suggest that the worst may be over for GIIPS countries, and recovery may be around the corner. Their primary fiscal deficits have been drastically trimmed and are moving toward surpluses.

GIIPS countries are also gaining access to borrowing at declining sovereign spreads. These developments may be the bonus of the ‘positive contagion’ triggered by Draghi’s policy stance. The challenges facing the ECB and Germany is to do what it takes to prevent a reversal of these gains. The tentative recovery of GIIPS may be threatened if and when global interest rates rise, or when the risk tolerance towards GIIPS debt deteriorates. The chance of pushing these countries’ future to the wrong side of the debt Laffer curve would be mitigated by a greater willingness for debt concessions tied to deeper structural reforms.

The mixed messages from Germany regarding its lacklustre support of Draghi’s policies -- including the country’s constitutional court ‘thunderbolt’ ruling in February -- are the elephant in the room, raising serious questions about the durability of any green shoots.

In the same vein, the Balkanisation of the banking system induced by the eurozone crisis is also a double-edged sword. Rapid financial integration in the eurozone prior to setting efficient and prudent supervision and banking union helped contribute to over-borrowing by GIIPS. The challenge facing the eurozone financial system remains that of finding a healthy balance between banking integration and prudent regulations. This challenge remains a work in progress in both the US and the eurozone, and time will tell if GIIPS countries’ greater access to renewed borrowing will backfire.

An underappreciated development has been the growing mobility of labour in the eurozone and in the rest of the EU. Although this mobility is mostly confined to younger workers and immigrants, it facilitates easier adjustment and increases the flexibility of labour markets. Greater mobility of labour and lower mobility of under-regulated capital may be the costly ‘second best’ adjustment until the arrival of more mature institutions in the eurozone.

The ‘muddling through’ process may prove to be a stepping stone toward a more perfect euro union. The challenges facing the eurozone are not unforeseen or unprecedented. The history of other unions provides examples where crises, with the proper leadership, created new institutions and upgraded existing ones in ways that increased their resilience.

This piece was originally published at VoxEU.org. Reproduced with permission.