The loose screws in Australia's economy

Those hoping for a residential investment-led rebalancing of the Australian economy will need to be patient. With mining investment set to fall rapidly, the Australian economy desperately needs construction to begin pulling its weight before it is too late.

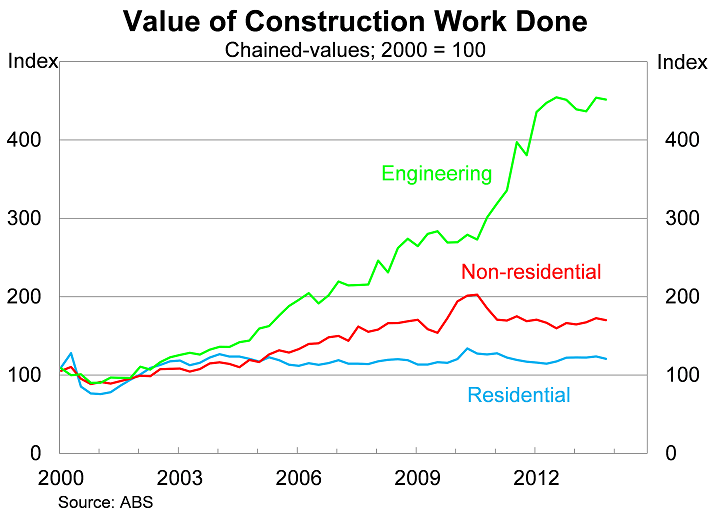

Construction work done fell by 1 per cent in the December quarter, failing to meet market expectations of a modest rise, to be 0.2 per cent higher over the year. Construction fell across the board with residential and non-residential dwelling construction and engineering activity all declining.

Residential construction fell by 1.7 per cent in the December quarter, to be 1 per cent lower over the year. But this understates the real weakness in new building construction, with building alterations and additions rising strongly.

The decline in residential investment provides further evidence that the non-mining sector of the economy remains fairly weak. Despite rising building approvals, very little of it has yet fed through to actual construction. It will eventually but so far construction hasn’t been promising.

It will be a bit of a concern for the Reserve Bank which, like many market analysts, has put its hopes and dreams on a residential investment led rebalancing of the Australian economy. At the very least it suggests that residential investment will struggle to generate much momentum before mining investment drops away.

Non-residential construction fell by 1.6 per cent in the December quarter and is now 0.3 per cent higher over the year. Low lending rates are yet to have much of an effect on non-residential investment activity.

I have a set of simple models that track how construction activity feeds through to real GDP growth using current and lagged construction spending. Based on these models, residential investment in the national accounts is set to fall by 0.3 per cent in the December quarter, while non-residential investment is set to decline by 0.9 per cent. The data suggest that market analysts will be forced to downgrade their growth forecasts for the December quarter.

Tomorrow, the ABS releases its Capex survey, which will provide us with our first look at investment expectations for the 2014/2015 financial year. Current expectations are that mining investment will drop off sharply over that period, creating a significant hole in GDP growth that the likes of exports, consumption and residential investment will be expected to fill. The Capex survey could be a bit of a game changer for the economic outlook and the Australian dollar.

The Capex survey will provide some insight into whether the Reserve Bank has done enough to provide a smooth transition for the economy. Residential construction will inevitably rise, but the lack of momentum thus far suggests that a swift decline in mining activity may punch a hole in the economy that we are ill equipped to handle, at least in the short-term.

Greater residential investment activity will not by itself be enough to offset the anticipated fall in mining investment. Those who believe a residential investment boom is upon us would have been hoping for far greater construction activity by now (Dwelling on housing growth is misguided; January 10). Right now, the prospects for the Australian economy in 2014 are far too reliant upon exports and consumption. Other sectors of the economy need to start pulling their weight before it is too late.