The jobs market is stuck in a rut

The labour market didn't get any worse in November but it also didn't get any better. The risks to the labour market appear primarily on the downside -- particularly with regards to the mining and automobile industries -- and the Reserve Bank may need to provide greater stimulus to boost domestic demand and support the rebalancing process.

On a trend basis, employment rose by 7,100 people in November, following growth of 7,300 in October, with growth stagnating somewhat over the past six months. The Australian economy has produced 133,500 new jobs over the past year, which remains well below the federal government's five-year forecasts and is particularly low by historical standards.

The seasonally-adjusted data provides a more upbeat read for November but given the trouble that the ABS has had in recent months, I'd be putting greater weight on the trend estimates. For the record, the seasonally-adjusted numbers jumped by 42,700 in November, to be 140,000 higher over the year.

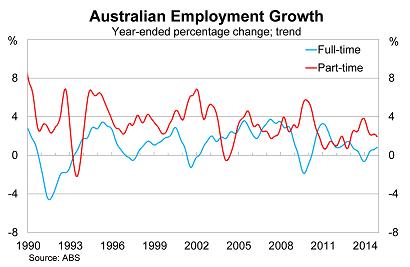

Part-time positions continue to drive employment growth. Part-time employment rose by 8,800 in November on a trend basis, while full-time positions fell by 1,700. The weakness in full-time positions has been among women (down 3,900 in November), while male full-time employment rose modestly. Part-time employment growth is concentrated mostly among women but there are gains among men as well.

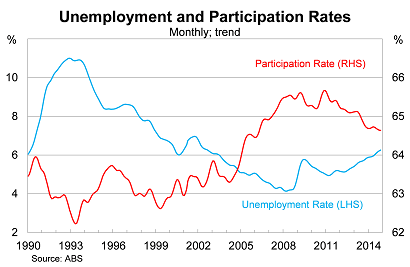

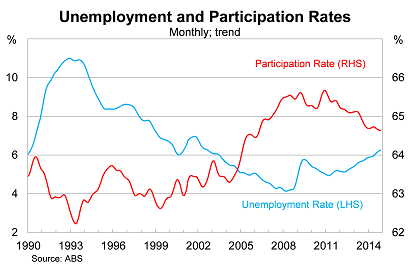

The unemployment rate ticked up to 6.3 per cent in November and is now at its highest level since August 2002. The labour market continues to deteriorate at a slow but steady pace, with the unemployment rate rising by 0.4 percentage points over the past year.

As always, a correct assessment of the labour market requires consideration of the participation rate. Considering either measure in isolation can be misleading.

The participation rate was broadly unchanged in November, to be 0.1 percentage points lower over the year. As a result, the participation rate has put some modest downward pressure on the unemployment rate over the past year. Participation is now at its lowest level since October 2004.

The participation rate is expected to decline further over the next decade as an increasing share of the ‘baby boomers' retire. That may be partially offset by the eventual increase in the retirement age.

In the near term, there could be considerable variation depending on the extent to which the economy successfully rebalances. As it stands, the economy is struggling to absorb our existing population growth and, if the mining sector deteriorates more quickly than expected, the unemployment rate might spike higher.

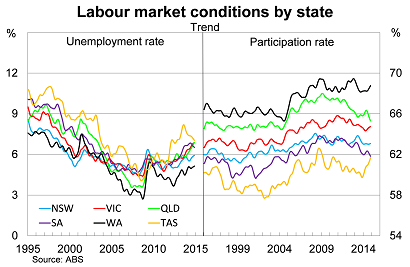

Labour market conditions continue to deteriorate in Queensland, with the unemployment rate surging to an 11-year high. Conditions are also weak in Victoria where the unemployment rate is at its highest level since May 1999.

Some regions are holding up better. The unemployment rate in New South Wales remains below its post-crisis peak, with only a modest decline in the participation rate. Economic conditions have softened in Western Australia over the past couple of years but its jobs market continues to lead the nation.

A pleasant surprise has been in Tasmania, where the unemployment rate has fallen by 0.8 percentage points over the past year. That, combined with the pick-up in participation, provides some relief for a region that has struggled for a number of years now.

On balance, these are a reasonable set of numbers. The seasonally-adjusted figures beat expectations -- always a nice surprise -- but the trend estimates suggest that there was no real improvement.

But to some extent that might be a win -- at least the figures didn't get worse -- particularly given the data we've received over the past few weeks. Nevertheless, the outlook for the Australian economy won't change due to these data and the market will continue to expect a rate cut in early to mid-2015. At this point in time, that seems like a pretty reasonable expectation.