The industries next in line for an 'age of entitlement' crackdown

You’ll never guess which sector topped the charts for government support last financial year. Not the motoring industry, the power companies, or the farmers. The winners were actually office workers.

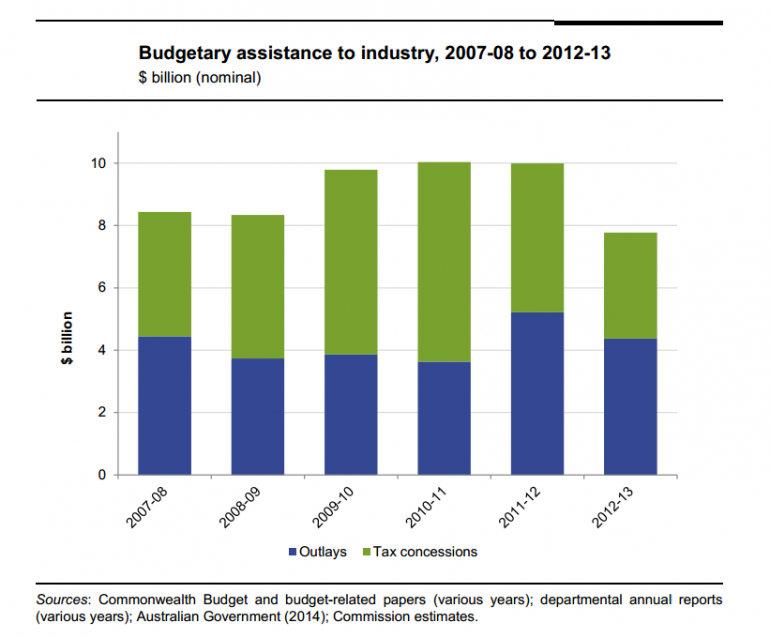

Each year, the Productivity Commission publishes a report on government support in Australia. An interesting trend has developed over the past couple of years, that we've illustrated in two graphs:

First, as the commission points out, Australia’s total level of government support has fallen over the past couple of years.

Source: Productivity Commission

But despite this, the payouts and tax breaks that two of the sectors have received have remained fairly consistent over the years. While subsidies and tax breaks in agriculture, car manufacturing and electricity production industries have peaked and troughed over time, the assistance offered to the property, professional and admin services sectors and the financial services, superannuation and insurance sectors has remained stable.

Now, as a result of a decline in handouts to other industries, the property, professional and admin services sector currently receives the highest quotient of government support in Australia. It’s trailed by the financial services, superannuation and insurance sector.

To put this in perspective, we've graphed total support received from both of these sectors over the past five years against that offered to other handout-heavy sectors.

This new data raises some prickly questions about government support.

Comments from the Coalition about "ending the age of entitlement" make for great headlines, but they miss the complex point around this issue: to what extent does government support actually provide a return for the economy?

There is a reason these two arguably self-sufficient industries are topping the charts for government assistance. Over the years they have consistently enjoyed R&D-related tax breaks and small business capital gains tax concession measures. The report also outlines that financial services receive the bulk of their breaks from offshore banking concessions. The government and the ATO are primed to reform this concession next year.

If the government is really keen about peeling companies away from welfare, will it start slashing the benefits that are fuelling this result? And what impact will this have on the country’s future economic prospects? The R&D tax break is also popular with the country’s budding start-up sector.

As the commission report notes, it’s not about how much money is being handed out -- it’s about how effective it is at delivering a return to the economy. On that note, the report found the auto manufacturing sector ranks fourth in terms of total budgetary support 2012-13; it also has the highest “effective rate of assistance” -- meaning that government funding is having an impact on both the sector and the economy.

We’ll have to wait for next year’s data to see the real impact of government’s much-hyped corporate welfare crackdown. But in the meantime, however, here’s a rundown of how much support each industry received in the past year as a benchmark for what we can expect next year.

Got a question? Let us know in the comments below or contact the reporter @HarrisonPolites on Twitter.