The income squeeze that's draining the economy

Australian chief executives and top managers are going to have to be a lot smarter in the next few years, especially since the yield boom has boosted share prices for many of them. Those looking for widespread rises in non-mining and non-housing corporate capital expenditure to drive the economy are being very optimistic.

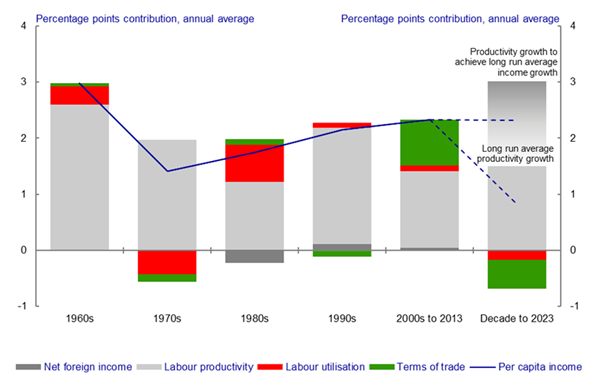

Since the 1970s, national accounts data shows Australian incomes have grown steadily by about 2.3 per cent a year. There have been tough times but our per capita national income has always bounced back.

That steady growth in national income per head meant that as long as companies did not run out of money, they could ride out the tough times.

But in the last budget Treasury dropped a bombshell on corporate Australia. In the June quarter, Treasury’s long-term forecasts are being proved to be chillingly accurate.

In the budget Treasury showed that future national per head income growth was in grave danger of slumping to nil over the next decade.

We have been able to maintain a 2.3 per cent per head growth rate over such a long period because of better terms of trade and productivity growth. With an ageing population and no immediate likelihood of a rise in the terms of trade, we would need to lift productivity by 3 per cent a year -- twice the historic average -- to maintain a 2.3 per cent per head growth rate.

That’s a huge task. In the June quarter, as Callam Pickering points out, real disposable income per head fell by whopping 0.6 per cent (Population growth can’t fuel the economy forever, September 3).

Figures like this seem remote from the real world. But in reality we are seeing outcomes you would expect.

In many areas of the economy, salaries are not increasing because revenues are not lifting. Companies are achieving profit rises by reducing costs. Strange things are happening. Clubs and associations are seeing falls in membership, football attendances are down, and small cafes cannot pay award weekend penalty rates, so to survive they are doing 'under the table' deals with their staff.

These are surface indications of an underlying income squeeze as forecast by the Treasury graph. Consumers are being a lot more careful about how they spend their discretionary income. Retailers are on the frontline and all too often are losing the battle for diminishing per capita discretionary dollars to services. They blame the budget, but relatively few people have been hit by the budget. Most of the budget blows take place well down the track.

What we are seeing is the effect of stagnant incomes and rising costs, particularly from the government sector. Thankfully we have abandoned the crazy carbon tax, which will help. The latest superannuation change will also help, but I suspect many struggling enterprises will pocket the non-required payments rather than pay staff.

But such matters are relatively minor when you see a trend like the one that has been alerted to us by Treasury. Enterprises trying to seek the discretionary dollar or supplying those who are chasing it are going to have to be very clever because the pool is being reduced.

The days of governments being able to suddenly announce huge expenditures (such as Gonski) and be able to afford them from underlying revenue growth are gone, unless there is a big game-changer like Andrew Robb’s vision for northern development (The one minister who has a vision for Australia, August 19).

Remember that the terms of trade in iron ore, coal and gas which have driven Australian wealth have very much turned the other way (The shifting balance of power will test our miners, September 3).