The housing boom is on borrowed time

Loan approvals for both owner-occupiers and investors rose in November, but buying a property remains unobtainable for most prospective first home buyers. The current situation is largely unsustainable and it is only a matter of time before house prices begin to fall.

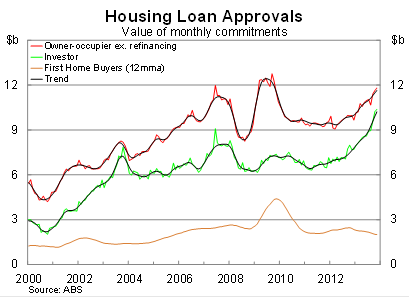

The value of loan approvals for owner-occupiers excluding refinancing activity rose by 1.5 per cent in November, beating expectations, to be 18.5 per cent higher over the year. For investors, loan approvals also rose by 1.5 per cent in November, following two consecutive months of 7 per cent growth, to be 35 per cent higher over the year.

By comparison, the value of loan approvals for first home buyers continues to trend downwards. So far the benefits associated with historically low lending rates have avoided first home buyers. A mixture of high investor activity, rising prices and labour market uncertainty has left few prospective first home buyers willing to take on big risks.

It is difficult to see that situation changing in the near-term and two things must change before first home buyer activity picks up: better labour market prospects and lower prices.

Greater first home buyer activity will require a pick-up in labour market conditions. Younger workers will need to feel greater certainty surrounding their job prospects, as well as career mobility, before they are willing to take on big risks.

But in all likelihood, the labour market will continue to deteriorate in 2014 before improving next year. I certainly don’t expect widespread job losses, but the declining participation rate masks the fact that Australia’s labour market hasn’t been this weak in over a decade.

In addition, prices are simply too high right now for many young people looking to enter the market. Young buyers would have to have rocks in their head to leverage up in the current climate, particularly given the limits on fixed lending and eventual exposure to variable rates.

I’m firmly of the belief that a lack of first home buyer activity will ensure that price growth will slow sometime soon and possibly in 2014. So conditions could improve for first home buyers, but for now it has never been more difficult for first home buyers to purchase a property.

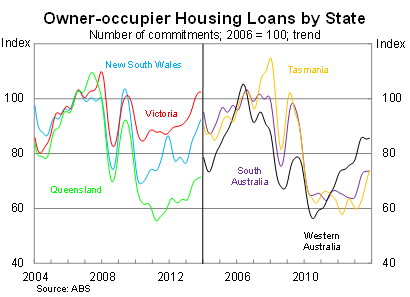

On a trend basis, growth in the number of loan approvals to owner-occupiers appears to be slowing in some states. Approvals in Western Australia and South Australia have practically stalled over the past six months.

House prices growth in Adelaide has been anaemic at best throughout 2013 and based on this data growth should be fairly soft for some time yet. Price growth has been much stronger in Perth, but owner-occupier activity suggests that growth there may slow fairly soon.

Owner-occupier activity has picked up significantly in New South Wales, but as a market that state continues to be driven by investor activity. Today’s ABS release does not have a breakdown on investor activity for each state, but that data will be publicly released on Wednesday.

Lending activity has picked up significantly over 2013 but many lenders continue to deleverage, taking advantage of low variable interest rates to pay down more of their loan than required. Loans outstanding to owner-occupiers have increased by 4.4 per cent over the year to November; for investors, growth is at 6.7 per cent. Clearly new activity is running at a much hotter pace.

Loan balances outstanding will continue to rise in 2014, particularly if new activity remains strong. But at least for now, the level of deleveraging and conservative behaviour from many households provides some insight into why the Reserve Bank does not appear particularly concerned about lending activity at the minute.

The pick-up in lending activity is exactly what you would expect to see given the historically low lending rates offered to buyers and investors. But how sustainable will this be?

Eventually owner-occupier activity will slow as there are only so many people interested in upgrading or downgrading their existing property and the market will be left with investors speculating among themselves.

Unless first home buyers begin to enter the market, then this latest housing boom will prove to be fairly short-lived. It is hardly the panacea that many are hoping for as the mining sector slows – not that the housing market was ever going to solve the economy's problems (Dwelling on housing growth is misguided, January 10). For the housing market, something will break. I’d put my money on investors losing their nerve before first home buyers lose their patience.