The growing threat to Australia's rebalancing act

Both the retail and residential construction sectors firmed towards the end of 2014. But are the gains sustainable? With the labour market remaining quite weak -- and income growth poor -- there is good reason to be concerned about the near-term outlook for household spending.

The residential construction boom should prove more persistent but the recent rebound in approvals has been concentrated in the volatile higher-density sector in Victoria, which suggests that approvals will moderate somewhat in the months to come. Nevertheless, activity should remain elevated during 2015 and support the ongoing rebalancing of the Australian economy.

Retail sales

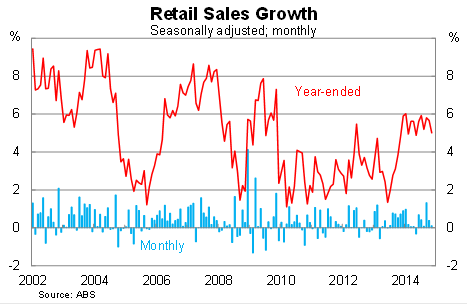

The value of retail sales rose by 0.1 per cent in November, missing market expectations, to be 5.0 per cent higher over the year. The result follows a couple of stronger months -- particularly the 1.3 per cent rise in trade during September -- suggesting that the result was a little stronger than the headline growth rate suggests.

Annual growth remains solid -- at least by the standards established this decade -- but appears to have already passed its peak. Over the next two months, retail sales growth should ease to between 3.5 and 4 per cent on a year-ended basis.

Nevertheless, retail sales are likely to contribute solidly to real GDP growth in the December quarter. Data in October and November sits 1.4 per cent higher than the September quarter average, so, unless retail trade crashes in December or non-retail household spending is remarkably weak, we should be looking at a pretty good number to end the year.

The longer term outlook, however, is more of a concern.

Low interest rates continue to support consumer spending but as a source of growth are clearly on borrowed time. At the same time, a rising unemployment rate, low participation rate and soft employment growth creates a combination of factors which suggest that the household sector will soften in the months to come.

Lower oil prices provide some clear relief, although this has been partially offset by the much lower Australian dollar. The lower exchange rate has directly reduced Australian's purchasing power -- pushing up the price of cheaper foreign goods and providing an incentive for us to buy more expensive Australian alternatives.

Growth remains concentrated in New South Wales and Victoria, which points to the strong growth in asset prices within these states. Those two states have accounted for almost 82 per cent of annual growth in retail trade over the past year.

Building approvals

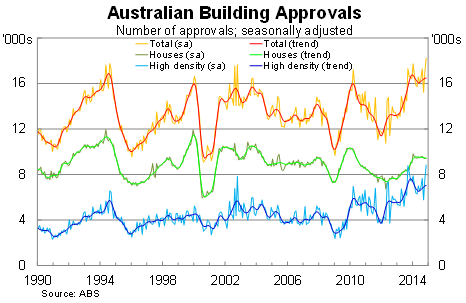

Solid retail sales data was complemented by a fairly strong rebound in building approvals, which reached a new historical high in November. The number of building approvals rose by 7.6 per cent in November, beating market expectations, to be 10.1 per cent higher over the year.

Approvals for housing -- which have historically been less volatile -- continued to ease in November on a trend basis. That has been the case for the past eight months, highlighting the fact that the residential construction boom will be concentrated primarily in the higher-density sector -- units and high-rise residential towers.

That segment jumped by 17.2 per cent in November on a seasonally-adjusted basis, following a 30 per cent jump in October. There will obviously be some consolidation in the months to come -- growth of this nature tends to reflect a few isolated but large projects.

Nevertheless, it indicates that the residential construction boom may prove more persistent than previously thought. That's good news given the rebalancing of the Australian economy was looking increasingly shaky.

Some of these projects will be cancelled -- they are approvals after all -- but the data suggests that residential investment should continue to rise over the next four quarters and remain at an elevated level beyond that.

Another factor worth noting is that the recent rebound in approvals has been far from broad-based, suggesting that there could be some downside risk in the months ahead.

Growth has been concentrated in Victoria, where the number of higher-density approvals has increased by 37 per cent and 67 per cent, respectively, in the past two months. Higher-density approvals in Victoria accounted for almost 83 per cent of total growth in November and are all but certain to moderate towards more normal levels in the months to come.

Building approvals fell modestly in New South Wales and less modestly in South Australia. Gains were posted in Queensland and Western Australia.

Assessment

The outcome for retail sales seems quite weak at first glance but looks more promising given the stronger outcomes in September and October. The challenge for the household sector will come from poor employment and soft wage growth. At this stage, it appears likely that retail sales growth will moderate over the next few months.

New data on building approvals suggests that the residential construction boom may prove more persistent than previously thought. The main issue is that the recent rebound is concentrated within Victoria's volatile units sector. That won't be sustainable but as long as these projects go ahead it should ensure that residential investment continues to grow during 2015.

Given its comparative size, the retail sector is obviously the more pressing concern. Unless conditions within the household sector improve, it will be difficult for the Australian economy to fill the hole left by the end of the mining investment boom. Stronger residential construction is great but, by itself, is simply inadequate to do the heavy lifting required in the years ahead.