The Great Sharemarket Return: ANZ's value proposition

| Summary: ANZ Bank is one of the few big stocks to be trading at a discount to its intrinsic valuation, and that’s good reason to be taking an interest. The bank still attracts from both a yield and capital gain perspective. |

| Key take-out: ANZ has delivered a 40% gain to investors since May last year, and expectations are for strong shareholder returns over the medium term. |

| Key beneficiaries: General investors. Category: Growth. |

They have led the resurgence on the Australian stockmarket since June last year.

And, even in the past fortnight, results – quarterly and half yearly – from three of our big four banks have continued to drive the market until the sell-off on Thursday.

Given such a stellar performance, do the big banks still offer investors the allure they held last year?

The answer is a resounding yes.

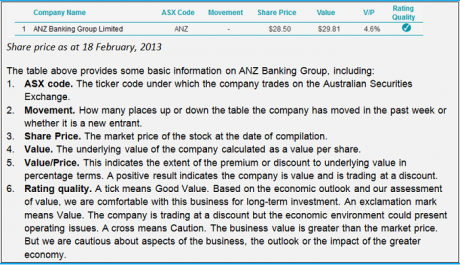

Clime Asset Management's most recent league table on the best value stocks includes not just one, but two, of the big four. And they hold number one and three spots.

In the lead is ANZ Banking Group, which is well in front in terms of value. The stock is valued at $29.81, making it one of the few companies to be trading at a discount following the recent surge in stock prices.

Analysts from Citigroup and Deutsche agree, rating ANZ a buy, while JP Morgan analysts are neutral, with UBS calling ANZ a sell.

Clime’s most recent table had ANZ trading at $28.50, and dividing the valuation by the share price delivers a ratio of 4.6%. Given the correction on Thursday, when ANZ fell further than its peers, that value measure has since has increased.

On a capital appreciation basis alone, ANZ has delivered a 40% gain to investors since May last year, when the stock was trading around $20.

Clime analysts argue, however, that the bank still attracts from a yield and capital gain perspective.

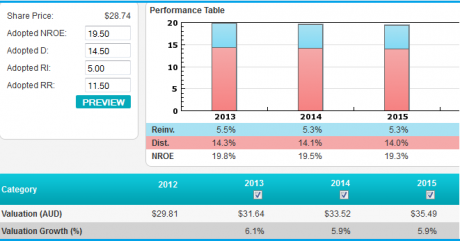

They argue the intrinsic value of ANZ should grow to $31.64 next year and $33.52 the following year. If the bank tracked towards that valuation two years out, and with expected dividend income of approximately $3 a share over the next two years, this would represent a total shareholder return of 28.4%, or 13.3% per annum.

It is worth noting that on an annualised basis, the total return is around double what investors in the recent bank hybrid issues, such as Westpac’s capital notes and NAB’s CPS, can expect. Clearly, there is greater risk associated with equity. But the potential reward amply covers that.

The performance table below shows that ANZ has a slightly lower payout ratio than its competitors. This indicates the bank is retaining more profit to reinvest in the business (blue portion of the column). That explains the rationale behind the asset manager’s valuation growth of around 6% per annum.

The recent quarterly update from ANZ showed the bank performing well in Australia, while it faced serious competition in Asia, and the New Zealand operations also held overall performance in check.

Despite this, reviews from banking analysts were mostly positive. Deutsche analysts argued that although margins in some areas of ANZ’s business were being squeezed, it was trading at around an 8% discount to its peers. Historically, they argue, ANZ carries a 5% discount.

Of all the big four, however, ANZ has the most compelling growth strategy, clearly outlined ever since Mike Smith assumed the role of chief executive. For that reason, Deutsche argued that the short-term headwinds had been well and truly factored into the share price.

Despite adopting a neutral approach to ANZ, JP Morgan analysts argued the bank was its preferred exposure to the sector. The below peer 65% payout ratio, enabling greater investment in the business, delivered a more compelling argument for future growth.

Rating ANZ a buy, Citigroup analysts were attracted by the discipline the company has asserted over its cost base. It no longer stands out as having higher expense growth than its peers while the absolute level of impaired loans had fallen.

UBS has a sell recommendation on ANZ, primarily because of its shrinking net interest margins. In 2010, it calculates that ANZ had a far better margin than any of its peers. But competition has seen that revert back to industry levels, offsetting volume growth in Asia.

As for the cost controls, while it lauds the approach, it argues that isn’t the reason investors own the stock. With signs of improvement in the global and Asian economies, ANZ needs to deliver on its regional strategy with increased revenue.

To experience MyClime and the insights they can offer, click here www.clime.com.au/eureka