The folly of the BoE's forward guidance

Although the unemployment rate is set to hit the Bank of England’s forward guidance threshold as soon as next month, the bank has reiterated over two years ahead of BoE estimates in August that they see no immediate need to raise rates.

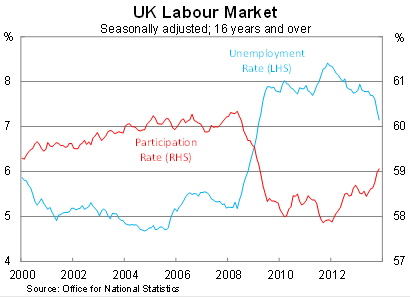

The unemployment rate fell to 7.1 per cent in the three months to November, from 7.4 per cent in the three-months to October. It is now at its lowest level since early 2009. The unemployment rate is now perilously close to the BoE threshold of 7 per cent, after which it has said it would consider raising interest rates.

Unlike the United States, the fall in the UK unemployment rate has not been driven by falling participation. The participation rate has picked up by 0.7 percentage points since May last year.

But the improvement in the unemployment rate has not been reflected yet in wage growth, while around a third of those remaining unemployed have been unemployed for over twelve months. The labour market is stronger, but it couldn’t be classified as being strong.

The rapid decline in the unemployment rate raises some questions for the BoE and further compromises its new forward guidance doctrine. It might be the hot new trend in central banking, but forward guidance has only caused the BoE grief and arguably harmed its credibility.

The idea of setting a forward-looking threshold that would prompt the central bank to consider raising rates seemed like a good idea at the time. It was intended to provide certainty to markets, and to give confidence to households and businesses that lending would remain cheap while the economy recovered.

Since introducing forward guidance in August last year, the UK unemployment rate has plunged. At the time, the BoE believed it would take over two years to reach the threshold of 7 per cent unemployment. Instead, it looks like it will take about six months.

The problem is that the BoE is not entirely sure why the labour market has improved. Rising employment has not been reflected in other labour market measures such as wages or productivity. Activity has improved, but it is coming off an incredibly low base, while there remains significant spare capacity across the economy and little pressure on prices.

Rather than providing certainty, forward guidance has instead created speculation and uncertainty.

In the minutes of their January board meeting, members of the Policy Committee noted that there was “no immediate need to raise Bank Rate even if the 7 per cent unemployment threshold were to be reached in the near future”.

At some point, probably as soon as its next meeting, the BoE will be forced to revise its forward guidance and lower the threshold at which it will consider raising the cash rate. It has no other option since once the threshold is passed forward guidance ceases to provide any guidance on when the central bank may act. A failure to adjust their communication will only increase uncertainty further.

But while I am critical of the BoE forward guidance, the BoE’s stance on policy right now is entirely correct. There remains a number of underlying concerns for the UK economy, including low productivity, subdued wages growth, household spending growth (which slowed in the December quarter) and a eurozone recovery that continues to be fragile.

It is sometimes easy to forget, particularly when looking at the unemployment data, that UK real GDP remains 2 per cent below its peak prior to the global financial crisis. Remarkably, the economy has not grown in six years and conditions remain a struggle for far too many people.

In such an environment the decision to maintain loose monetary policy makes sense. But unfortunately for the BoE, their communication – despite fine intentions – has proven to be dreadful.