The Fed's doves can't fly forever

Measures of inflation continue to track at around the Federal Reserve’s annual target of 2 per cent but with conditions in the labour market improving and easing spare capacity, the risks to inflation are mainly on the upside. For now, the Fed remains dovish but it will become increasingly difficult to justify such loose policy when the unemployment rate falls below 6 per cent.

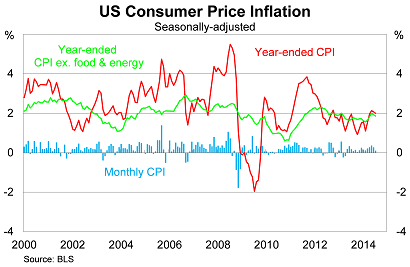

Headline inflation rose by 0.1 per cent in July, meeting market expectations, to be 2 per cent higher over the year. This marks the fourth consecutive month that annual inflation has been around 2 per cent, reflecting strong job creation and a moderate decline in measures of spare capacity.

Core inflation, which excludes volatile items such as food and energy, also climbed by 0.1 per cent in July and continues to track slightly below headline inflation over the year. Energy prices fell by 0.3 per cent in the month, following solid gains in May and June, which largely offset the rise in food prices.

While some measures of inflation are either at or approaching the Fed’s upper target for annual inflation, its preferred measure remains somewhat weaker and hints at greater spare capacity than indicated by the unemployment rate.

The core personal consumption expenditure deflator is tracking well below other measures of inflation, increasing by just 1.5 per cent over the year to June.

The different measures of inflation are showing some signs of convergence and I expect that to continue, with the core PCE measure pushing towards the Fed’s upper target over the remainder of the year.

The outlook for inflation will largely rest on two central but conflicting forces: wage growth and the US dollar.

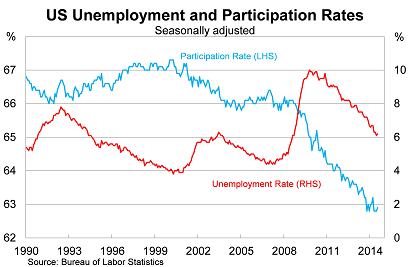

The US labour market is on a bit of a roll right now, with non-farm payrolls rising by over 200,000 for the sixth consecutive month. During that time, the labour market has posted its strongest gains in over eight years.

Since taking over as Fed chair, Janet Yellen has been at pains to remind the market that there remains significant spare capacity across the US economy. The participation rate is at around its lowest level in 35 years and measures of long-term unemployment remain elevated.

Consistent with this, wage growth remains fairly weak, with real average hourly wages largely unchanged over the year. This has weighed on household spending, which has been surprisingly modest in light of strong job creation.

Wage growth has been unimpressive for the past five years, consistent with the prevailing level of unemployment and spare capacity over that time. However, it is important to remember that wages typically lag employment and activity, suggesting that wage growth could pick up a little in the coming quarters as a tighter labour market creates some competition for the best candidates.

On that basis, wage growth poses some modest upside risk for inflation but any pick-up will be relatively slow and steady and unlikely to catch the Fed or other market analysts by surprise.

The dollar is always much harder to predict. The market recognises that the US outlook has improved relative to Europe and Japan and it is also pricing in some rate action for next year. Fundamentally this must shift further in a favourable direction for the US dollar to push higher.

I’m moderately bullish on the US, at least compared with the likes of Europe, and I expect the US dollar to appreciate somewhat against its major trading partners. At the very least, the dollar appears almost certain to appreciate further against the Australian dollar, particularly if the recent decline in commodity prices reflects a permanent shift for the resource sector and Australia’s terms-of-trade.

Obviously Yellen remains fairly dovish but next year will be dominated by growing speculation on the Fed’s exit strategy. This speculation will only increase once the Fed ends its asset purchasing program in October.

If non-farm payrolls continue to expand at their current pace, resulting in the strongest annual employment gains in 15 years, those discussions will inevitably be brought forward. It will become increasingly difficult to justify a zero per cent cash rate when the unemployment rate starts with a five.

For now, though, the US is nicely placed, with strong employment growth and a solid outlook for the remainder of the year. The risks to inflation are fairly modest and mostly to the upside if wages respond to stronger employment, although they may be partially offset by a rise in the US dollar (though obviously that’s difficult to predict).