The Fed won't waver from its on-track taper

Growth may have slowed during winter, but everyone knew that it would never be enough to dissuade the Federal Reserve from once again winding down its asset purchasing program.

At its March meeting, the Fed decided to cut its asset purchasing program by a further US$10 billion. The Fed will now add to its holdings of mortgage-backed securities by US$25bn per month (from US$30bn) and also purchase US$30bn of longer-term Treasury securities (from US$35bn).

The Janet Yellen era has begun with two key changes to its statement: First, it dropped the unemployment rate threshold from their forward guidance. Second, Fed officials believe that rates will be higher by the end of 2015 and 2016 than they did in December last year.

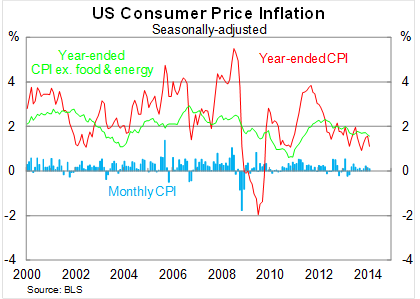

The Fed has stated that it will be appropriate to maintain the current level of the federal funds rate until well after the asset purchase program ends, especially if inflation expectations remain below the Committee’s 2 per cent long-run target.

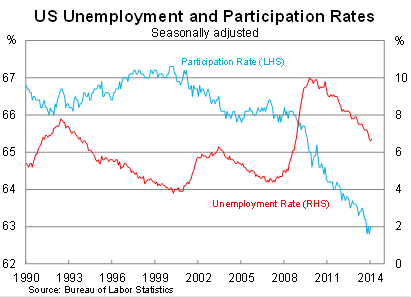

This is a noticeable change from previous statements, which relied upon a 6.5 per cent unemployment rate threshold at which the Fed said they would consider raising rates. With the unemployment rate down to 6.7 per cent in February, it was obvious that the unemployment rate threshold was no longer a good indication of when the Fed would consider raising rates.

Instead it is now mostly about inflation, though the Fed will consider a wide variety of other economic indicators. Basically it is taking an old-school approach to monetary policy, returning to how it conducted policy prior to the global financial crisis and trendy terms such as quantitative easing and forward guidance.

As I suggested yesterday morning, the federal funds rate will remain near zero as long as inflation remains significantly below the Fed’s 2 per cent target (Don’t inflate expectations about a US rate rise March 19).

But despite the statement providing a more bearish view, the Fed’s forecasts for interest rates were actually a little more hawkish overall. The median forecast from the Fed is that the federal funds rate will rise to 1 per cent by the end of 2015, compared with a median forecast of 0.75 per cent at the December meeting. No rate rise is expected in 2014.

The median forecast is that rates will rise to 2.25 per cent by the end of 2016, compared with 1.75 per cent at the December meeting. The long-run aim of the Fed is to push rates back towards around 4 per cent.

The more aggressive interest rate forecasts were consistent with the view that the labour market would tighten faster than the Fed expected in December. The March forecast for the unemployment rate at the end of 2014 is around 0.25 percentage points lower than in December and 0.2 percentage points lower at the end of 2015.

But the more optimistic forecasts for interest rates and the unemployment rate are somewhat at odds with a slightly more pessimistic view for GDP growth. Though perhaps this just reflects the nature of the Fed’s forecasts, which take the central tendency from individual forecasts by Fed board members and Fed presidents. There is no reason why forecasts derived this way will end up being entirely consistent.

The Fed was right to drop its unemployment rate threshold for its forward guidance -- which was, at best, only creating further uncertainty -- and instead focusing on inflation and other measures of economic conditions. It provides the Fed with greater flexibility, which is important in an environment that cannot be characterised within a single statistic.

Despite poor weather in January and February, the outlook for the US economy is fairly bright for 2014 and that momentum is set to continue over the next couple of years. The Fed is betting that is will be enough to push inflation back towards its target.

The Fed is likely to continue tapering its asset purchase program in measured steps, likely to be a further US$10bn at its April meeting. Despite Fed assurances that the taper is not on a preset course, I get the distinct impression that is almost is. I anticipate that the taper could be over as soon as October, which is perfect timing for the Fed to begin considering their first move for the federal funds rate in 2015.