The Fed fuels investors' sweet dreams, but for how long?

“To sleep: perchance to dream: ay, there’s the rub.” What better escape from the daily torments of life for Shakespeare’s Hamlet than sleep? What better escape for markets from their wall of worries than to sleep and dream, and who better than the dream-makers at the Federal Reserve to put them to sleep!

For decades, in particular in the years leading up to the financial crisis, investors have been in a dream world, a parallel universe coexisting with the world’s inherently unstable financial system. It's a bitter fact evident in the many boom-and-bust episodes throughout the past century.

At the heart of it all is the fractional reserve banking system managed by the world’s central banks, including the Federal Reserve. In it, banks are able to do what might seem possible only in a dream, creating money out of thin air when they turn every dollar, euro and yen into a money supply many times larger than the so-called base money central banks create.

Fractional reserve banking explains how nations have money for both 'guns and butter' despite empty coffers, and it explains how households and businesses are able to borrow until the cows come home. It is different under a gold standard, where the limited supply of gold limits the growth of credit.

By no coincidence, credit growth began to soar in the US (see Figure 1) and throughout the world after the US left its gold standard for a fiat currency in August 1971. Money printing and the Fed’s magic dust for years helped keep the risks from this debt explosion confined to a dream world until the 2008 financial crisis made it apparent that easy money was partly to blame.

Today, central bankers are acting mightily to manage the inherently unstable financial system, taking mammoth actions designed to boost asset prices and encourage lending, all the while hoping to keep households, businesses and investors dreaming and distracted from the monumental issues related to the financial system’s architecture. Investors would rather be as Scarlett O’Hara from Gone with the Wind and think about that tomorrow.

Low market volatility in the Land of Nod

So, if investors are losing little sleep over big issues such as the inherent flaws in the design of the financial system, what today are the frets that must be foiled, the troubles to be tackled, and worries wrestled? For Fed chair Janet Yellen and the Fed, there are many, but there are three in particular that have the Fed looking to put investors safely into the arms of Morpheus, the Greek god of dreams:

1. The recent acceleration in inflation

2. The 'dots' in the Fed’s Summary of Economic Projections

3. Financial stability risks

In soothing these concerns, Yellen has been every bit the Sandman that Hans Christian Andersen depicted in his 1841 folktale, Ole Lukøje. In the tale, Ole Lukøje (the Sandman) sprinkles fine sand into the eyes of good children, just enough to keep their eyes closed and to “dream the most beautiful stories the whole night”.

Ole keeps two umbrellas to help him with his task: one for the good children with pictures for them to dream about, and the other with no pictures, for the naughty kids. It is the former umbrella that the Fed these days keeps over the markets; the latter it is saving for when it decides to raise interest rates.

Janet Yellen is now the Sandman, having taken over the duties of Sandman from Ben Bernanke in February. Save for her “six months” comment in March, when she appeared to indicate the Fed might raise interest rates six months after completing its bond buying program in November, Mrs Sandman has been masterful at keeping investors in their dream state.

Whether Yellen has enough magic sand to keep investors calm -- to suppress interest rate volatility and keep financial markets stable more generally -- remains to be seen, however. It will become more difficult the closer unemployment and inflation move toward the Fed’s targets.

Yet it won’t be that difficult, because in the new neutral, which is PIMCO’s thesis that global growth rates are converging toward more modest trajectories while global leverage remains high, the Fed won’t raise interest rates as much as it has historically. We believe the new neutral policy rate is today 2 per cent instead of the old 4 per cent.

Let’s look more closely at the three issues mentioned above and how Mrs Sandman has thus far put them to rest.

Inflation

One of the biggest moments of this year occurred when Yellen in her post-Federal Open Market Committee press conference on June 18 lulled investors back to sleep a day after they were shaken by the biggest advance in core consumer prices (all prices minus food and energy) in years. Mrs Sandman said the data were “noisy,” making clear that the data were not yet loud enough to wake investors. So, back to sleep they went; Treasury yields fell and they haven’t been higher since.

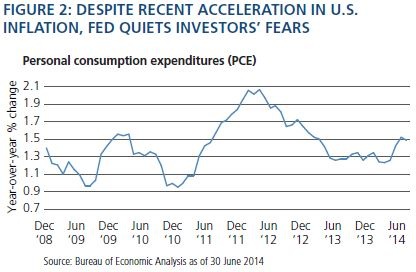

It will nonetheless be an ongoing effort to keep investors from worrying, because the inflation rate has accelerated somewhat (see Figure 2). The FOMC acknowledged this in its 30 July policy statement when it said “inflation has moved somewhat closer to the Committee’s longer-run objective,” adding that “the Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced and judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat".

Slow gains in wages give the Fed confidence the acceleration in inflation is quieter than a pin drop. Labor costs, after all, account for the lion’s share of the contribution to inflation. One major gauge of labor costs is average hourly earnings, which have increased at a paltry 2 per cent pace over the past five years compared with the historical norm of 3 per cent (see Figure 3). Yellen has indicated she would like to see wage growth get back there, so she will aim to keep investors in their slumber until she’s confident paychecks will be getting fatter.

The 'dots'

Janet Yellen has used her magic sand to keep investors’ eyes from being fixated on the 'dots' that are part of the Fed’s Summary of Economic Projections released four times per year (see Figure 4).

The dots show where FOMC meeting participants believe the appropriate level of the federal funds rate (the Fed’s policy rate) should be for a given point in time as far out as three years. Recent projections show participants on average expect a hike in the middle of 2015, with the fed funds rate ending the year at about 1.2 per cent and ending 2016 at about 2.5 per cent. New projections for 2017 will be revealed at the Fed’s September 17 meeting.

In March, the dots indicated a higher level of the fed funds rate than many in the market were projecting. Worried that markets would focus too much on the dots rather than what she and the Fed’s core leadership were thinking, the Fed chief at her 19 March press conference reached into her sandbag and said,

“I would simply warn you that these dots are going to move up and down over time a little bit this way or that. … I really don’t think it’s appropriate to read very much into it.”

That was that, and back into repose investors went. Going forward, if inflation and unemployment continue to move toward the Fed’s objectives, investors may worry about the dots moving higher and that there might be an increase in the numbers of Fed officials opposing the Fed’s extraordinarily accommodative monetary policy. In that case, Yellen will reprise the role of Morpheus.

Financial stability risks

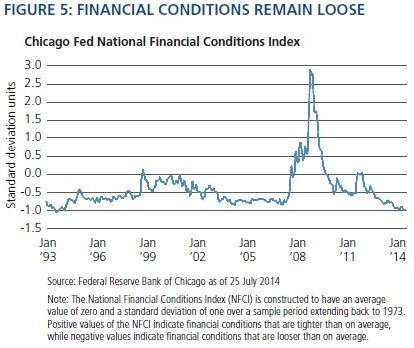

Recent corrective action in the financial markets has somewhat alleviated concern about their bubbliness, but certainly has not alleviated all of it, given the shallowness of the correction thus far relative to gains of the past few years (see Figure 5). Many nonetheless worry that the Fed will begin to view the gains as an unwanted byproduct of its policies.

Yet, investors should ask, why worry? Mrs Sandman in early July said that while there may be 'pockets' of increased risk taking across the financial system, “monetary policy faces significant limitations as a tool to promote financial stability”. The Fed chair said a macroprudential approach is the first line of defense against financial stability risks. So, don’t look for the Fed to shatter investors’ dreams of higher prices anytime soon.

Investment implications

The Federal Reserve’s monetary policy remains geared toward accomplishing three main objectives:

1. Flatten the forward interest rate curve

2. Lower interest rate volatility

3. Prod investors to move outward along the risk spectrum

These objectives are likely to be in place until wage gains accelerate and Americans’ paychecks get fatter. Even when they do, the Fed is likely to allow a bit of catch-up following over five years of weak gains.

Although the Fed can’t keep investors in their dream state forever, interest rate levels go a long way toward keeping them there, and in the new neutral they likely will be there for a long time, because the Fed’s policy rate won’t be increasing much in the years ahead. This supports equity and credit markets, which are likely to stay on a path for positive, albeit relatively low returns.

This favours considering a carry-heavy portfolio and leaning against interest rate volatility from time to time. A carry-heavy portfolio will be overweight credit, and we suggest considering broadening your definition of credit to include mortgage credit as well as sovereign debt in Europe’s periphery, among other ideas.Fed

Central bankers are striving gallantly to defend the inherently flawed fractional reserve banking system that for decades led to sharply increased indebtedness throughout the world, and their efforts are succeeding. Yet they can’t do it all. Geopolitics and continued political dysfunction are just two of the challenges central bankers face in their attempts to promote economic growth and keep investors in their slumber.

Nevertheless, there remains a great deal of sand in the Sandman’s bag, and the Sandman has a mystical ability to create more of it anytime investors begin to toss and turn.

This article was originally published at Pimco. © Pacific Investment Management Company LLC. Republished with permission. All rights reserved.