The false averages trap

Summary: Relying on average market returns to guide investment decisions can result in investors taking an overly negative view of the opportunities that exist. The ASX200's limited diversity has contributed to negative sentiment, as the financials and natural resources sectors have dragged overall average performance down. Strong performers can still be picked from a market with subdued average growth. For example, as financials and resources have taken a hit in the UK market, the information technology sector has delivered very strong results. |

Key take out: Value investors should be aware that the Australian economy looks set to move away from traditional investment areas, and they should look for companies capable of succeeding in challenging market conditions. |

Key beneficiaries: General investors. Category: Shares. |

The willingness to diverge from the herd view continues to be vital for investors wishing to maintain strong equity returns. However, the lack of sector diversity in the S&P/ASX200 Index, along with headwinds for traditional blue chip companies, typically favoured by investors, points to subdued average market returns over the medium term.

Averages, however, can be misleading and we are strongly of the opinion that investment opportunities still remain for value investors.

Why averages mislead and why diversity is important

Anyone familiar with statistics will understand that purely looking at an average result can have misleading conclusions. The comical example is the statistics professor who sleeps with his head in the freezer and feet in the oven because “on average” he is at the right temperature.

The use of crude averages, such as market indices is based on an understandable psychological desire to simplify the complex, but can lead to false conclusions when the average is not a representative sample of the population.

To illustrate, in 2015 we have seen the S&P/ASX200 experience increased volatility and many market participants have found themselves swept up in a wave of negative information. These effects have been compounded by the ASX200's limited diversity, with 48 per cent financials and 14 per cent natural resource companies. These sectors were punished by weak Chinese growth figures and tougher capital requirements for domestic banks.

The diversity issue is apparent when compared to the S&P500. No one sector represents more than 21 per cent of that Index. It is unsurprising that the S&P500 has outperformed by 3.7 per cent in the recent volatile markets.

When an index is not representative of its underlying economy, investors can wrongly adopt an overly negative perception of the investment opportunities, particularly when headline growth is forecast to be subdued.

What investors can learn from the UK

The experience of the UK market over the past 3 to 5 years demonstrates why there are many reasons to remain cautiously optimistic.

Like Australia, the headline market index in the UK, the FTSE100, has a similar concentration issue and non-representative structure to its domestic economy. There's a greater than 40 per cent allocation to financials and natural resource companies. It has also recently experienced a prolonged period of below-average GDP growth, as Australia looks set to experience. This has resulted in the FTSE100 providing a return of just 1.66 per cent per annum over the past two years.

Active assessment of sectors is important

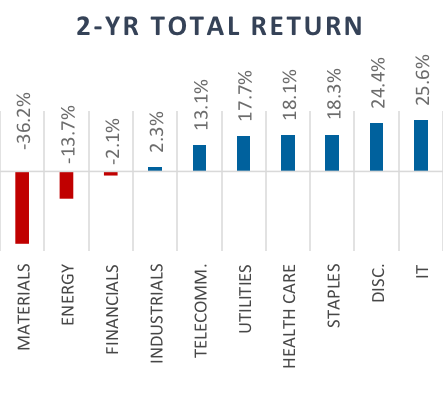

The modest returns of the FTSE100 hide a dichotomy of results at the individual sector level, as illustrated in Chart 1. Sectors with historically higher weightings, financials and natural resources, delivered negative returns, while returns from all other sectors were positive. The performance included returns of over 20 per cent in the last two years for consumer discretionary and information technology, illustrating the potential for strong returns in a low total growth environment.

Turning back to Australia

By virtue of a market capitalisation construction method, market indices will buy high and sell low, overweighting companies and sectors that have performed well historically, with no consideration of future returns. This is now an issue for the ASX200, as well as many investors who have favoured passive investing or the traditional blue chips, as the strong performance of financials and natural resource companies has reduced the exposure to growing areas of the economy.

Considerations when seeking investments in 2016

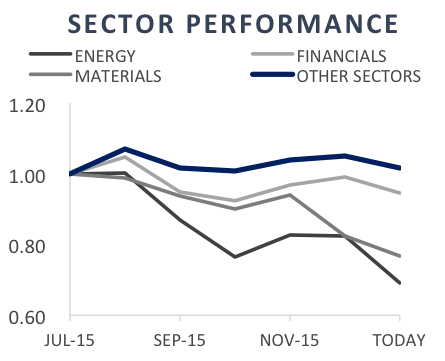

The Australian economy looks set to enter a period of adjustment away from traditional investment areas, which have reached high valuations due to a “search for yield” mentality, as well as high commodity prices. As Chart 2 illustrates, we have already seen evidence of this in the underperformance of the energy, financials and materials sectors.

When assessing investment options, investors should be seeking companies that display the competitive attributes and management skills that will enable them to thrive in more challenging markets.

David Clark is an Investment Manager at Cameron Harrison Asset Management.