The euro has yet to reflect grim reality

While much has been written in regards to recent Aussie dollar strength against the greenback, it is the trade against the euro that has caught my attention lately.

The local economy is showing some positive signs of transition away from the mining sector, and the Reserve Bank of Australia has finished cutting interest rates. So I can understand some bullish sentiment returning to the Aussie dollar. But Europe?

There has been some stability in the eurozone. With no bad news from sovereigns or banks in the region, this is apparently good news. Some are arguing the region’s economy is steadily recovering, with GDP in positive territory and growing, at least in northern Europe anyway. But it is the flat and possibly declining inflation outlook that provides the biggest challenge for a return to meaningful growth across the region.

The markets have, for quite a while now, been speculating the ECB will have to take some extraordinary steps to ward off a deflationary spiral that would threaten the fragile eurozone recovery. While the conversation to date has been about the possibility of negative interest rates (ECB's minimum bid rate is currently at 0.25 per cent) following last week’s ECB meeting it is turning towards a rumoured €1 trillion quantitative easing program.

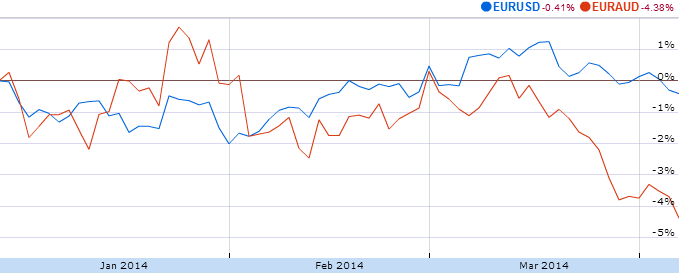

The response? There hasn’t been much at all really with the euro losing only 0.5 per cent against the US dollar since last Thursday’s ECB meeting. In fact the EUR/USD, the world’s most heavily traded currency pair, is sitting less than 2 per cent away from its highest level in two-and-a-half years and just 0.41 per cent below where it began 2014.

Now this could be because the markets don’t believe the speculation yet, but if they do it becomes more likely the euro could be in for some very tough times. Against the Aussie dollar the euro is down 4.38 per cent so far this year but that is more due to the strength of the Aussie and should a likelihood of ECB QE kick in, the cross rate could possibly double these losses.

This week's Australian employment data will capture the market's attention but I am also looking forward to next week's eurozone CPI release for further direction on the euro and the EUR/AUD cross rate.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".