The economy needs more than another brick in the wall

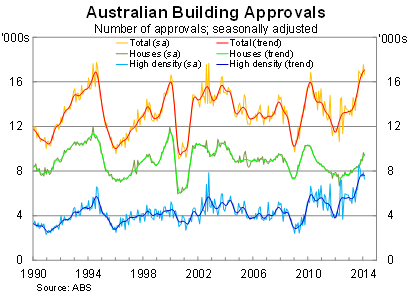

Despite declining in February, building approvals remain at an elevated level and point towards a boost in dwelling investment over the next two years. But after adjusting for population growth, building approvals remain well below their prior peak and suggest that the boost to dwelling investment may not be as large as many hope.

Building approvals fell by 5.0 per cent in February, much weaker than expectations, to be 23.2 per cent higher over the year. The decline largely offsets last month’s strong 6.9 per cent rise in approvals.

Despite the monthly fall, the housing sector remains fairly strong with both houses and apartments showing strong gains over the year. It is also perfectly normal for building approvals to decline one month after a strong gain, which is precisely why it is better to focus on trend rather than seasonally-adjusted estimates.

On a trend basis, building approvals rose by 0.7 per cent in February to be 27.6 per cent higher over the year. But while approvals continue to climb, the momentum has slowed significantly since September.

Nowhere is that more evident than in approvals for apartments, which have actually trended downwards over the past two months. This shouldn’t come as too big a surprise given the unprecedented growth over the past two years; there was always going to be a correction at some point.

But we shouldn’t ignore the downward trend entirely, particularly since approvals for apartments provide a good indication of investor activity.

A decline in apartment approvals, if persistent, could indicate that investor demand has softened, which not only has implications for construction but also for house prices.

The rapid rise in apartment approvals over the past couple of years continues to mark a change in the social composition of families towards higher density inner-city living.

One only has to walk around Melbourne to see the unprecedented number of high-rise apartment buildings in construction or about to commence construction.

This is particularly obvious in Sydney, Melbourne and Brisbane, where high-density housing makes up an increasingly large share of total building approvals. Housing construction in our less populated cities continue to be dominated by houses.

The high level of building approvals shows that the rebalancing of the Australian economy continues to take place. But it is not obvious that there will be a significant rise in dwelling investment, particularly given so much of the investment will take place in high-density dwellings.

Adjusted for population, building approvals remain well below their peak in 1999 and have only just reached their peak in early 2010.

Although dwelling investment will certainly rise, I have doubts that it will climb to the heights required to fill the eventual hole left by the collapse in mining investment.

Despite the monthly decline, the Reserve Bank of Australia will welcome the continued strength in building approvals. It indicates that dwelling investment is likely to be quite strong throughout 2014 and 2015.

But those who believe that housing construction will be the driving force behind the new economy may be left disappointed. Based on historical data, dwelling investment has limited upside and is likely to be a minor player in the RBA’s battle to rebalance the Australian economy.