The economy is not out of the woods yet

The Australian labour market posted some solid gains on a seasonally adjusted basis but given the data's recent troubles it is far too soon to declare that the economy is out of its rut. Australia faces a number of headwinds in the year ahead that will continue to weigh on employment and income and it will be some time before the Australian economy turns the corner.

On a trend basis, employment rose by 14,400 people in December, with the pace of growth picking up modestly over the past four months. The Australian economy has produced 158,000 new jobs over the past year -- the strongest calendar year since 2010 but still poor by pre-crisis levels.

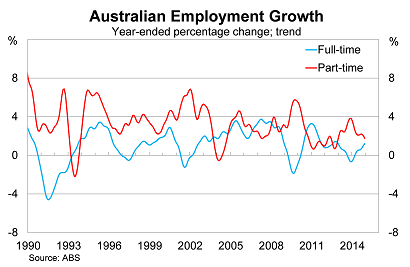

Growth was broad-based between full and part-time positions. Over the past year, however, full-time jobs have accounted for two-thirds of total employment growth.

Employment rose by 7,200 for both men and women -- though growth for men was concentrated among full-time positions and for women part-time positions.

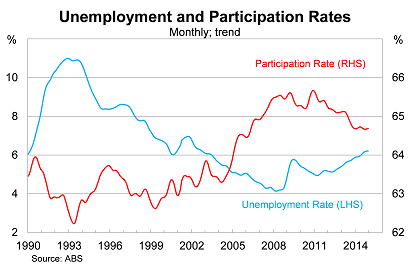

The unemployment rate remained at 6.2 per cent in December and appears to have stabilised somewhat in recent months. The unemployment rate is now 0.3 percentage points higher over the year.

As always a correct assessment of the labour market requires consideration of the participation rate. Considering either measure in isolation can often be misleading.

The participation rate has also stabilised in recent months and doesn't appear to be putting much pressure on the unemployment rate – in either direction. The outlook for the participation rate is somewhat mixed; there remains a number of headwinds that may shift the rate lower and our population is slowly shifting towards age-groups that have historically had lower participation.

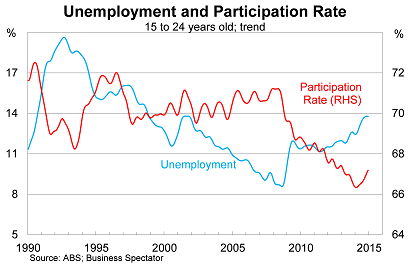

Youth unemployment remains elevated at a little under 14 per cent. The rise in the unemployment rate has been matched by higher participation, suggesting that while young people are actively searching for jobs there are few opportunities available (A hardline stance won't work for youth unemployment, January 7).

So the Australian economy is producing jobs at a moderate pace. Not quite enough to absorb population growth -- hence why the unemployment rate has increased -- but sufficiently high enough to ensure that any rise in unemployment is gradual.

However, a very different picture of the Australian economy will do the rounds over the next few days. It will tell a story of a booming labour market and an economy that has turned the corner.

Unfortunately, most of the mass media continues to focus on seasonally-adjusted estimates. The same estimates that only a couple of months ago the ABS basically scrapped because it had no idea what the heck was going on (Is the data real, or just another snow job? October 9).

Given the circumstances, it is clearly more sensible to focus on the trend estimates. They might not be as sexy -- and they certainly won't give you great headlines -- but they are reliable and sensible and provide a more accurate view of the Australian economy.

The labour market may very well be on the mend -- hopefully it is -- but it certainly isn't booming. We know this because most indicators point to an economy that is struggling or at best treading water.

It's an economy characterised by rising construction but also a business sector that is reluctant to take risks. It's also characterised by a mining sector that may very well collapse in the next twelve months and a motor vehicle industry that will soon disappear.

Lower interest rates and now lower oil prices are helping to support domestic spending. Asset prices -- particularly for those living on the east coast -- have increased and are supporting household spending. But is that likely to prompt a jobs boom?

When the economy does come out of its rut it will be a gradual affair, given the ongoing structure of the Australian economy we are no longer able to have the growth periods that we experienced during the mining boom. The decline in the terms of trade and commodity prices will continue to weigh on the federal government budget and Australian income, and that all but ensures that the Australian economy will remains fairly weak during 2015.

Does this mean anything for monetary policy? The RBA was unlikely to cut rates in February anyway -- since it had no time to communicate their intentions -- so I doubt that it will. If the result was due to seasonal volatility, then the market will snap back in the next few months, providing a clear impetus for the RBA to lower rates and appease the market.