The economic clouds are darkening

The Reserve Bank has downgraded the economic outlook for the third time in the past year. We continue to face considerable uncertainty, with the economic outlook hinging precariously on the outlook for commodity prices, Chinese demand and whether non-mining investment will ever improve.

The RBA released its Statement on Monetary Policy earlier today, which showed that the near-term outlook for the Australian economy has soured over the past three months. That follows significant downgrades for both the May and August SMPs (forecasts in the November SMP were unchanged; Downside risks prevail in the RBA's economic outlook, November 7).

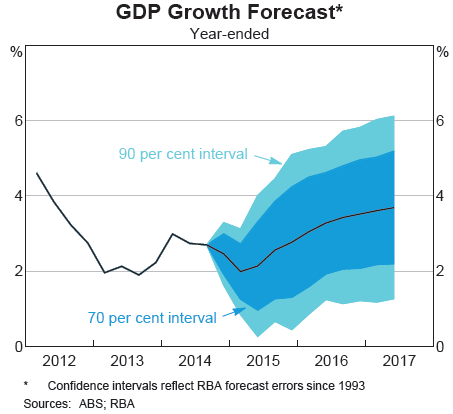

According to the RBA, the economy is set to grow at a sub-trend pace during 2015, before picking up to around 3.25 per cent in 2016. It's important to remember that the confidence intervals around these forecasts are huge and anything beyond the next six months is about as accurate as throwing darts while blindfolded.

In the graph below, the darker blue interval indicates that the RBA is 70 per cent confident that growth will fall within those parameters. As such, we can safely say that the RBA is 90 per cent certain that Australia won't suffer a recession between now and the 2016-17 financial year, though it believes the greatest risks will be during the next 12 months.

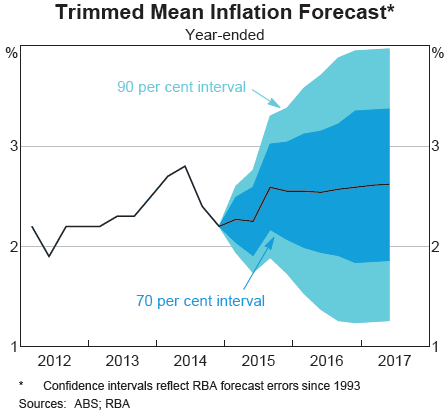

The outlook for inflation was revised down by around 0.5 percentage points in 2015 but revised up slightly for the following year. The near-term downgrade reflects a sharper-than-expected fall in oil prices but also weaker domestic demand and soft labour market outcomes.

According to the RBA, “the fall in automotive fuel prices … subtracted around 0.25 percentage points from headline inflation in the September and December quarters combined”. It expects lower fuel prices to “subtract a further 0.5 percentage points in the March quarter". The indirect effect of lower fuel prices -- since fuel is a key input for most businesses -- is uncertain but is expected to be passed on to the consumer over the next couple of years.

These forecasts appear awfully optimistic -- particularly above trend growth during 2016 -- but one of the RBA's key assumptions is that the “cash rate moves broadly in line with market pricing”. According to ASX estimates, the market has fully priced in a cut by May and a 50 per cent chance of a further cut by September.

The Australian dollar jumped sharply following the release of the SMP, which suggests one of two things: either the market doesn't fully grasp the assumptions behind these forecasts or the RBA has done a downright terrible job of communicating its stance on policy. After Tuesday's debacle, it is probably a mixture of the two (The RBA must not let its rate cut go to waste, February 3).

The SMP also includes a discussion on the uncertainties surrounding these forecasts. This section gives readers an insight into the opportunities and threats the economy will face in the near and medium-term.

The RBA placed special emphasis on the Chinese property market -- as it did last quarter -- such is the influence that conditions in the property sector have on the demand for Australian commodities.

Chinese property prices continue to decline, albeit at a slower pace, despite authorities taking steps to support activity. The rate of investment growth has eased and a number of property developers remain precariously placed, suffering from high levels of debt and elevated inventories.

The RBA notes there is a concern that softer growth in Chinese land prices -- and in some cases falling land prices -- may have an adverse effect on local government revenue. This could, in turn, slow local implementation of infrastructure investment programs. That scenario has direct implications for the demand of Australian commodities.

Those commodities remain a key source of risk for the Australian economy. Lower iron ore and coal prices pose a genuine threat to the economy, while lower oil prices should provide a boost to household and business activity. The impact of both developments has been dampened by a weaker Australian dollar, which in itself remains major source of risk to the economic outlook.

As the present time, it appears as though China's economic transition -- from relying on infrastructure investment to consumption -- poses a considerable downside risk to both commodity prices and Australian exports. As this unfolds, expect consolidation within the mining sector -- either through mergers / buyouts or bankruptcy. Australia's mining sector may be a very different beast this time next year.

The RBA notes that "consumption growth could be stronger than anticipated if conditions in housing markets strengthen". This is the so-called ‘wealth effect' of rising asset prices and while it exists it also tends to be quite small. The property market could begin another boom phase -- interest rate cuts certainly help -- but the household sector faces a number of headwinds that will weigh on property prices over the next few years (The RBA's spark won't see house prices rocket, February 6).

Finally, the RBA reiterates comments made in previous SMPs regarding the uncertainty surrounding "the timing and pace of the expected decline in mining investment." The RBA doesn't believe that the recent declines in commodity prices will lead to a significant additional fall.

The outlook for non-mining investment remains weak. The RBA notes it has pushed back the timing of the recovery in non-mining investment until later in 2015 because “there has not yet been convincing evidence of a turning point in the forward-looking indicators.” In other words, the RBA is at the finger-crossing and praying stage of the investment cycle, hoping that businesses will respond to lower interest rates and a softer exchange rate.

On balance, the SMP paints a fairly depressing picture of the Australian economy. Furthermore, recent trends suggest that the RBA is probably overstating the pace of recovery and will need to revise growth down further in the future.

The Australian economy continues to face a number of headwinds -- only a few of which have been mentioned within this article -- and while it is awfully difficult to predict growth rates accurately we can safely assume that Australian households and businesses are set for another challenging year.