The dangers in Garnaut's last ditch stand

Desperate to save the underlying legal architecture of the carbon pricing scheme, Professor Ross Garnaut suggested on Friday a radical compromise option that would mean the scheme would remain largely intact, but with a carbon price of a measley 50 cents per tonne of CO2.

Under this compromise proposal from Garnaut the current scheme would be amended to remove the limits it applies to the use of United Nations Certified Emission Reduction (CER) carbon credits. Under the current legislation companies liable under the scheme can use CER credits to cover no more than 12.5 per cent of their emissions. These CERs have been trading below 50 cents for some time now.

This would go a long way towards largely addressing Clive Palmer’s proposal for an emissions trading scheme with a price initially set at zero, but then adjusted upwards in line with the emission controls enacted by the United States, China, Europe, Korea and Japan.

In addition such a proposal carries the support of the Australian Industry Group (AiGroup) which represents a large proportion of Australia’s manufacturing sector. Before cowering to what was obviously backroom government pressure, AiGroup had said that complete abolition of the carbon price legislation would be unwise, and it would be better to remove the fixed price and move to unrestricted use of international trading.

It could also get support from other sides of the business community because in many respects this represents the best of possible worlds for big carbon emitters.

The reality is that in spite of all their Henny Penny squawking in the media, the current carbon pricing scheme represents a good deal for heavy emitters. It gives them some reasonable certainty over carbon pollution control policy, while at the same time heavily insulating trade exposed industry from the carbon price via free permits.

One suspects the bulk of the Business Council of Australia’s membership would support Garnaut’s proposal, also. It would fit with their historical position of supporting a market-based approach to controlling carbon pollution (read: emissions trading) as recently as 2013.

Just today the Climate Change Authority has dropped into this debate a research paper looking at how Australia could use CER credits to contribute towards its emission reduction targets. Although the CCA doesn't suggest we do this, its paper explains that there are so many credits available that Australia could acquire the entire 431 million tonnes of abatement required to meet its minimum 5 per cent reduction target from CERs while doing nothing additional at home, and barely budge the CER market price from laughably low levels.

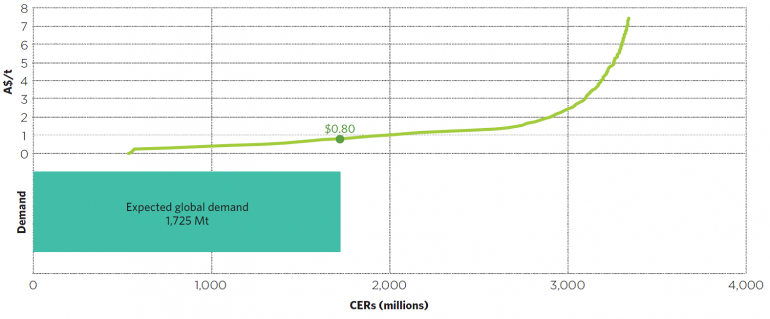

The report contains the following CER credit supply cost curve adapted from Bloomberg New Energy Finance. Future demand from countries other than Australia would only manage to tip prices to 80 cents. If Australia then bought a further 431 million tonnes, prices would squeak barely past a dollar.

Supply cost curve for CDM carbon credits

Source: Bloomberg New Energy Finance cited by Climate Change Authority.

At such bargain prices, we could simply outsource our emission reduction efforts to overseas. Sounds like a great deal – save the world and barely lift a finger.

The Climate Change Authority report speaks favourably about the environmental integrity of CER carbon credits, as do some environmental NGOs, such as the Climate Institute and WWF.

But within the CCA’s report are some reasons for why one should be cautious about whether large scale purchasing of CER credits will make a difference to global emissions beyond what is already locked-in.

Firstly, much of the supply of CERs are from historical projects that are already built and will deliver abatement irrespective of whether the carbon credits they’ve created manage to be sold. If we buy these up, it isn’t leading to any new abatement activity – instead we’re rewarding project developers for past good deeds. In particular, carbon credits produced prior to 2013 will ultimately expire in 2015, so these would be removed from the market anyway.

This still might be useful – investors could be more inclined to make future investments in abatement projects because they managed to sell their carbon credits from past projects. It also might also help build goodwill with developing countries, that we’ve helped them shoulder the burden of emissions reduction activity. This might make them more inclined to co-operate on future emission reduction efforts.

But we shouldn’t fool ourselves that buying a carbon credit at 50 cents, or even a dollar, has meant global emissions will be lower by a tonne of CO2 tomorrow.

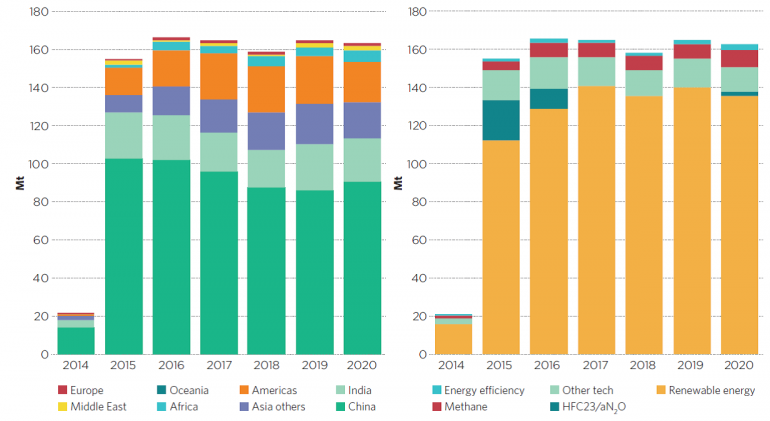

Secondly, there is room for double counting of carbon credits by the buyer and the seller. The chart below on the left illustrates that China is projected to be by far the largest producer of carbon credits to 2020. But China already has its own emissions reduction target for 2020. China has not given any commitment that it will tighten the stringency of its target by a tonne of CO2 for every carbon credit Australia buys from that country.

Thirdly, there are still legitimate questions surrounding whether purchasing of CDM credits leads to a genuine reduction in emissions from business as usual. The chart on the left indicates China (shown in dark green) is the predominant supplier of carbon credits to 2020, and the chart on the right indicates most credits will be from renewable energy projects. As keen readers of Climate Spectator would know, China has ambitious targets and policies for driving growth of the renewable energy sector in its country.

CER carbon credit supply by country and technology

Source: Bloomberg New Energy Finance cited by Climate Change Authority.

I am deeply sceptical that the offer of a paltry dollar for the carbon credits from renewable energy projects, which would be lucky to add 1 per cent of additional revenue, can claim credit for the abatement flowing from the many renewable energy projects in China producing CER credits. I also suspect a dollar for carbon credits won’t be responsible for renewable energy projects getting up in other countries around world.

This doesn’t mean purchasing CERs is a bad idea full stop, or that Garnaut’s last ditch effort to save the carbon price legal architecture is misguided. Keeping the legislation in place makes it much easier to ratchet up abatement efforts in the future. And purchasing certain types of CERs can make a genuine and unambiguous difference to global emissions.

But if someone tells you that it shouldn’t make a difference whether Australia reduces its own emissions or buys a carbon credit from overseas then they are oversimplifying the issue.