The clouds on Australia's economic horizon

It has long been expected that 2014 would be the year when mining investment would begin to significantly detract from real growth in Australia as the investment intensity of many large-scale resource projects starts to decline.

However, signs of life outside of mining have started to tentatively appear in recent data and allayed some concerns of a collapse in domestic demand.

We share this cautious optimism but stop well short of expecting higher policy rates this year. Australia has just begun a multi-year transition away from mining-assisted growth. Like a small boat in a large ocean with its anchor dragging behind it, the economy will need wind in its sails from other sectors to prevent it from stalling.

The economy also has limited ability to manoeuvre and change course in response to sudden storms or external shocks. While we expect a gradual slowing of growth in China, risks to this outlook are tilted to the downside, and this remains the key external cloud on Australia’s horizon.

Cyclical momentum

Recent economic data are finally showing some tentative signs of life outside the mining sector in Australia, suggesting that the current mix of a 2.5 per cent policy rate and the Australian dollar hovering around $US0.90 is starting to spur the long-awaited growth rebalance.

Historically, one of the most interest-rate-sensitive sectors of the economy has been the housing market, and this was no different in 2013.

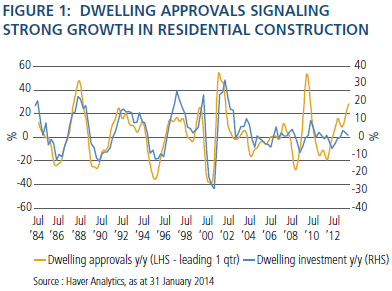

House prices rose 10 per cent on average as policy rates hit record lows. Importantly, this has begun to translate into a firmer outlook for residential dwelling investment, with a sharp rise in building approvals, which typically lead construction by about one quarter (Figure 1).

Dwelling investment represents approximately 5 per cent of the economy, so the recent acceleration in approvals implies a 0.5 per cent to 1 per cent contribution to growth from this sector.

But the pass-through from approvals to construction may be a little slower this cycle due to the significant shift towards multi-unit structures. This segment, which includes apartment blocks, has risen from a post-crisis low of 27 per cent of residential building approvals in 2009 to 44 per cent today. Regardless, dwelling investment appears poised to contribute meaningfully to growth this year for the first time since 2010.

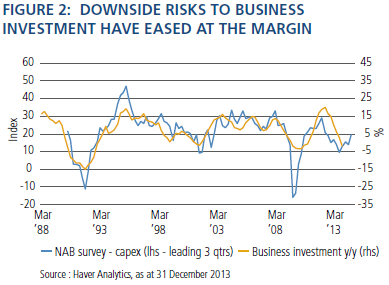

Additionally, the downside risks to business investment outside of the mining sector appear to have diminished at the margin. Indicators of business confidence have bounced over recent months. Of particular note is the improved outlook in the capital expenditure components of these surveys (Figure 2).

Although far from suggesting a marked acceleration, the risk of a large outright contraction appears to be reduced.

Secular headwinds

These cyclical tailwinds will need to be sustained just to offset the growth drag from the secular unwinding of the first two stages of the resource boom -- the decline of mining investment and Australia’s terms of trade -- as well as continued government fiscal consolidation.

The tapering of mining investment exerted a meaningful drag on domestic demand last year, and we expect this to intensify to be the largest growth drag in 2014.

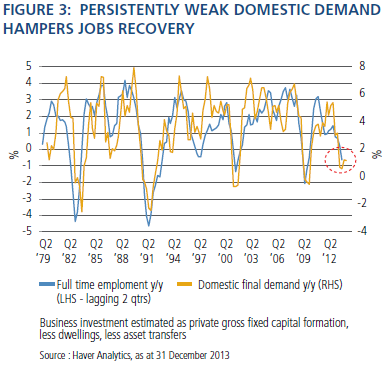

As Figure 3 illustrates, domestic demand typically leads employment growth so Australia’s soft labour market conditions should come as no surprise.

The persistent drag from this sector of the economy will likely weigh more heavily on growth and employment outcomes over the cyclical horizon, dampening any improvements we are beginning to see in other industries.

In this likely low domestic growth environment, Australia will be vulnerable to external shocks, and therefore the outlook for China will remain critical. While we still expect Chinese growth to slow gradually over the cyclical horizon, uncertainty has risen recently and risks to the outlook are tilted to the downside.

Excessive credit creation funded by products outside traditional banking channels continues to pose risks to financial stability in China. We certainly believe China has the resources to manage these risks, but doing so while progressing with needed structural reform and growing at 7 per cent will be a significant challenge.

If our forecast growth range of 6.5 per cent to 7.5 per cent proves incorrect, it will more likely be lower, with negative implications for Australian growth and additional policy accommodation likely needed from the Reserve Bank of Australia.

So are the cyclical signs of life strong enough to produce the type of growth outcomes that would see the RBA raising interest rates over the next year? We think this is unlikely. The RBA will want to see the unemployment rate start trending down before beginning a hiking cycle, and for this to occur, Australia needs to be growing above potential, which we estimate to be around 3 per cent.

With the decline in mining investment and ongoing government fiscal consolidation at the federal and state levels likely to be heavy growth drags this year, we find it very difficult to construct a forecast for aggregate real GDP growth meaningfully above 3 per cent. Our base case expectation is for the RBA to keep policy rates unchanged this year, and risks to that view remain to the downside.

Investment implications

Overall, the downside risks to domestic growth have receded somewhat, and our expectations for growth prospects elsewhere in the developed world have improved for the next year. As a result, we have reduced our emphasis on duration as a source of carry, or total expected return, across our domestic portfolios.

Australian bond yields remain highly correlated to global developed market bond yields, and without a near-term domestic catalyst to cause that correlation to break, Australia’s yields are more likely to gradually rise, particularly in the longer end of the yield curve, which isn’t supported by anchored policy rates.

We are therefore running less duration risk in portfolios relative to their respective benchmarks and adding to high-quality credit with shorter three- to five-year maturities. We expect any negative external shock from China to have the greatest impact on the currency, and although this isn’t our base-case expectation, we prefer to hedge this tail risk via a short position in the Australian dollar.

© Pacific Investment Management Company LLC. Republished with permission. All rights reserved.