The budget bottom line

| Summary: Australia’s budget deficit situation reflects the failure of the Government to rein in spending rather than a slowdown in China and the end of the mining boom. But if concerns of a global slowdown do come to fruition, investors will need to adopt a more defensive investing strategy. |

| Key take-out: Government revenue growth is strong, but there has been no attempt to bring spending back to its original pre-GFC path. |

| Key beneficiaries: General investors. Category: Economy. |

I wasn’t initially planning on writing anything on Treasury’s Pre-Election outlook. I mean, the numbers are so rubbery and the forecasts so flawed, you simply can’t believe them.

However, with an election three weeks away, the statement has attracted much attention, and I’m a little concerned about some of the commentary that’s come out. I can understand why investors may be feeling a little uncertain about things. Specifically:

- That there is a budget crisis, particularly a revenue crisis, which urgently needs to be addressed. Either we need higher taxes or cuts to services.

- That this budget crisis is symptomatic, as stated by Treasury and other economists, of a global economic slowdown, especially a China slowing, the end of the mining boom and slow domestic economic growth. This is why revenue has collapsed.

For investors, this is a particular problem given Treasury’s focus on the concessional taxation of superannuation. If you read some of the Treasury documents you can see quite clearly that institutionally, Treasury is opposed to this concession, which it views as the “single biggest tax expense” i.e. cost, for government. Moreover, we know Treasury is having trouble plugging the budget black hole, and I think everyone ridicules the idea that the budget will be back in surplus by 2015-16.

Indeed if the Grattan Institute is correct, there is a $60 billion hole that needs to be plugged (by 2023), and the big question is where is the money going to come from? With that in mind, it is highly unlikely that the “single biggest tax expense” will be left alone – certainly if Treasury has got anything to do with it. We saw a bit of that in the 2012-13 budget when super concessions were reduced. While that has been eased some, and there were no further measures in the latest budget, this will be the big sting for investors, if the rhetoric is correct (see Bruce Brammall’s excellent August 5 piece Super choices on the political menu).

The problem for investors is that this isn’t just a political discussion and it’s not just about super. It matters because, if my above points one and two are correct, then it has portfolio implications. It adds to the case to sell down our miners, stay clear of mining services, and adopt a more defensive investing strategy. More generally, it implies people should invest cautiously and avoid risk etc. Why? Because the boom is over, and the country’s current budget woes are symptomatic of that fact. Global investors should then retain an underweight position on Australian equities.

Fortunately, I don’t think the budget is showing any of these things. Although the above line of reasoning does concern me, because it is common and perpetuates the myth that Australia has significant underlying structural issues to address. Just one more manifestation of the pessimism gone mad in this country – which of course hits confidence.

Revenue not a problem

But first things first. The fact of the matter is, the budget is not showing a revenue problem.

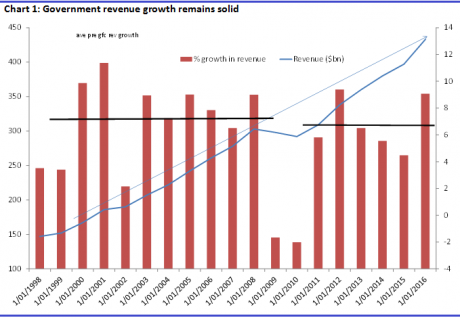

The red bars in Chart 1 show the revenue growth rate for each fiscal year, while the blue line is the dollar value of revenue. It shows that revenue growth is only marginally below the pre-GFC average (averages shown by the two black horizontal lines). The story being shown by the data is that revenue, having taken a hit during the GFC, is now on the path to recovery. Revenue growth is solid.

But haven’t’ recent budgets shown the government’s failure to achieve a surplus is revenue driven? At face value yes, that is true. But it is also misleading for the government to claim that.

To see why this is the case, consider that the government had initially forecast, during the 2011-12 Budget, a $40 billion, or 13% surge in revenues for the 2011-12 fiscal year. This was to be followed by another spike of $33 billion or another 9% surge the following year. The actual 2011-12 outcome was a still strong at $30 billion, or a 9% spike and 2012-13 should be good as well with a $20 billion lift.

That actual revenue results failed to meet forecasts for exceptionally strong revenue growth can’t be blamed on some revenue problem. Revenue growth has still been strong and so the deterioration in the budget has nothing to do with a slowing in China or the end of the mining boom or other ‘challenges’. It’s about rather dubious forecasts, and an overreliance perhaps on resource taxes. This then allowed the Government to project a surplus without addressing the real issue – and that is the failure of the Government to make any meaningful attempt at restraining spending. Take a look at chart 2.

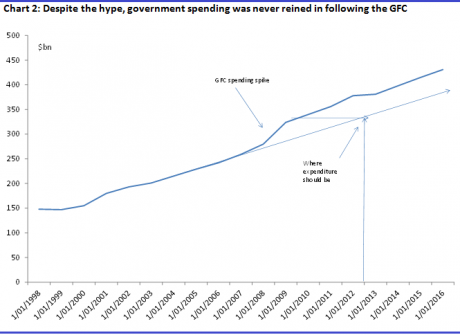

The top line shows the current path of government expenditure. Note that there is no attempt to bring spending back to its original pre-GFC path. Spending is on a new, permanently higher trajectory. This is why the budget is not in surplus. It’s not the end of the mining boom or slower domestic growth. Indeed domestic growth, up until recently, has been very strong.

The Government’s options

Alright, so if revenue growth is actually quite robust, with upside probably more likely (no China hard landing, no end to the mining boom just yet and a pick-up in domestic activity), what then are the Government’s options for tackling the growing budget deficit? Does it even need to do anything if revenue is going to pick up?

Upfront the answer is highly subjective. Many economists are convinced that it does – there is a sense of crisis. On Treasury’s estimates, the budget will be back in surplus 2015-16, after projected deficits of $30 billion this year and $24bn next . The rhetoric now from Treasury is that this failure to cut spending over the next couple of years is because the government “is now using the flexibility in the fiscal strategy to respond to the changes in the economic outlook, while strengthening fiscal sustainability in the medium term… with the economy currently facing a period of transition and falling terms of trade, cuts in the near term to offset the lower than expected tax receipts and other variations in the budget would put jobs and growth at risk.”

Notwithstanding that comment, there is widespread ridicule at the projections for a surplus in 2015-16, a sentiment with which I would agree. But I would place less emphasis on the risks to revenue, which the Treasury and others focus on, and more on the expenditure side. Treasury expect spending growth to average 3.3% over the next four years, which quite frankly I don’t think is going to happen. Inflation by itself will take spending 3% higher per year and the average is closer to 8%. Noting that Treasury have failed to restrain spending to date, I doubt they’ll be able to do it in future either - no effort is being made - just rhetoric.

The bottom line

The bottom line is that, and at best, a disciplined government might be able to achieve spending growth of 4-5%, which would mean a deficit of $10 billion in 2015-16 - on current revenue estimates. This assumes another revenue surge in that year. A $20 billion-$30 billion deficit is more likely, with more reasonable revenue assumptions.

The fact is this isn’t really a big deal though. At worst this might be a deficit of 1%, most likely less, which in the grand scheme of things isn’t a disaster. Should it be better? Absolutely, given recent economic strength, and if we do go into a downturn now, the inability of fiscal policy to stimulate growth without adding to the burden of debt can only be put down to economic mismanagement.

That the budget isn’t in an actual crisis doesn’t preclude Treasury continuing to push for further raids into superannuation. There is ideology at play here. The bureaucracy think that you are stealing their money. But in terms of concerns over portfolio allocation and the like, the only thing I would say is don’t believe the hype.

The budget isn’t in deficit or in a crisis because revenues are collapsing or because of China’s ‘slowdown’ and the end of the mining boom. This is not true. The bottom line is that no attempt has been made to rein in the GFC spending splurge. The most likely response to that – of any government – is to just allow the passage of time, and bracket creep, to lift revenues slowly back up to the level of expenditure.

At best, modest deficits will be the order of the day – let’s just hope we don’t have that downturn!