The bigger picture with high tech manufacturing

As a supply chain practitioner in the High Tech industry for 10 years and having covered the industry as an analyst for two years, I tend to keep an eye out for high tech supply chain stories. Over the last year, there have been several announcements about opening sites in the US or at least plans to do so. In fact, links below include Motorola (now Google), Apple, Foxconn, Intel and Lenovo all with single examples of US manufacturing plans.

Motorola to Make Moto X Mobile Phones in Texas

Foxconn Talks US Manufacturing

Intel Helps Make Oregon #1 in Manufacturing Jobs

Lenovo Opens Plant in North America

So as I started to see these stories build, I wondered, “Are these early signs of a larger trend?”

What?

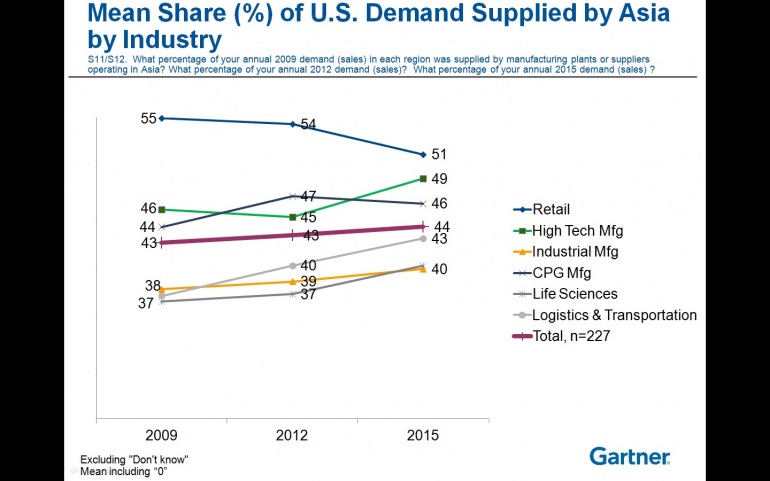

Fortunately, my colleague runs an offshore/near shore/re-shore study every three years. 2012′s study had 300 global, supply chain director and above respondent’s, 50 from High Tech companies. The study includes a lot of great findings with a common theme. Re-shoring (including to the US) is occurring, but it’s not a massive wave (full results available to Gartner clients at “Asia Plays a Key Role in US and European Supply Chains Through 2015“). What we are seeing in these news links above – and across industries – are smart supply chain organisations balancing their global manufacturing strategies so that they can meet regional requirements for speed, quality and agility. Let’s look specifically at supply from Asia used for demand in the US… I’ve included the cross-industry results but take a look at the High Tech respondents.

Between 2009 and 2012, High Tech companies did shift some of the US demand volume to be supplied from regions other than Asia, but going forward into 2015, they plan to increase percentage even beyond 2009 levels.

Why?

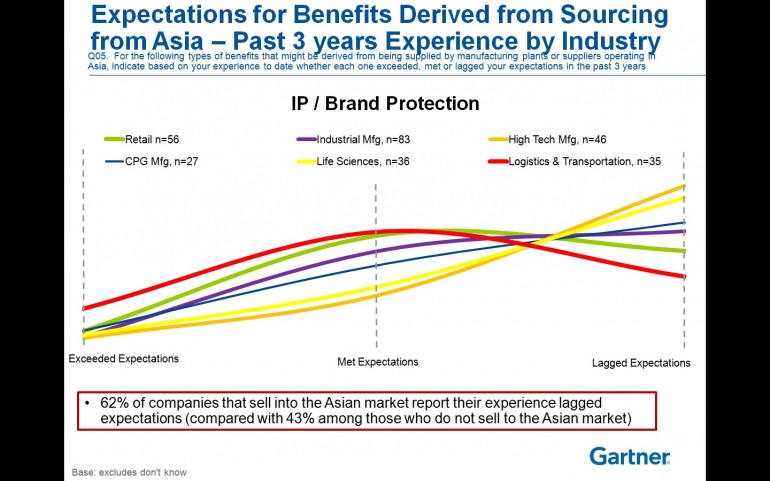

Cost, quality and speed are present in the top six influencers on outsourcing expectations, but security of the supply chain a particular challenge for High Tech manufacturers who want to sell to larger corporations or government customers. IP / brand protection has been a consistent issue in evaluating High Tech outsourcing and the 2012 study shows continued disappointment. In fact, you’ll see that High Tech responds the most negatively across the supply chain industries represented.

There is a fair amount of work in the space of secure supply chain and I have found particular value in the efforts of The Open Group. We also address the trends of secure supply chain and it’s impact on High Tech supply chain strategy in a recent publication High-Tech Industries Supply Chain Update, 2013.

Who?

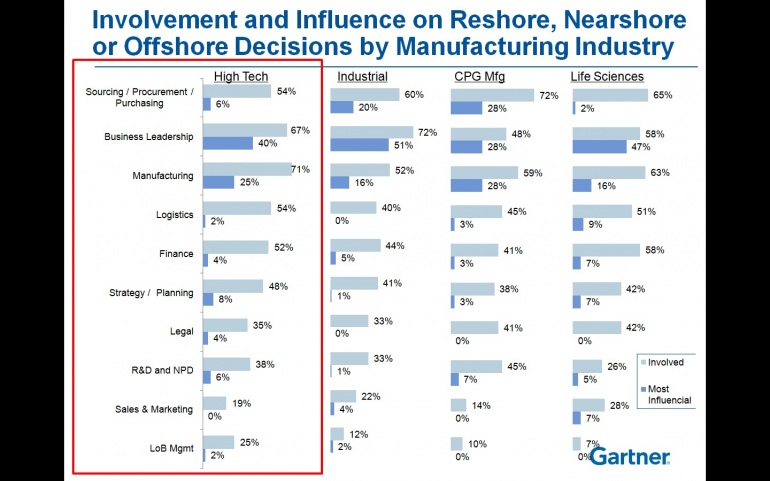

The final piece of data that jumped out at me in reviewing the study results is who is responsible for the outsourcing strategy. It’s the light blue bars that really grabbed my attention. Outsourcing is truly a cross-functional decision and organisations have involved the entire supply chain even if the final decision tends to fall with Business Leadership and Manufacturing.

These results say something clearly. Outsourcing is not a silo’ed decision and it has progressed beyond functional cost reductions. The decision on where to manufacture is a supply chain… no rather a corporate strategy decision. My takeaway is that what we’re seeing in the news stories is recognition that supply chain and manufacturing strategy cannot be one-size-fits-all. It is better decision making. Manufacturing in Asia is right for some customers and some demand but not all. A return to US manufacturing will enable companies to deal with IP protection, speed and agility challenges for specific customers. It does not mean that all or even the majority of volume will move.

Will we continue to see announcements about US manufacturing? Yes. And it’s good news for many reasons. One of those reasons is that supply chain organizations are now operating globally. We’ve tried manufacturing in region for region. We’ve tried global hub for all regions. And now we are seeing hybrid models. By starting with total global demand, supply chain can help create a global supply strategy that meets many customer needs. I believe we are seeing yet another positive result of operating demand-driven value networks.

What do you think? Near-shore, re-shore, no shore… What’s going to happen?

Matt Davis is a Supply Chain Research Director and lead analyst for Supply Chain Strategy at Gartner.