The big hole in the housing market

The household lending boom appears likely to hit its peak over the next few months and, based on the elevated nature of activity, the drop-off could be quite sharp. A slowdown in lending activity will usher in a new period of softer house price growth and a distinct risk that prices will begin to decline.

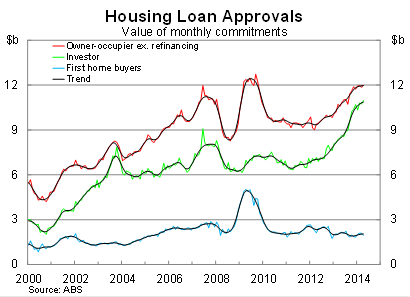

The value of loan approvals to owner-occupiers, excluding refinancing, rose by 1.3 per cent in April, below market expectations, to be 13.4 per cent higher over the year. Growth was driven by higher loan sizes, with the average loan value to owner-occupiers rising by 1.6 per cent in April. By comparison, the number of loans declined by 0.3 per cent.

Refinancing of existing home loans remains strong, which is to be expected given the low lending rates than home owners and investors can take advantage of. Refinancing accounts for around one-third of all loans to owner-occupiers.

The value of investor loan approvals rose by 2.3 per cent in April, following a decline in March, to be 30 per cent higher over the year.

What may not be immediately apparent is that the pace of growth has slowed significantly for both owner-occupiers and investors over the past six months.

On a trend basis, growth in the value of loan approvals to owner occupiers slowed to 0.1 per cent in April (compared with 1.7 per cent in October) while for investors, growth slowed to 0.5 per cent (compared with 4.0 per cent in September).

This should come as little surprise, though to the best of my knowledge it has received little emphasis elsewhere, and is a trend that we should keep an eye on. Low interest rates have encouraged owner-occupiers and investors to bring their purchases forward, but that eventually creates a void that must be filled.

If it can’t be filled -- and it is unlikely that anything can replace investor speculation -- then loan approvals will tank and house prices, which are demand-driven, will inevitably follow suit.

Certainly, investor demand is unlikely to be replaced by loan approvals to first home buyers, which fell by 7 per cent in April on a seasonally adjusted basis to be 9 per cent lower over the year.

First home owner activity was showing some tentative signs of improvement so this result comes as a bit of a shock. It may simply reflect monthly volatility that will right itself in May, but it might also reflect a combination of poor consumer sentiment and ever-increasing loan sizes.

Nevertheless, it almost goes without saying that the housing market continues to price many younger Australians out. That is unlikely to change in the near-term, with a subdued labour market and negative wage growth creating a particularly uncertain outlook for many Australians.

Beyond the immediate aftermath of the global financial crisis, this is perhaps the worst time for Australians to take on excessive risk since our last recession in the early 1990s.

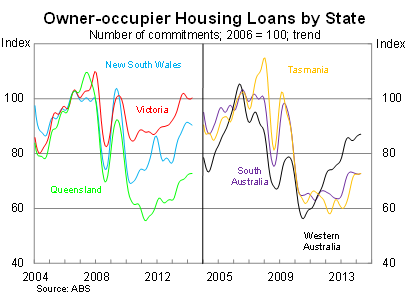

At the state level, demand from owner-occupiers appears to have slowed in Victoria and New South Wales -- the two regions which have driven most of the recent gains in house prices. Demand in Queensland and Western Australia continues to trend upwards, although they haven’t enjoyed the rampant speculation that has underwritten our two biggest property markets.

Housing loans continue to trend upwards, but it does so with diminishing momentum. The big question is: what comes next? What will fill the void when investor demand begins to decline?

The answer will surely not come from owner-occupiers or first home buyers. Loan approvals to owner-occupiers are already near their peak, while first home buyers appear increasingly pessimistic about the economic outlook and are unlikely to take on additional leverage in such a subdued economic environment. In such an environment, the only logical conclusion to reach is that the housing boom does not have long to run.