The Aussie dollar's NPC hurdle

In a week with markets focused on escalating tension in the Ukraine -- as well as central bank meetings in Australia, Europe and the U.K and key economic data -- there is another important event. The annual meeting of China’s National People’s Congress kicks off tomorrow, with further reform and a focus on economic growth expected.

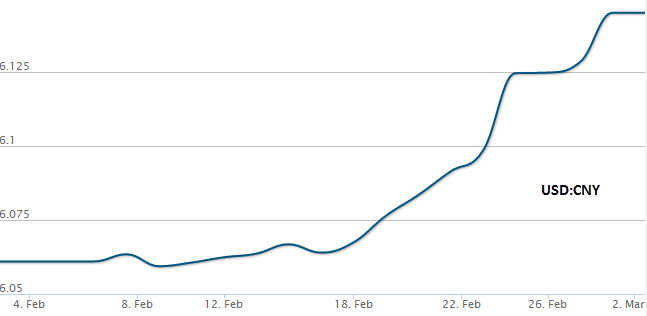

The debate surrounding financial liberalisation was generally expected to see further yuan appreciation, however the currency has been doing the opposite in recent times. The yuan was sold off rather aggressively and allowed to trade lower in February, with the onshore spot-rate posting its biggest monthly drop in February since 2005, touching a 10-month low of 6.1808 against the greenback.

SOURCE: OZFOREX.COM.AU

It’s hard to say how much of this can be attributed to capital outflows and whether or not the aim is to discourage short USD/CNY positioning as some are alluding to. If you believe the State Administration of Foreign Exchange, China continues to “face massive capital inflows, and domestic and overseas market participants continued to buy CNY”.

Whatever the reason, it is unlikely policymakers would want to encourage too much depreciation in the currency as it would increase the risk of more capital outflows. So I am looking for this trend to start reversing in coming weeks.

One of the major take outs for the markets from the NPC meeting will be targets for economic growth and inflation.

It’s no secret GDP in China has been declining for the last few years, with much of the downside risk to the Australian economy and the Aussie dollar heavily linked to growth in the region. It is widely expected that the NPC will maintain the 2013 targets of 7.5 percent for GDP and 3.5 per cent CPI. However they will also set some expectations for the bottom-line growth for 2014.

It is this number, likely to be at 7 per cent or lower, that might just set the tone for the Aussie dollar for the next few weeks.

So if the NPC releases a bottom of the GDP range any lower than 7 per cent, I will look for more downside in the Aussie dollar regardless of developments in the Ukraine, central banks or local economic data this week.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".