The Asian Tigers rebound

PORTFOLIO POINT: Investors worried about Europe and the US should look much closer to home, with growth across Asia set to accelerate well ahead of the advanced world.

In a market more obsessed with Greek Eurozone membership and (so far) unrealised expectations for a Chinese hard landing, one of the more interesting features of recent IMF growth revisions was overlooked.

That is, the expectation that growth for the Newly Industrialised Asian Economies, or NIAEs, (South Korea, Taiwan, Singapore and Hong Kong) and the ASEAN-5 (Thailand, Indonesia, Malaysia, Philippines and Vietnam) would accelerate next year.

Table 1: IMF forecasts for NIAEs and the ASEAN-5

Having moderated in 2011, growth in the ASEAN-5 is expected to accelerate in both 2012 and 2013 (to about 6%). That may, in some cases, still reflect below-average growth, but I have highlighted before why this focus on averages misses the big picture. Putting it into context, no one would blink if growth in Australia was 3% instead of 4%. So to focus on below-average growth for some developing Asian economies misses the point that this growth is normally still robust.

It’s a similar story for the NIAEs, with growth expected to rise sharply from a low 2.7% this year to 4.2% next. Some would even argue that the IMF’s forecast for 2012 is a little pessimistic. The Asian Development Bank, for instance, looks for growth of more than 3% for the NIAEs in 2012, and over 4% in 2013.

There are several reasons why this matters more to Australia (and the globe) than a European recession or a stall in growth in the US (if that indeed does occur). Firstly, there are the direct trade linkages to consider. Most people would probably already realise that these regions are important. But it probably isn’t quite appreciated that, taken together, the ASEAN-5 and the NIAEs are just as important as China. Table 2 shows that excluding China and Japan, the NIAEs and the ASEAN-5 are significant Australian trading partners in their own right, taking 25% of our total exports of goods and services.

Table 2: Share of Australian exports (total goods and services)

That’s a significant multiple above the EU and US and, as mentioned, equal in importance to China. Specifically, the NIAEs and the ASEAN-5 take about 40% of our wheat, 30% of our other cereals and 30% of our dairy. On the resource side they’re taking 40% of our crude exports and copper, 14% of our iron ore, and they’re big players in our manufactured and service export space as well. Throw in China and Japan and, all up, around two-thirds of our exports go to Asia.

Now we need to consider that a significant proportion of Asian trade is in turn intra-regional and not reliant on the EU, US or even Japan. This, self-evidently, has important ramifications for the sustainability of Australia’s export growth and economic growth more broadly, in an EU and US obsessed world.

Chart 1: Developing Asia – exports by region

Chart 1 above shows that for most of the NIAEs and ASEAN-5, developing Asia is actually much more important that the advanced economies. For China, developing Asia is as important.

The reason for this becomes clear when you consider the fact that Asia has a significant and rapidly growing middle class of its own. People have, of course, touched on this over the last week, although as some emerging power or influence that will be relevant in the future. The reality is, it’s an importance influence now – in the present tense.

Now getting statistics on the importance of this middle class is actually quite difficult. There is no consensus as to what constitutes middle class, and so no consistency as to its size. According to the Asian Development Bank (ADB), a middle class family would be defined as spending between $2-$20 per person per day. On this measure, the proportion of middle or high income persons in developing Asia people was about 83% as at 2008, up from 30% in 1990. There is obviously a big skew within that though as the data includes countries like India, Bangladesh, Cambodia and Pakistan. Proportions for the NIAEs would be much higher and closer to the OECD average –100% with 90% of that classified as high income (more than $20 per person per day, which are global standards, not western definitions).

Nevertheless, that’s a threefold increase since 1990 – 7% per annum roughly. This means, and if past growth rates are any guide, we’ve got something like 2.8 billion middle class consumers in developing Asia. The US by way of contrast has 100% of the population in the middle-high income bracket, which yields about 311 million people.

Now people might argue about the exact definition of middle class, but one thing people argue less about is purchasing power. The purchasing power of the individual US consumer certainly can’t be matched at this point, but even on their lower incomes, 2.8 billion people as a group do a pretty good job. Indeed they do a better one.

In 2008, the purchasing power of the consumer in developing Asia was $5.8 trillion. The US consumer had about $5 trillion (note that the ADB measured this in 2005 prices on a purchasing power parity basis). Four years down the track in 2012, that is probably more like $7.3 trillion for Asia compared to $5.5 trillion for the US (using past growth rates as a guide). Developing Asia then has about 1.3 times the spending of the US in aggregate – and the growth rates for developing Asia are 2-3 times the OECD average, so it’s growing at a phenomenal rate every year.

With such a significant purchasing power, Asian consumers are and can be expected to continue to complement strong growth rates powered by rapid urbanisation and investment. Remember, while there are some highly urbanised Asian economies – Taiwan and South Korea come to mind – developing Asia still has a very long way to go in that process. It’s not going to end anytime soon as chart 2 below shows.

On current growth rates we’re seeing roughly 27 million people per year, just from those countries, entering cities. That’s a lot of housing and associated infrastructure just there – concrete copper, steel to say nothing of food demand.

Chart 2: Urbanisation rates: selected countries and regions

This brings us to another often overlooked point. The ASEAN-5 and the NIAEs are as important to global growth as the EU and US. In conjunction with the growth dynamics in China and developing Asia and the increasing intra-regional trade links, this all suggests that even if Europe has a modest to severe recession and even if the US posts modest growth itself, it’s unlikely that growth in Asia will slow too much. You can get a much better picture of this when you take a look at table 3.

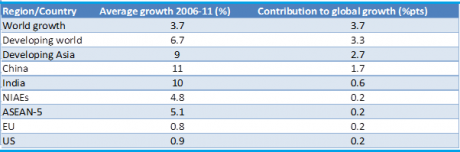

Table 3: Contributions to global growth: 2006 to 2011

The table above shows that the ASEAN-5 and the NIAEs, by themselves making up 7% of the global economy, have accounted for almost 14% of global growth. This is the same contribution that the EU and US combined have made – and they are something like 30% of the global economy. Developing Asia more broadly accounts for almost three-quarters of global growth. So if Europe has a severe recession, does it matter?

Don’t forget that the Asian economies also have plenty of scope to stimulate growth. Interest rates are comparatively high and fiscal balances generally in much better shape than in Europe. Consequently, if the slowdown in Europe and the US looks more severe, these economies can provide an offset. Given their respective contributions to growth, this is much more important than the magnitude of any slowdown in the US or EU.

Having said that, the picture changes if global finance collapses like it did during the GFC. It wasn’t so much the contraction in real European and US demand that hurt the Asian economies in 2009, but rather the sharp reduction in trade finance. Global trade collapsed as a result of this.

Outside of this risk though there isn’t much standing in the way – certainly no one is forecasting another financial crisis. The pre-conditions simply aren’t there. So, the best way to play the market’s preoccupation with Greece, Spain and Europe more generally is to look at buying into some beaten up emerging market indices as Robert Gottliebsen and Gerard Minack highlighted last week.

For those who prefer the domestic market, look to stocks with a greater proportion of revenue earned in the region. For instance, I wrote about our miners last week – they are still very attractive on these very low P/E multiples and the above analysis shows why. Remember, multiples by themselves are meaningless, but in conjunction with a sound macro view, they are very good indicators of value.

If you don’t believe our miners are cheap, you are in effect dismissing the Asian growth story and all the evidence in support of it. Outside of our miners, Ansell and Cochlear also derive a decent proportion of their revenues from Asia (about 20%) as an example.