The $5 trillion divestment challenge; Atlantis' tidal tilt

The switch from fossil fuel to renewable energy faces both political and financial challenges – although they are not unsurmountable, according to new research from Bloomberg New Energy Finance this week.

Oil, gas and coal companies make up one of the world’s largest liquid asset classes. In the past two years, dozens of public and private institutions have announced plans to divest their fossil fuel holdings because of environmental concerns, ethical investment strategies, or worries that assets might become ‘stranded’ by emission regulations.

However, a much larger-scale divestment from fossil fuels by institutional investors would be far from easy, according to Bloomberg New Energy Finance.

The new white paper forecasts that while $US5.5 trillion in clean energy investment is needed from now to 2030, pension funds or institutional asset managers may not integrate clean energy into their portfolios based on the risk-return and liquidity characteristics of projects. Nathaniel Bullard, author of the white paper, said a major switch to clean energy will require “a massive scale-up of new investment vehicles”. Bullard discusses some of these alternatives in the white paper available to download here.

Meanwhile, renewable energy is facing large political hurdles ‘Down Under’. A BloombergNews story last week found that Australia is “frightening developers away” from renewable energy as the government is preparing to decide whether to overhaul targets.

Prime Minister Tony Abbott’s decision to take advice on the renewable energy targets from a panel led by Dick Warburton – known sceptic about the causes of global warming – has prompted at least two developers to reconsider plans for wind and solar farms. Earlier this week, the company planning a giant solar plant in Mildura pulled out of the project, citing the risk the government will rework its policy. In addition, Australia’s spending on large-scale renewable energy projects fell to $58 million in the first half of calendar 2014 from almost $1.3 billion a year earlier, according to Bloomberg New Energy Finance in Sydney.

The renewable energy target review is widely expected to recommend a significant weakening of the nation's clean energy target, as the government works to dismantle almost all climate-change-related programs and policies. Although it is unlikely to be able to legislate changes that reduce the target, the federal political uncertainty could hamper large-scale investment until at least the next election. Read more about Bloomberg New Energy Finance’s outlook for the industry in a presentation at the Clean Energy Week Conference in Sydney on June 22.

Unlike the situation in Australia, sub-Saharan Africa is emerging as one of the most exciting new markets for renewable energy technologies such as onshore wind, small-scale and utility-scale solar and geothermal power, according to Bloomberg New Energy Finance. Its latest analysis suggests that 1.8GW of renewable power capacity (excluding large hydro-electric projects) will be commissioned in the region in 2014. That’s more than the amount that came online in the entire 2000-13 period.

The advance of renewable energy in Africa reflects a combination of growing local need for power, and awareness that the cost per megawatt-hour of clean options such as wind and photovoltaics has declined sharply over recent years.

Bloomberg New Energy Finance forecasts that investment in clean energy excluding large hydro in Sub-Saharan Africa will be $US5.9 billion this year, down 5 per cent on 2013′s figure of $US6.2 billion, but that it will accelerate to $US7.7 billion in 2016. In the 2006-11 period, investment was far lower, averaging some $US1 billion per year.

Finally, there was more news last week on marine energy. Atlantis Resources, a Morgan Stanley-backed maker of tidal turbines, raised about $US83 million to start building the world’s largest tidal-stream power plant in Scottish waters.

The money was raised from the UK’s Department of Energy and Climate Change, Scottish Enterprise, Highlands and Islands Enterprise, The Crown Estate and by Atlantis, the Singapore-based turbine maker said, according to Bloomberg News. The funds will be used to finance the installation of four 1.5MW turbines in the Pentland Firth.

The installation forms a portion of the first 86MW phase of MeyGen that may eventually reach 398MW. Construction should start this year and the first power is expected to be delivered to the grid by 2016, according to the statement.

The project may become the first commercial-scale tidal stream power facility operating in the world. Total installations of tidal-stream facilities around the world are seen reaching about 148MW by 2020, according to Bloomberg New Energy Finance. The researcher revised down its original 167MW forecast by 11 per cent saying marine power projects were taking longer and costing more than expected. However, there is clearly huge political support for the MeyGen project, as seen by the dominant role that public sector money is playing in this financing.

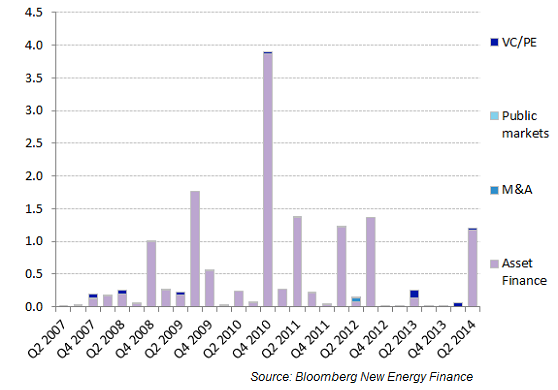

Graph of the week: About 96 per cent of global investment in carbon capture and storage has been financing of projects.

Originally published by Bloomberg New Energy Finance. Reproduced with permission.