The 3 firms that didn't pay the carbon tax

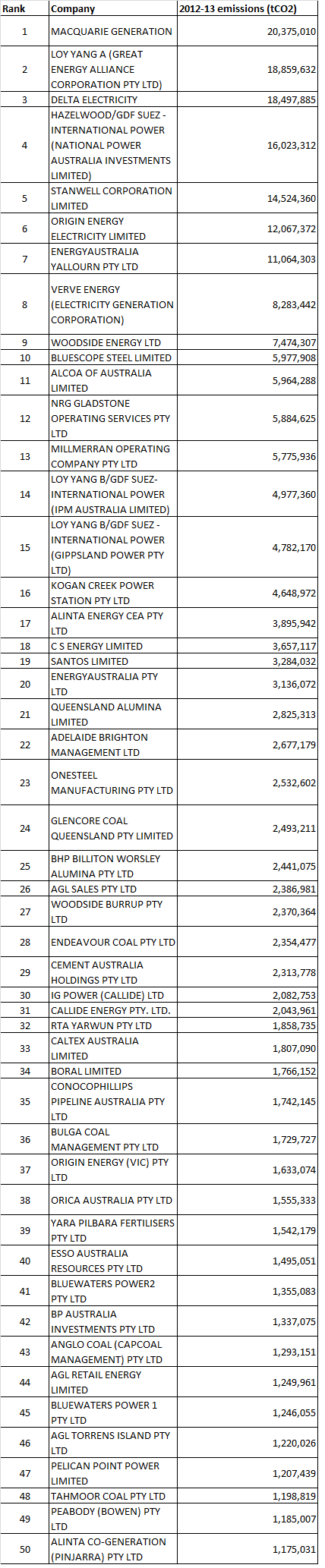

The Clean Energy Regulator has now released the final numbers on how much each company is liable to pay under the first year of the carbon price. There’s no real surprises with power generators and oil and gas producers topping the list (top 50 emitters listed below).

So far, most companies have done the right thing, with just three companies failing to meet their obligations to pay for their carbon pollution emissions.

Topping the list is Gujarat NRE which operates two of the most emissions-intensive coal mines in the country, located near Wollongong. It has an outstanding carbon price obligation of $8.4 million. This will increase by a further $1.5 million in February when the final bill comes in to cover all emissions for last financial year.

These coal mines were ranked by Woods Mackenzie as some of the highest cost coking coal mines in the country a few years ago, and have hit hard times as the coal price has plummeted. In addition to being chased by the Clean Energy Regulator for carbon price liabilities, the tax office is after them for unpaid taxes, Origin Energy had threatened to cut off their electricity supply due to unpaid bills and workers had been unpaid for several weeks.

The Illawarra Mercury's story tracing the fall of the company raises serious questions surrounding the flamboyant, Bentley-driving management of the company.

One hopes that the government doesn’t hand them any further cash from the Coal Sector Assistance Package, which rather bizarrely rewarded the worst polluting coal mines in the country.

Next comes Clive Palmer’s nickel refinery (Queensland Nickel Pty Ltd) which has an unpaid carbon price obligation of $6.17 million. The interesting thing is that they partly complied by surrendering 493,205 permits, but they fell short by 206,436 permits for the initial part-year compliance point. They will need to find a further 164,170 permits worth $3.8 million to meet their final end of year obligations. Interest will accrue at 20 per cent per annum if they don’t.

It’s worth noting this is not their only environmental compliance problem. Back In January, the Queensland state government found that the refinery’s tailings dam – which stores toxic waste from its operations – was in danger of overflowing. The government gave them until December 2 to address the problem. But the nickel business has indicated that it won’t be able to meet the deadline. Premier Newman told 612 ABC Radio Brisbane just last week that Mr Palmer had wanted to release “thousands and thousands and thousands” of litres of contaminated water into the Great Barrier Reef's waters.

According to The Australian, the nickel refinery was already in a stressed situation back in 2009 when BHP Billiton offloaded the aging refinery to Palmer for $40 million. At the time of sale BHP, concerned about reputational damage from a closure, had insisted Palmer not strip the company of cashflow for three years. But instead Palmer used this cashflow from the refinery to buy a number of other assets including a coal mine tenement and the Hyatt Coolum Resort that he’s converted to a dinosaur theme park.

Last is the Penrice Soda Products operation. Rather oddly this company has surrendered just 6.4 per cent of its initial obligation even though its soda ash production process received 94.5 per cent of its permits for free from the government. Penrice has ultimately chosen to shut what it described in its annual report as: “an old soda ash manufacturing plant, which, despite valiant efforts to enhance it, continued to suffer from plant unreliability.”

Still, the parent company continues to operate and a spokesperson from the Clean Energy Regulator has said they are still in the process of negotiating a payment plan for Penrice’s outstanding bill.

So, at the end of the first year of the carbon price it looks like we’ve got a whopping three firms facing difficulty meeting their obligations. One was a business running high cost, extremely high emission coal mines with questions overhanging flamboyant, Bentley-driving management. Another was a nickel refinery whose cashflow has been used to purchase a range of unrelated assets. And lastly, we have a soda ash plant that was so old it had difficulty maintaining reliable operation.

Top 50 emitters liable under carbon price for 2012-13

Source: Clean Energy Regulator LEPID database – accessed November 18, 2013.