The 230 GW solar jackpot

During 2012, the solar photovoltaic industry was confronted by many conflicting trends that had a profound impact on every company active within the sector.

On the positive side, there was no shortage of highlights and achievements recognised by the industry:

-- PV end-market demand during 2012 reached 29 GW, a new annual record level.

-- The PV industry passed 100 GW of cumulative installed PV by the end of 2012.

-- New markets opened up globally as PV became a serious contender for energy supply across large regions of the Middle East, Africa, Latin America, and Southeast Asia.

-- Average selling prices of modules declined well below the $1/watt mark and installed system pricing declined so much that grid-parity discussions became a reality (even without government incentive policies).

However, these top-line summaries from 2012 offer a highly misleading representation of an industry that provided severe challenges to many companies whose business models relied upon its health.

For many companies active within the PV industry, 2012 will be remembered for all the wrong reasons:

-- Chronic over-capacity set in, following several years of excessive manufacturing investments.

-- Over-supply through the value-chain caused price erosion that resulted in negative operating margins.

-- A shakeout hit the industry, with many casualties across both the upstream and downstream channels.

-- Amidst an economic crisis and fiscal austerity measures, many European countries made further adjustments to limit the rate of PV adoption by significantly reducing (or removing) incentive policies.

-- Trade wars gripped the industry, with PV manufacturers becoming engaged in political lobbying in an attempt to improve domestic competitiveness or to counter threatening proposals from other groups.

Many of these issues are likely to continue during the course of 2013 (and probably well into 2014), by which time the PV industry will have gone through the most brutal transition phase of its relatively short history.

However, despite this climate of uncertainty and investment caution, the five-year end-market demand forecasts for the solar PV industry remain strong:

-- According to the ‘most likely’ forecast scenario outlined within the new NPD Solarbuzz Marketbuzz 2013 Report, between 2013 and 2017, the PV industry will cumulatively add over 230 GW.

-- Almost half of this 230 GW will be driven by large-scale ground-mounted solar PV projects.

Ultimately, the challenge for the industry over this time period will be to restore financial health and establish a credible position against traditional energy sources within the framework of renewable energy adoption.

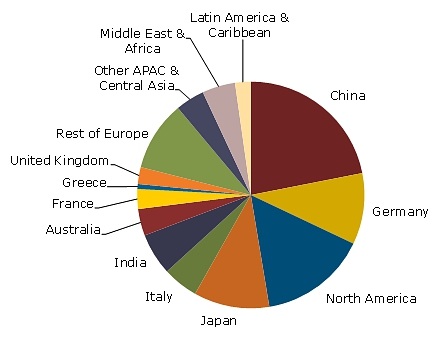

230 GW Cumulative New PV Demand by Geography: Covers 2013-2017 (Inclusive)

Source: NPD Solarbuzz Marketbuzz 2013 Report

Figure: According to new findings in the NPD Solarbuzz Marketbuzz 2013 Report, under the most likely forecast scenario, 230 GW of cumulative PV will be required out to 2017.

Identifying the 230 GW jackpot

During the five-year forecast period (2013-2017), the global market is projected to have a compound annual growth rate exceeding 15 per cent, highlighting strong long-term confidence in global PV adoption levels.

Starting in 2013, China is set to become the largest country market for PV demand. This will elevate China to become the leading driver in the supply and demand segments of the industry.

However, a new group of emerging PV markets is poised for strong growth. This group includes Latin America, the Caribbean, the Middle-East, Africa and all counties across the Asia Pacific region (excluding China, India, Japan and Australia).

This Emerging group accounted for 2 per cent of demand in 2012 but is set to grow rapidly with a CAGR of 50 per cent out to 2017. Emerging markets are projected to create over 25 GW of PV demand, more than 10 per cent of the cumulative total to 2017.

A detailed analysis of future PV demand can be performed by segmenting the globe into 14 key territories. The 230 GW of PV demand across these territories is shown in the figure attached, and is based upon a comprehensive bottom-up country analyses featured in the new Marketbuzz 2013 report.

Having located PV demand by region, the next challenge is to work out which application segments are driving these opportunities: residential, commercial, ground-mount, utility, off-grid, etc.

The PV industry remains driven predominantly by the ground mount segment, with many of the top 10 countries having policies that favour utility-scale ground mount. At the rooftop level, residential systems are projected to decline in market share out to 2017, with non-residential (or commercial) systems seeing increasing market share.

In fact, the emergence of grid-parity in many end-markets over the forecast period to 2017 is stimulating demand for commercial systems as large-scale power users seek to reduce energy bills significantly. PV demand from ground mount will exceed the 100 GW level out to 2017.

Identifying served market segments

However, for every company participating within the PV industry over the next five years, knowing the global (or total) addressable market is only a starting point. Ultimately, the PV industry is comprised of multiple served markets that have different barriers to entry for the PV supply-chain.

Therefore, it is essential for every company to know the specifics of each end-market in order to filter out the served addressable markets within which market-share can be targeted. Factors that may influence the choice of countries include: preference for domestic manufacturing, any import tariffs or duties in place, the split between rooftop and ground-mount applications, route-to-market channels and the ability to bring finance packages to stimulate market-demand.

Ultimately many PV manufacturers are being forced to make decisions on which countries to focus on now, and the share of the 230 GW opportunity-matrix is likely to be distributed across a wide range of suppliers over the next five years.

This article was originally published by Solarbuzz. Republished with permission.