Telstra's message for investors

PORTFOLIO POINT: Telstra’s enormous cash flow will ensure the company continues to grow operationally, but shareholders shouldn’t expect strong share growth at this stage.

While Telstra resides in my Income Portfolio, rather than in my Growth Portfolio, the announcement of the 2011-12 result gives us a chance to consider my view of the company.

The size and diversity of Telstra’s business does mean that there are many moving parts to consider in this review. Therefore, a good way of approaching this task is to take a high-level review of the market environment to see whether Telstra has done as well or worse than it should have.

To my mind, the key market influences and events that affected Telstra in the last 12 months were:

1. The business and service upheaval at Vodafone, which caused its customers to seek a better mobile offer. This should have clearly benefitted Telstra so that its mobile sales would have lifted faster than the market;

2. The agreement and the shareholder ratification of the NBN compensation arrangements. This arrangement improves Telstra’s free cash flow and creates options for the company in strategic capital investment and shareholder returns;

3. The rollout of the 4G mobile network involves significant capital investment but gives Telstra a short-term competitive market edge. However, it does involve significant capital investment in its early years;

4. The continued push forward with bundled retail product to households is an advantage that Telstra is now utilising more extensively and coherently to grow its market share; and

5. The continued decline in fixed-line rental and the directories media businesses, which is a drag on the group’s revenue and profit growth.

When I consider the actual Telstra result and the key movements in the financial accounts I see a mixed performance given some of the tailwinds and headwinds noted above. Telstra grew customer numbers across its mobile and broadband services but it struggled to grow revenue. Given the receipt of about $400 million in gross NBN proceeds, a greater level of revenue growth was expected.

Group revenue or sales lifted marginally by a mere 1.1%. This level of growth is below inflation and it suggests that the telecommunications marketplace continues to be afflicted by deflation and discounting.

To offset this and to increase the operating profit margin, Telstra must lift its labour productivity and lower its overall costs of doing business. Telstra struggled to achieve these objectives, but this is explainable by the Australian environment where the cost of doing business continues to be excessive on a world comparison.

The overall profit growth reported at EBITDA level of a mere 0.8% was hardly impressive, but actual reported net profit was better and lifted by 5.4%. The growth was due to a lowering of interest expense resulting from lower net debt and a lower interest expense as market rates generally declined.

A positive and key feature of Telstra’s business is its solid and recurring free cash flow. This cash flow is explained by the fact that capital investment approximates 14% of revenue (about $3.5 billion), whilst depreciation and amortisation is expensed at about 18% of revenue (about $4.5 billion).

So operating free cash flow generally exceeds the reported profit by over $1 billion, and now the NBN proceeds further enhances this amount. Last year free cash flow rose above $5 billion, and a similar outcome is forecast for 2012-13.

The depreciation and amortisation rate does acknowledge the declining value of the Telstra fixed-line network. It is noteworthy that the shareholders’ equity or NTA per share will continue to decline while the NBN is rolled out. The acquisition of new spectrum increases intangible assets. Therefore, declining tangible equity will focus the attention of directors on reducing debt.

The cash flow is a powerful business advantage for Telstra and gives it many options. From the directors’ statements it seems clear that there will be no increase in dividend, with the cash being directed to a reduction in debt and key capital investments. The continued rollout of the 4G network and new spectrum acquisitions are earmarked. Acquisition of mobile rights to major sports is also a potential investment.

These are important investments to ensure that the comparative advantages that Telstra now has are maintained over its competitors. However, it ensures that Telstra needs to heavily reinvest in the short term.

I noted above that the flow of NBN payments began last year. Various pronouncements by the government-owned NBN suggest that the rollout is already behind schedule and that the costs will be higher.

Unfortunately we still have no clarity regarding the timing of payments to Telstra, although we know that the NPV of these payments suggests that tens of billions of dollars will flow to Telstra over decades. Of course that assumes that a Liberal government would not renegotiate the agreement. Recently this has been suggested in the commentary of many reporters but I suspect that such an event would lead to a massive compensation claim by Telstra. Further, today’s press indicates that there is an incentive for Telstra to upgrade its network aggressively to bring forward NBN payments. Thus, Telstra has the ability to further increase its already high cash flows.

Conclusion

The result confirmed my portfolio decision to hold Telstra as an income producing investment rather than a growth opportunity. We noted recently that the “bond valuation” of Telstra could be stretched to $4 based on a pre-tax yield of 10%. From a pension fund investor perspective (zero tax rate) the acquisition of shares at the current $3.90 will deliver 42 cents of franked dividends over 14 months. With tax rebates, this is an attractive return and the company’s shares are clearly supported by continuing substantial cash flows.

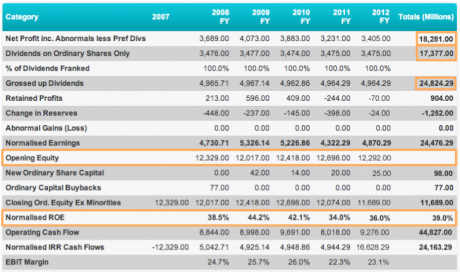

The last five years show that Telstra has maintained profits and profitability. Net debt has slowly declined and whilst there is a high level of debt, it is offset by the substantial payments from the NBN. The solid cash flows of the business cover interest payments by over 10 times.

It is noteworthy that Telstra has not needed to raise equity from shareholders over the last five years. Shareholders have received dividend after dividend.

That is the past and the real question for investors to consider is whether Telstra can reinvest $5 billion of cash flows to generate a growth in profits. Arguably it should be able to do so.

Figure 1. Five-year financials: Telstra Corporation Limited

Source: MyClime; TLS Financials

Those who own the stock must expect some volatility in coming months. Once the stock trades ex dividend, and given the political noise from Canberra, it is likely the shares will drift lower.

So the owners and buyers need to determine their reasons for owning Telstra, as short-term gains from a revaluation seem unlikely unless the market environment improves dramatically.

Growth Model Portfolio

Clime Model Growth Portfolio (prices as at August 9, 2012) | ||||||||

| Company | Code | Purchase Price $ ^ | Market Price $ | FY 2013 Value $ | Safety Margin | FY13 (f) GU Yield | Total Return | |

| BHP Billiton | BHP | 31.45 | 32.80 | 49.72 | 51.59% | 5.23% | 3.80% | |

| Commonwealth Bank | CBA | 53.10 | 57.03 | 61.48 | 7.80% | 8.62% | 7.74% | |

| Westpac | WBC | 21.13 | 24.01 | 27.30 | 13.70% | 10.23% | 13.08% | |

| Blackmores | BKL | 26.25 | 28.57 | 29.91 | 4.69% | 6.85% | 8.42% | |

| Woolworths | WOW | 26.80 | 28.50 | 35.90 | 25.96% | 6.77% | 6.58% | |

| Iress | IRE | 6.55 | 6.70 | 7.78 | 16.12% | 6.99% | 2.22% | |

| The Reject Shop | TRS | 9.15 | 9.47 | 14.18 | 49.74% | 6.64% | 2.66% | |

| Brickworks | BKW | 10.10 | 9.89 | 12.66 | 28.01% | 6.36% | -2.01% | |

| McMillan Shakespeare | MMS | 11.82 | 11.80 | 12.72 | 7.80% | 6.30% | -0.18% | |

| Mineral Resources | MIN | 8.95 | 7.88 | 15.56 | 97.46% | 10.88% | -9.09% | |

| Rio Tinto | RIO | 56.50 | 56.86 | 92.60 | 62.86% | 4.32% | -0.54% | |

| OrotonGroup | ORL | 7.30 | 7.75 | 10.99 | 41.81% | 10.51% | 5.21% | |

| * Market prices as at close August 9, 2012. ^ Purchase price as of close June 29, 2012 | ||||||||

Weighted Portfolio Return

Since Inception: -3.77%

Since June 30, 2012: 3.49%

Average Yield: 7.47%

Gain exclusive access to Reporting Season summaries including commentary from leading investment analysts with MyClime. Register for a free two week membership.