Swanbank shut-down a swan song for gas

Queensland government-owned Stanwell has announced it will be mothballing its gas-fired 385 megawatt Swanbank E power station in October for up to three years. Meanwhile, it will restart one of its two mothballed units at the coal-fired Tarong Power station instead but, critically, is yet to give a firm indication on timing.

This announcement marks a pivotal point in the east coast National Electricity Market – the end of gas’ rise and the beginning of a major fall as a source of power generation.

According to Stanwell’s chief executive officer Richard Van Breda, “With subdued market conditions and increasing gas prices expected to continue, Stanwell can earn more revenue from selling our gas rather than using it in electricity generation.”

He also observed that, “We expect to achieve significant financial benefits by replacing generation at Swanbank E with generation at the lower marginal cost Tarong Unit 4 and through the sale of Swanbank E gas”.

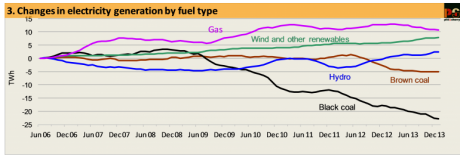

As the chart below, from Pitt & Sherry’s Hugh Saddler, shows gas has experienced a steady rise in output from June 2006 to December 2013 while black coal and, more recently, brown coal have suffered (click on chart to enlarge).

Source: Pitt and Sherry CEDEX

Back around 2006 it all looked very bright for gas as the low carbon bridging fuel to renewables. It was thought that gas would steadily increase its share of power generation while coal declined on the back of policies to reduce Australia’s greenhouse gas emissions.

Lots of new gas had been discovered within Queensland coal seams that meant there was little risk of the east coast running short. Gas prices at around $3.50 per gigajoule plus power plant construction that was quicker and lower cost meant that there was only a relatively small difference in the economics of a new coal versus a gas power plant. A relatively moderate carbon price of around $20 to $30 was all that was needed for coal to lose out to gas in baseload operation, not to mention coal’s inferior flexibility and larger minimum size that increased its risk profile.

The Queensland 13% Gas Target and NSW’s Greenhouse Gas Abatement Scheme were already in place, providing a clear precedent for what many saw as an inevitable national emissions trading scheme. A dash for gas, like what had been seen in Europe and the US, seemed to be on the horizon.

But then Santos announced it planned to build a plant to liquefy Queensland coal seam gas and export it overseas. It changed everything, although at the time the consequences were not entirely clear.

Now they are. Gas contracts are now being struck at prices of $9 per gigajoule rather than the $3.50 price of the past. There is also talk of gas shortages because of a huge surge in demand from a range of LNG plants coming online within short succession.

At the same time the Coalition intends to unwind the emissions trading scheme, and no one expects Direct Action to do much to help gas-fired power.

Yet, apparently, Queensland government-owned Stanwell will be complaining in a submission to government that this is not enough, and the Coalition should also wind back the Renewable Energy Target, complaining it and the carbon price were “implemented for ideological reasons with little analysis of the impact on electricity prices and economic growth”.

Strange, but I think I can recall several hundred pages of analyses undertaken to evaluate the price and economic impacts of these policies before they were implemented and in subsequent reviews. Some examples are available here, here, here, here and here, just to get started.

If anything, one would think this decision by Stanwell to mothball Swanbank E illustrates that the RET is increasingly important to contain emissions in the electricity sector. Gas is becoming exceedingly expensive, and it’s likely it will be replaced by higher emissions coal. The only thing stopping this from happening is a robust Renewable Energy Target.