Super takes a hit

Summary: Data from SuperRatings shows that average balances at the end of January had edged ahead, but are down $2000 this month.

Key take-out: Higher interest rates are likely to place pressure on equities.

Data just released by SuperRatings shows that superannuation balances have remained in positive territory for the last 12 months, although the recent market volatility is likely to have cost retirement accounts around $2000 on average.

Meanwhile, the fund ratings and research firm has found that more Australians are switching their super from typical balanced fund options into other investment strategies.

Although the balanced option remains the most popular, there has been almost a 10 per cent swing away from balanced accounts into other asset allocations.

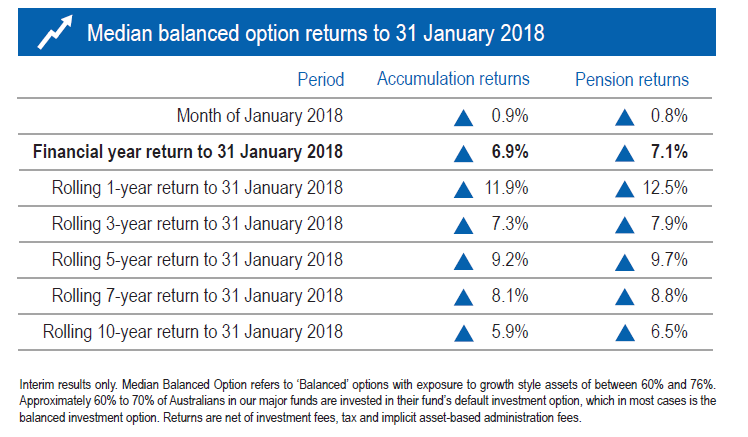

On the latest return numbers, SuperRatings said the SR50 Balanced (60-76) Index, used to measure balanced super fund returns, is estimated to have risen 0.9 per cent in January, with the 12-month return at 11.9 per cent. Over five years, the balanced option return is 9.2 per cent, highlighting the long-term strength of the superannuation system.

“Recent falls in shares and the spike in market volatility has obviously had an impact on superannuation account balances,” says SuperRatings CEO Kirby Rappell. “However, over longer periods, as well as over the past 12 months, super returns are holding up well. Super funds are focused on ensuring their portfolios are well diversified to appropriately manage any downside risks.”

“Aside from the immediate impact on share markets, it is clear that investors are now starting to think about inflation and what this could mean for interest rates. For super funds, higher rates could mean equity values continue to come under some pressure, and funds will need to manage their longer-term CPI plus return targets.”

But the recent market volatility will not significantly diminish the strong performance achieved by super funds over recent years.

An investment of $100,000 in the median balanced fund 10 years ago would be worth around $174,000 as at the end of January 2018. In the best performing balanced fund over that period, the $100,000 would now be worth over $197,000.

Members taking more control

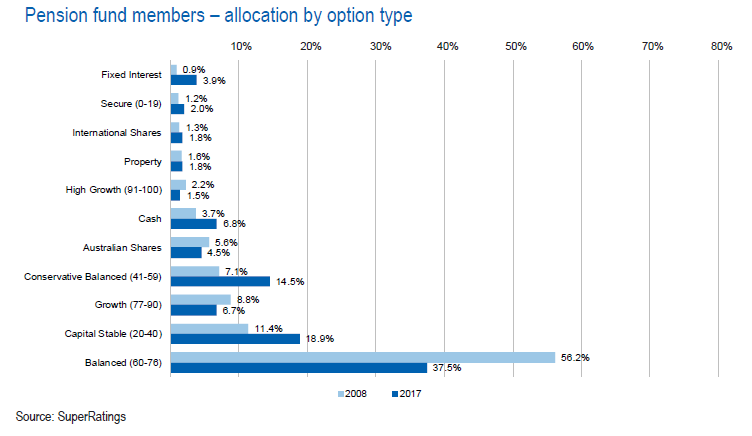

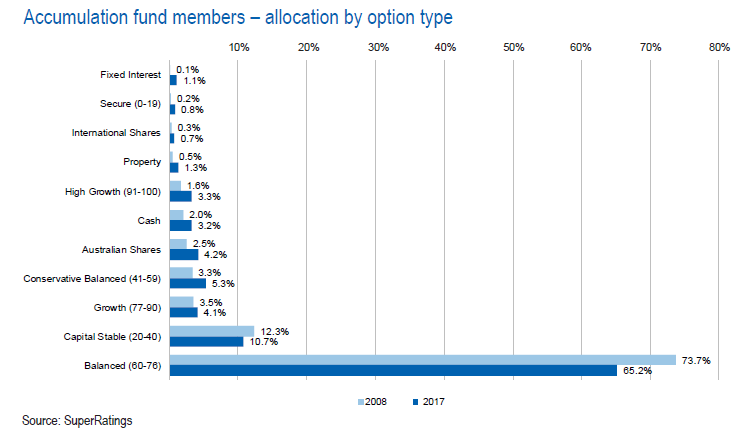

Investors are gradually moving away from typical balanced option funds (defined as a fund with a 60-76 per cent allocation to growth assets). While balanced funds still represent the most popular option among members in both the accumulation and pension phase, the proportion of investors looking outside of this option has grown over the past decade.

SuperRatings data shows that the proportion of investors in the accumulation phase selecting a balanced fund has fallen from 73.7 per cent to 65.2 per cent since 2008. For those in the pension phase, the shift has been more dramatic, with the proportion falling from 56.2 per cent to 37.5 per cent.

Given that most Australians are in the accumulation phase, it is interesting to note that the allocation is becoming increasingly split between higher growth and more defensive options.

The allocation to higher growth options (including local and international shares, property, and high growth options) has risen from 8.4 per cent to 13.6 per cent, while the allocation to more defensive options (cash, secure, fixed interest, conservative balanced and capital stable) has risen from 17.9 per cent to 21.1 per cent.

The result of this trend means that there may be more divergent outcomes for members depending on market conditions, with more conservatively positioned portfolios outperforming during periods of market stress or high volatility as we have seen recently.