Super returns enjoy a late surge

Summary: Managed super funds enjoyed a strong finish to 2016 from Australian and global share markets. |

Key take-out: Super investors, including self-managed super funds trustees, should brace for more market volatility in 2017. |

Key beneficiaries: General investors. Category: Superannuation. |

Australian managed super funds achieved a fifth consecutive positive annual return in 2016, thanks to a strong share market surge in December.

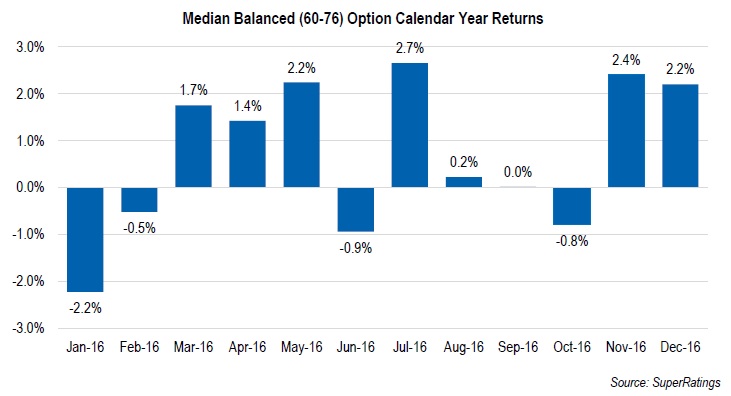

Data released Thursday by superannuation research firms SuperRatings and Chant West shows the median return from managed super funds exceeded 7 per cent in the 12 months, despite negative returns in January, February, June and October.

SuperRatings said the median balanced return, based on an allocation of 60 to 76 per cent in growth assets, was 7.3 per cent over the year to December 31. Chant West said the median growth fund return, based on a similar asset allocation of 61 to 80 per cent in growth assets, was 7.7 per cent for the year.

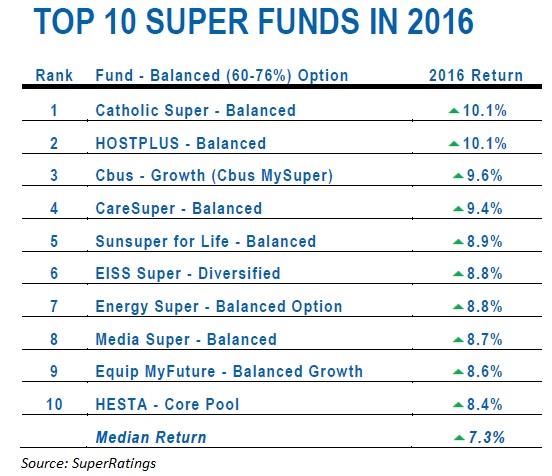

Returns ranged between 4.2 per cent and 10.1 per cent, with both firms ranking the Catholic Super Balanced fund and the Hostplus Balanced funds in top place with annual returns of 10.1 per cent.

Next was the Cbus growth fund with 9.6 per cent, the CareSuper Balanced fund with 9.4 per cent, and the SunSuper Balanced fund with 8.9 per cent.

Longer-term returns for super continue to sit close to funds' inflation targets, with the seven-year return sitting at 7.6 per cent per annum. The 10-year return is sitting at 5.1 per cent per annum due to impact on returns of the Global Financial Crisis.

However, over longer periods, superannuation funds have generally delivered solid performance, and while 10-year returns are marginally below the common inflation plus 3.5 per cent target, medium-term returns continue to sit well above these levels.

“When you look at the long-term performance of super as a whole, it is clear that Australians have been well served by the system,” according to SuperRatings chairman Jeff Bresnahan. “It is important to note that, since the GFC, there has been only one year of negative returns, and 2016 represents the fifth consecutive year of robust positive returns. While 2017 will certainly have its own challenges, we expect long-term performance to hold up.”

Australian listed and direct property were the top performing asset classes in 2016, but super funds were also bolstered by strong performance from local shares.

“Three of the key stories in 2016 were the shock ‘Brexit' vote, the equally surprising Donald Trump election victory and the timing of the second US interest rate hike,” said Chant West director Warren Chant.

“All of these created uncertainty, but share markets again proved how resilient they can be. Investors chose to focus on the gradual improvement in the US economy and what that might mean for global growth, and as a result international shares returned 8.9 per cent in hedged terms and 7.9 per cent unhedged. Australian shares did even better, returning a healthy 11.8 per cent.”

Infrastructure performed particularly well, with unlisted infrastructure generating 17.3 per cent and global listed infrastructure 12.7 per cent. Private equity produced a more modest return of 7.8 per cent.

Defensive asset sectors yielded the lowest returns but were still in the black. Australian and international bonds gained 2.9 per cent and 5.2 per cent, respectively, while the return from cash was just 2.1 per cent.