Super fund returns crack double digits

|

Summary: It wasn't the best way to end off the financial year, with the Australian market falling in tandem with a sell-off on the US market. Yet, even with a drop of more than 1 per cent, most managed super funds have done quite well. Self-managed super fund trustees should be benchmarking their performance against the broader superannuation marketplace. |

|

Key take-out: International and Australian shares delivered the best returns in 2016-17. Property trusts went backwards, while bonds and cash remained weak performers. |

When it comes to investment performance, the story is always in the bottom-line.

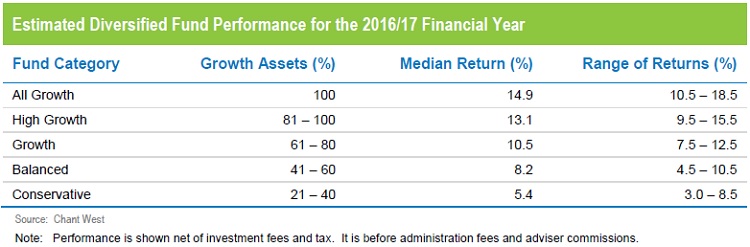

The bottom-line for self-managed superannuation fund investors is that the median investment return to beat for the 2016-17 financial year was more than 10 per cent.

That's despite the slightly negative impact of a fall of more than 1 per cent on the Australian share market on the final trading day of the financial year, spurred by an overnight sell-off in US technology stocks linked to profit-taking and end-of-quarter portfolio adjustments.

Of course, timing is everything. With major new super fund rules coming into effect on July 1 linked to super fund account balances, the 1.5 per cent market fall will cut the value of some SMSF holdings.

Yet, even after the untimely June 30 slip, median balanced super funds returns have bettered 10 per cent. SMSF trustees should be expecting to have achieved at least the same outcome for the financial year.

The benchmark return is based on a portfolio with roughly a 61 to 80 per cent allocation to growth assets, with the balance directed to areas such as fixed income and cash.

Eight years of growth

The final numbers show a positive return for the eighth consecutive financial year, and cap off a 110 per cent market rebound since the end of the global financial crisis.

But, while achieving a return above 10 per cent was respectable, better-performing managed super funds will have delivered returns above 12.5 per cent over 2016-17.

And the difference between the funds that have performed adequately, versus those that have exceeded the median return, all comes down to asset class allocation.

The best returns over the financial year have come from international equities, followed by Australian equities. The worst one-year returns were from listed property, which fell into negative territory, and from defensive assets such as bonds and cash.

Warren Chant, who heads up superannuation funds research and ratings firm Chant West, says the double-digit returns by managed super funds are impressive, especially following an extended period of economic and political uncertainty.

“We're not out of the woods yet, but the economic indicators are looking better now than they were this time last year,” Chant says.

“The last negative financial year most people experienced was back in 2008-09. Since the GFC low point, the median growth fund has delivered a cumulative return of over 110 per cent, or an average of nearly 9.5 per cent per annum.

“That's over 7 per cent above the rate of inflation over the period, so it's comfortably ahead of the typical longer-term return objective for these funds which is to beat inflation by between 3 per cent and 4 per cent annually.”

Chant says the better performing funds will be those that had higher allocations to listed shares and to unlisted assets generally. It will also have helped to have a lower exposure to listed property, bonds and cash.

International shares outperform

At the June 30 curtain close, Australian shares are up more than 14 per cent. International shares have performed even better, with a return of 20 per cent in hedged terms and more than 16 per cent unhedged.

“So, it would certainly have helped your performance to have a sizeable exposure to listed share markets,” Chant says.

“It's been a different story for listed property, however. Australian REITs were the strongest performing sector a year ago but have been the worst performing sector this year, falling 3 per cent. Meanwhile, global REITs, although in positive territory, have returned just over 3 per cent.

“Unlisted assets aren't valued continually, so it will be a little while before we can see exactly how well they have performed. But we expect returns for unlisted infrastructure, unlisted property and private equity to be in the double digits or very close to that, once the June quarter revaluations are factored in.

By contrast, Australian and global bonds have returned 0.8 per cent and 1 per cent, respectively, while cash has returned just 1.8 per cent.