Subdued lending could stall the economy

Housing speculation continues to drive credit growth across the country. Lending otherwise remains quite muted, reflecting both the high existing stock of credit to businesses and households and the subdued outlook for the Australian economy.

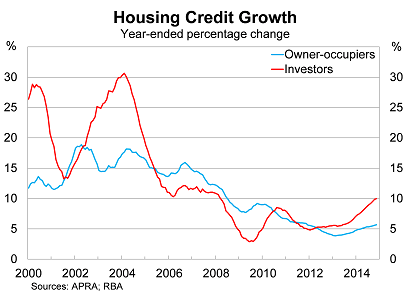

Housing credit rose by 0.6 per cent in November, to be 7.1 per cent higher over the year. Growth continues to be concentrated among investors, with credit outstanding to this segment rising by 10 per cent over the year to November.

Growth in investor activity is now at its highest level since March 2008. That might give the impression that this level of speculative activity is not particularly unusual -- a view only reinforced by the next graph -- but we have to remember that this growth is coming off an exceedingly high base.

As a general rule, the higher the stock of credit compared with GDP the greater the potential systemic and financial risks for any given level of credit growth. In the absence of a lengthy period of deleveraging, the Australian economy is unlikely to experience credit growth in the same vein as the 1990s and early to mid-2000s.

APRA tends to agree and it has established a range of rules to monitor lending activity within the investor segment. Earlier this month, APRA said in reference to investor activity, “growth materially above a threshold of 10 per cent will be an important risk indicator for APRA supervisors in considering the need for further action”. That ‘threshold' has now been reached.

The word ‘materially' clearly indicates that there is considerably scope for discretion. APRA supervisors plan on reviewing lending practices at each institution in the first quarter of 2015. While the aggregate figures are merely at the threshold, there will clearly be some institutions that are already materially above that threshold, including members of the big four.

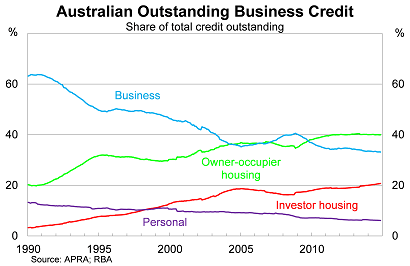

Credit to property investors has increased by 67 per cent since December 2007 and investor activity, as a share of total credit outstanding, has increased from 16.4 per cent in 2008 to 20.7 per cent over that period.

Credit growth to owner-occupiers continues to grow at a more moderate pace, rising by 5.7 per cent over the year and -- given mortgage approvals appear to have peaked -- I'd expect credit growth in this segment to peak in the next three to six months. Credit outstanding to owner-occupiers now accounts for around 40 per cent of total credit.

Credit to the business sector accounts for 33 per cent of total credit outstanding, down from 45 per cent in 2000.

Credit growth to businesses has begun to pick-up more recently, rising by 4.6 per cent over the year to November. But with commercial lending activity beginning to ease, it appears unlikely that the recent surge will persist.

Current lending dynamics do not appear to be conducive to strong economic growth or sufficient to rebalance the Australian economy. Lending isn't the only way in which businesses can expand but it often is the only way in which small businesses can survive and thrive. It certainly doesn't help that investor lending -- perceived rightly or wrongly as being less risky -- has effectively crowded out more productive investments.

The next few months will be interesting ones for the financial sector and the broader economy. If monthly lending activity has peaked -- and at this point it appears likely -- then there is a very real risk that the rebalancing of the Australian economy will stall. That's one of the key reasons why there has been mounting support for further interest rate cuts, which promises to be one of the key narratives for the Australian economy in early 2015.