Strong sector returns, but some things are wrong

Robert Gottliebsen

Strong sector returns, but some things are wrong

This weekend I am going to start by looking at which segments of the American share market have really performed in 2017, and which ones are lagging.

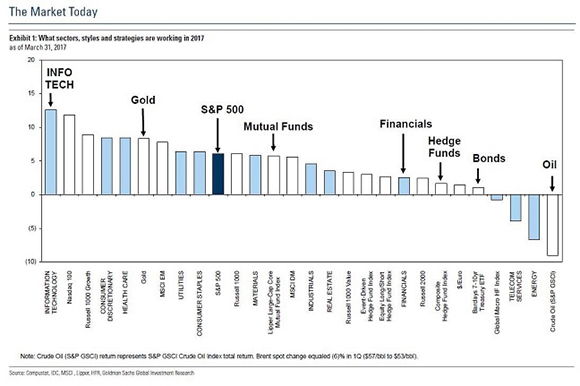

I am grateful for a remarkable chart from Goldman Sachs in New York, which sets out very clearly what has taken place. I will make comments on the graph, but no doubt you will have your own views and the chart leads us to the remarkable statements of the head of JP Morgan this week, and to some research by the Professor of Economics at Yale, Robert Shiller.

And then, finally, I will compress a whole raft of data into what I think is happening in Australia. Here is the US chart.

The sectors snapshot

As you can see along the bottom of the chart, information technology stocks have been by far the best performers in 2017, followed by NASDAQ and the Russell 1000 covering smaller stocks.

We are moving into an era where there will greater disruption as a result of new technology breakthroughs. And, indeed, I was yarning to a medium-sized business owner this week, who says his opposition is not conventional competition with rivals but rather disruptions from totally new developments that will produce unthought-of competitors.

The trick of management in today's environment is to watch for what is happening around you and not simply focus on day-to-day competition. And leading those new competitors are the American stocks in the info-tech sector. Also notice that the smaller companies are doing better than the bigger ones, because the market has fathomed that large corporations have great difficulty adapting quickly in the sort of world we have ahead of us.

But consumer discretionary stocks are doing well in the US because the market expects the Trump stimulations to boost discretionary spending amongst Americans. And, closer to home, look at the way gold stocks have performed.

They have been a real winner, and at the other end of the scale energy stocks and particularly oil stocks have been hammered. Clearly the market believes that the energy being produced by America will depress prices, and it is apprehensive about the OPEC production cuts. Note, this is a totally different view to BHP.

As you move down the list you will see that real estate has not performed all that well, and financial stocks led by banks have been particularly hard hit. Here, in Australia, our market is dominated by banks, so it is no surprise that we have not performed as well as Wall Street. And look at the miserable performance of the hedge funds. They have been calling it incorrectly.

Bonds managed to stay in positive territory, but telecom services have been hammered because clearly the market is nervous of the ability of the large telcos to adapt to this new environment.

And ailing America

And so, against that background, it was fascinating to read the description of the United States by Jamie Dimon, the chief executive officer of JP Morgan. He starts by saying: “The United States of America is truly an exceptional country, but it is clear that something is wrong”. In the list of things that are wrong, he names inner-city schools that are failing poor children, high schools and vocational schools that are not providing skills to get a decent job, and anaemic infrastructure planning and spending which has meant that the US has not built a major airport in more than 20 years.

And then he points out that corporate taxes are so enormous that they are driving capital and brains overseas, and regulation is excessive. Now, of course, those statements are almost exactly what President Trump has been saying, and indeed Jamie Dimon was a possible candidate to be in the Trump administration.

The market expects Trump to rectify all those problems and create jobs. But if something goes wrong or the whole process is delayed, then we are back to Dimon's starting point that America is a country where something is wrong.

We have an American stock market that is incredibly finely tuned at the moment, and that downgrades the Trump risks.

Signs of an overheated market

Against that background, across my desk this week came some research from Robert Shiller. Remember, he is an academic but his remarks about the US market have a ring to them that is similar to what Dimon is saying.

Shiller says that important market measurements tell us that the market is quite expensive, and that investor optimism is tinged with plenty of worry. None of this tells us where the market is going tomorrow, but it suggests that some caution is advisable, and that returns over the next decade or so are likely to be constrained.

His first measurement is the CAPE ratio – the inflation-adjusted stock price divided by a 10-year average of real earnings. Shiller says averaging earnings over 10 years smooths short-run or cyclical fluctuations, thus providing a better indicator of fundamental value.

CAPE had averaged about 15 since 1881, and in the years when CAPE was lower than 15 the subsequent 10-year returns for the stock market tended to be good. In years when it was higher, the 10-year returns tended to be bad.

The ratio is now almost 30. Using monthly data, it has been higher only in 1929, when it reached 33, and in the few years around 2000, when it reached 44. We know what happened in the years that followed.

Investor sentiment is another factor, and current readings also give cause for concern. In calculating investor sentiment, Shiller uses regular opinion surveys of institutional and individual investors undertaken by Yale. The survey indexes are measured in six-month intervals, and the latest data is for the six months to February 28, which includes the election of President Trump.

Valuation confidence in February was quite low. The only time it has been lower was in the years surrounding the market peak of 2000. Investors aren't confident that current prices are reasonable or that the market is stable.

On the other hand, one-year confidence is at a record high for institutional investor and it is at the highest level since 2007 for individual investors.

Shiller says we don't know where the market will go this month or this year. It could well rise a lot. But given the high pricing of the market — and the public perception that the market is indeed highly priced – investors should not let themselves be tempted to bet aggressively on the Trump bull market.

Beware of using interest-only loans

And finally, back to Australia. A great many people here, particularly high-income earners, have become very frustrated by the superannuation curbs and have been taking out interest-only loans to buy residential property using negative gearing. Indeed, some 50 to 60 per cent of Australian bank investor loans are now interest-only.

Combined with the Chinese buying, this has created a major buying force which has boosted dwelling prices in Sydney and Melbourne and also helped the other capital city markets.

The government, bank regulators and the Reserve Bank are determined to stop this continuing. In their anxiousness to prevent a housing bubble that might affect the prosperity of our banks, the regulators and government are playing a dangerous game.

What they probably don't realise is that with non-public servant incomes depressed and low interest rates affecting self-funded retirees, rising power and gas prices are beginning to affect consumer spending. In the first few months of this year food expenditure is up (so the supermarkets will be happy), but café and restaurant expenses are down.

To save money we are eating more at home, which surprises me. Meanwhile, we are cutting back on other areas of discretionary spending. What is really helping the total scene is the wealth effect of higher dwelling prices.

If that is stopped we will see a much tougher retail sector. And we all know, as that starts to happen, it will affect income levels throughout the community.

For what it is worth, I would be cautious of taking interest-only loans to negatively gear houses in this environment.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

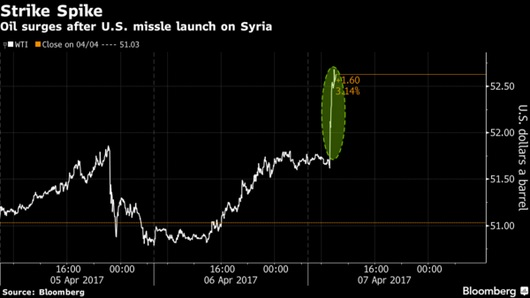

- Most share markets slipped over the last week with ongoing nervousness regarding whether President Trump will pass his pro-business reforms, the Fed signalling a likely start to reducing its balance sheet later this year and a US missile strike against Syria injecting a bit of uncertainty. Bond yields fell. Commodity prices mostly rose led by oil and gold but the $A fell.

- News that the US has launched a missile strike against Syria in response to a chemical attack on civilians does add a bit of short term uncertainty but we have seen such events in the past and the impact usually proves short lived. This is likely to be the case again, particularly as it's unlikely to signal increased US involvement in the war in Syria.

- In terms of the policy progress around President Trump: the resurrection of debate around healthcare reform is a negative in that it could delay tax reform but a positive in that if its successful it can result in budget savings that make tax reform easier; the change to Senate rules to allow a simple majority of 51 to approve Neil Gorsuch to the Supreme Court will further enrage Democrats and risk more gridlock long term but is unlikely to have much impact in the short term as the GOP has the 51 Senate votes; talk of bringing back Glass-Steagall regulations won't go anywhere as there is no support for such a move in the US Congress; the meeting between Presidents Trump and Xi Jinping is likely to be long on “consulting” and “cooperating” but at least the risk of a Trump driven trade war will remain on the back burner for now. In short lots of noise around all this – but as long as Trump's pro-business agenda remains the focus investment markets won't be too fussed.

- The US Federal Reserve signals that the third phase of monetary policy normalisation – ie, balance sheet reduction - is likely to get underway from later this year. The first phase was the tapering and then ending of quantitative easing or QE (which had involved the Fed expanding its balance sheet using printed money to buy government bonds and mortgage backed securities) between January and October 2014, the second was the start of interest rate hikes in December 2015 and the third will be letting its balance sheet start to decline with the minutes from last month's Fed meeting indicating that this is likely to be appropriate from later this year. The Fed has long signalled that this will be achieved by not reinvesting (or rolling over) the proceeds from maturing bonds in its balance sheet and from the Minutes it looks to favour a phasing down of its reinvesting. In other words, it won't actually have to sell any bonds to run down its balance sheet. The first two phases in moving to more normal monetary policy were associated with corrections in share markets (the “taper tantrum” of mid-2013 and the correction in share markets between May 2015 and February 2016) as investors fretted the Fed will automatically wind back stimulus regardless of the impact on the economy. So there is a risk of something similar happening in the months ahead particularly given that share markets have been vulnerable to a correction for some time. However, there are several reasons not to get too fussed:

- First, as the first two phases showed the Fed will not blindly start to run down its balance sheet but it will be contingent on a continued improvement in the US economy so it's likely to be gradual and subject to stopping and starting if needed.

- Second, balance sheet run down is likely to be substitute for rate hikes so if it commences this year it adds to confidence the Fed will only do two rate hikes this year and not three.

- Finally, while it will involve a net increase in the supply of bonds in the market and so along with further rises in US interest rates points to a resumption of rising bond yields – the Fed won't be actually selling bonds so the rise in bond yields is likely to be gradual.

- The bottom line though is that Fed balance sheet reduction along with the end of quantitative easing and rate hikes signal that the Fed's efforts to support the US economy since the GFC have worked and that it's appropriate to continue to take it off life support. This is a good thing.

- In contrast to the Fed, the ECB and Bank of Japan are yet to start even the first phase of monetary policy normalisation – they are still doing QE. Relative monetary policy still points to a strong $US against the Yen and Euro and the same applies relative to the $A with the RBA on hold.

- The first round of the French presidential election is now only two weeks away on April 23rd. Polls continue to show Le Pen and Macron on around 25 per cent of the vote each. So it remains likely they will make it through to the run-off on May 7 where polls show Macron leading Le Pen by around 20 per cent.

- RBA on hold and likely to remain so well into 2018. As widely expected the RBA left the cash rate on hold at 1.5 per cent for the eighth month in a row. The uncomfortably hot Sydney and Melbourne property markets along with RBA expectations that GDP growth will return to around 3 per cent and that underlying inflation has bottomed argue against a rate cut. Against this, high unemployment and underemployment, the too high $A, fragile economic growth and downside risks to underlying inflation all argue against a hike. Meanwhile, bank rate hikes, regulatory moves to tighten lending standards and hopefully action in the May budget on the capital gains tax discount should help deal with financial stability risks around house prices and household debt giving the RBA flexibility to set rates in the best interest of the wider economy and not just the Sydney and Melbourne property markets. Our view is that rates have probably bottomed and that the next move will be a hike but not until the second half of 2018.

- The drip feed of cooling measures and negative news flow - bank rate hikes, tightening measures by APRA and ASIC, talk of increased bank capital requirements which will only result in more out of cycle rate hikes and the frenzy of authorities and commentators warning about the risks - should at least help slow the Sydney and Melbourne property markets. For investors who think that the 10-15 per cent pa average home price gains of the last four or five years are a guide to the future its worth having a look at Perth home prices which are where they were ten years ago. Ten years of zero capital growth in Sydney and Melbourne would mean a housing return of just the net rental yield which is 2 per cent or less.

Major global economic events and implications

- US data was mostly solid with slightly softer but still strong readings for ISM business conditions indexes in March, strong jobs data, a rise in construction spending and a better than expected trade deficit. A fall in auto sales was the main disappointment and GDP growth for the March quarter is tracking just 1.2 per cent annualised according to the Atlanta Fed's GDPNow. That said US March quarter growth is often soft.

- Eurozone retail sales rose more than expected in February and unemployment continued to fall reaching 9.5 per cent. While unemployment is still high from a growth perspective it's the direction that counts and its down from a high of 12.1 per cent in 2013.

- The Japanese Tankan business conditions survey showed further improvement in the March quarter as did the March composite business conditions PMI and consumer sentiment is up all of which points to reasonable economic growth.

Australian economic events and implications

- Australian data over the last week highlighted why the RBA needs to remain on hold. On the one hand March house prices rose strongly with Sydney and Melbourne remaining very hot, the AIG's manufacturing and service conditions PMIs taken together were solid, job ads rose, building approvals rebounded and the trade surplus rose to a near record. Against this though February retail sales were soft, building approvals still look to have peaked, the near record trade surplus partly reflected weak imports which is a negative sign and in any case will fall in the next month or two thanks to Cyclone Debbie's hit to coal exports and the MI Inflation Gauge showed underlying inflation

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Upcoming economic and financial market events

Key employment data in focus

- In Australia there is a healthy offering of new economic data in the coming week. Overseas the highlight in China are trade and inflation figures. Similarly in the US inflation will be in the spotlight with retail sales.

- In Australia, the week kicks off on Monday with data on housing finance (new home loans). The tighter lending standards adopted by the banking sector are likely to result in loans for owner-occupiers (those who want to live in the homes) easing by 0.7 per cent in February. And the total value of all new loans may have fallen by 1.2 per cent in the month.

- On Tuesday, Roy Morgan and ANZ release the results of the weekly consumer confidence survey. Home prices and company tax cuts are hogging the radar screen at present.

- National Australia Bank also releases the March business survey results on Tuesday. The NAB business conditions index eased from a 9-year high of 16.3 points to 9.3 points in February. And the business confidence index eased from a 3-year high of 9.7 points to 6.9 points.

- On Wednesday, the Westpac/Melbourne monthly survey of consumer confidence is issued together with data on dwelling starts from the Bureau of Statistics (ABS).

- Also on Wednesday, the ABS releases data on lending finance – the broader data on new lending across the economy – including business, personal, housing and lease loans. Investor housing is one of the key drivers at present. Also the Reserve Bank releases February data on credit card and debit card transactions. Plastic cards are being used more often, especially for smaller transactions.

- On Thursday, the monthly employment report is released. The labour market data has been resilient despite the weaker result last month. Importantly the weakness last month was largely driven by part-time jobs. We expect that the below-average growth will give way to above-average growth in March and we are tipping job growth of around 25,000 in the month. The jobless rate should remain near 5.9 per cent.

- Also on Friday the Reserve Bank releases its bi-annual Financial Stability Review. While primarily designed to check the health of the financial system, a big focus in Thursday's report will be comments on the home building markets in various capital cities, notably Brisbane and Melbourne.

China inflation & trade; US inflation

- Chinese and US economic data compete for top billing in the coming week. The highlight is probably Chinese trade data on Thursday and the US retail sales and inflation data both due on Friday.

- On Monday the week kicks off in the US with the Employment Trends report.

- On Tuesday the NFIB Business Optimism index is issued – a gauge of small business sentiment. And on the same day the JOLTS report of job openings is released – a forward-looking indicator on the strength of the job market. The usual weekly data on chain store sales is also issued on Tuesday.

- On Wednesday, Chinese data on producer prices and consumer prices are released. Business inflation is no longer going backwards, and the latest result should show that producer prices are up 7.6 per cent over the year – just off the fastest growth in eight years. In contrast, data should show consumer prices are lifting at a more sedate pace with 1.0 per cent annual growth of prices expected in March.

- Also on Wednesday in the US, data on export and import prices are to be released together with the monthly budget statement. The usual weekly data on mortgage finance is also issued.

- On Thursday in the US the weekly data on claims for unemployment insurance is released together with data on producer prices and the preliminary University of Michigan consumer confidence reading for April. Excluding food and energy prices, overall producer prices may have lifted by 0.2 per cent in March, keeping annual growth near 1.5 per cent.

- In China on Thursday, March trade data is issued in China. Data from previous months has been complicated by the timing of the Lunar New Year holidays. A US$10 billion trade surplus is tipped for March.

- On Friday, two key US indicators are slated for release; US consumer prices and retail sales. The Federal Reserve is keeping a close eye on inflation especially with regards to the timing for future rate hikes. For the record, the headline inflation reading may have actually edged up only 0.1 per cent in March, leaving headline growth near 2.7 per cent. But the more important core inflation measure (excludes food and energy) is likely to have risen by 0.2 per cent in the month to be up 2.2 per cent over the year.

- In terms of spending, economists expect that US retail sales rose by 0.3 per cent in March with a similar increase expected when auto sales are excluded.

- Also on Friday, data on US business inventories is released with a 0.3 per cent increase expected.

Financial markets

- The US first quarter earnings season gets underway in the coming week. Alcoa is slated to release earnings on Monday. And on Thursday, Citigroup, JP Morgan Chase and Wells Fargo are expected to report. Thomson Reuters tips 10.1 per cent annual growth in earnings by S&P 500 companies over the season.

Craig James is chief economist at CommSec.

Readings & Viewings

As we were compiling some of our Readings & Viewings on Friday, the Australian Stock Exchange was heading on a nice upwards trajectory to end the week higher. Wall Street had already closed higher. But as the US launched missile strikes on Syria, our market came off the boil.

The ASX lost ground, but that wasn't the case for oil and gold.

Skyrocketing house prices and calls for the government to intervene quickly have been all over the headlines this week, and not just in Australia.

Meanwhile, talking about banks, the first fallout from Brexit is seeing a slow exodus of bankers from London. But that's ok. Some workers are finding life better away from The City.

But comments from the IMF suggest that banks won't be feeling too unhappy if they get to charge higher fees.

Did you get the tweet? That is, of course, if you subscribe to Twitter and follow the social media stock. Co-founder Ev Williams has decided to sell a large chunk of his stock.

After a part-time job? Amazon is hiring in the US – the online retailer wants to put on 30,000 people.

So what does Amazon and electric cards producer Tesla have in common? Amazon boss Jeff Bezos and Tesla's Elon Musk are both involved in a space race to put more humans into orbit. They're spending billions, but they can afford it.

But you have to feel sorry for BP's chief executive Bob Dudley. His pay packet was cut by 40 per cent to a measly $US11.6 million last year after shareholders revolted.

By contrast, Oil Search boss Peter Botten received a 17 per cent raise in his 2016 pay packet.

Australian airlines have highly paid chief executives too, and they should take notice of how US airlines treat their customers when they cancel flights. Pizza anyone?

At least Qantas boss Alan Joyce has finally switched on free wi-fi.

Apple dropping Imagination should come as a warning to all the little guys at the mercy of the leaders.

The robot revolution may have already begun. After Samsung's Galaxy blow up last year, there's now reports of a smoking Samsung and an electrocuting iPhone.

Hang around dogs, and you might catch… laziness? There's new evidence that personality traits, like laziness, are contagious.

A few news organisations could use this guy, but they're probably not hiring.

Lastly, he had a stellar career as a US television comic and, sadly, Don Rickles passed away on Thursday at the age of 90. With a strong of appearances on films and TV sitcoms, Rickles was also well known as an “insult comic”. And here's some of Rickles' best celebrity insults.