Strategists see China stock rally into year end

Summary: Nomura's head of China equity research Wendy Liu is upbeat about Chinese stocks staging a moderate rebound. In November and December, third quarter results could show the reality in China is not as bad as investors fear, Liu says. Meanwhile, Goldman Sachs strategist Kinger Lau argues the correction in the A-share market could be almost done, as margin financing falls. |

Key take-out: Nomura's Liu likes the Hong Kong-listed H-shares of banks and insurers, saying a more subdued outlook for risk could lead to a re-rating of bank stocks. |

Key beneficiaries: General investors. Category: International investing. |

The fireworks displays that lit up China's skies to celebrate the National Day holiday are an apt metaphor for the performance of mainland stocks this year: Once dazzling gains from skyrocketing stocks quickly faded as the formerly red-hot bull market fizzled, leaving a lot of smoke as paper profits went up in flames.

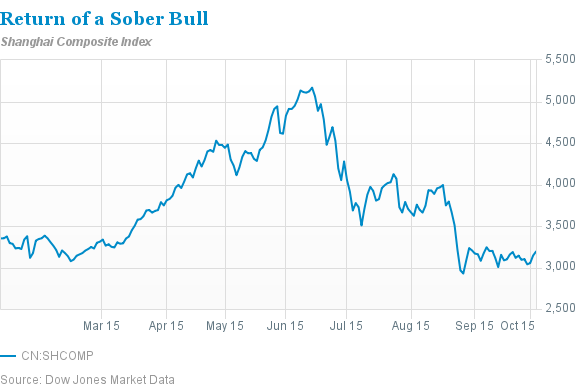

It's been a gut-wrenching ride for investors and speculators in China's A-share market, which includes stocks listed in Shanghai and Shenzhen. From sizzle to fizzle, the Shanghai Composite rose 60 per cent from the start of the year to its June 12 peak, only to crash 43 per cent to its low on August 26 as the boom in margin financing went awry. But the benchmark index bolted out of the blocks in the first trading session of the fourth quarter, jumping 3 per cent on Thursday, and offered hope for a rebound amid the exit of flighty retail investors and less frothy valuations.

Nomura's head of China equity research Wendy Liu is one market maven who is upbeat about China stocks staging a moderate rebound, or as she puts it, seeing “the return of a sober bull”. But investors should expect a few rough patches as the market continues to be dogged by concerns about the strength of China's economy and Beijing's commitment to pursuing much needed reforms. However, any pull back in stocks may present opportunities for long-term investors.

The exit of retail investors juiced up on margin finance in the pursuit of quick gains is clearly a positive. Chewed up and spat out by the vicious selloff, the retreat of the hordes of retail speculators has brought a calmer pace of trading. Mizuho strategist Kengo Yoshida says retail investors had accounted for as much as 85 per cent of trades, but average daily turnover in Shanghai in the last week of September was less than a third of levels at the end of May. Additionally, the balance of margin loans, which fuelled the fevered rally, has shrivelled from close to CNY2.3 trillion in mid-June to CNY907 billion, which is around levels last December.

Less margin financing and retail investors suggest the correction in the A-share market could be almost done, argues Goldman Sachs strategist Kinger Lau. Lau notes that the ratio of margin financing to market capitalisation is now on par with that of the US, which means “the market could be close to equilibrium without government buying”. Meanwhile, 95 per cent of suspended stocks have resumed trading, while cash ratios for Chinese mutual funds are at record highs.

Valuations also don't look pricey anymore. Shanghai-listed A shares trade at around 12 times forward earnings, which is below the long-term average of 14.4 times. The valuation is also lower than that of markets with far worse economic backdrops, notes Nomura's Liu. For example, Thailand trades at 13 times forward earnings and Malaysia 14.5 times.

However, while A-shares look to be on firmer footing, there may be some market wobbles over the coming month. “October could still be mixed and tentative,” notes Nomura's Liu. Beijing's 13th Five-Year Plan, a blueprint for China's economic and social development, will be unveiled at the fifth plenum of the Chinese Communist Party Central Committee next week. The plan is expected to include initiatives to double the size of China's economy by 2020 from its 2010 level, which would be a boon for stocks. But near-term concerns about growth could weigh on confidence as key economic data is released in mid-October, including industrial production, and may be weaker than expected, cautions Nomura's Liu.

Pullback may be a buying opportunity

Nomura's Liu likes the Hong Kong-listed H-shares of banks and insurers. A stock to consider is Industrial and Commercial Bank of China (1398.HK), which Barron's took an upbeat view on in late August. While the Hong Kong-listed stock of China's biggest bank has risen 12 per cent since then, at HKD5.07 a share, it's still down 25 per cent since the start of the third quarter. ICBC H shares trade at 0.9 times book and at a 9 per cent discount to their A-shares. Another interesting stock is Ping An Insurance (2318.HK), one of China's top performing private sector companies. At HKD42.5 a share, the life insurance giant is down 27 per cent since the start of the third quarter. The stock trades at 1.9 times book value, which is well below five-year average levels, and offers a 19 per cent return on equity.

Prospects for Chinese stocks could brighten come November and December as earnings underscore the ability for good business to continue to grow despite the slower economy. “By then, third quarter results may help to show the reality in China is not as bad as currently feared,” argues Nomura's Liu. For example, life insurance companies posted faster new business value growth in the first half and are likely to continue to enjoy double digit growth in the second half on rising agent numbers and higher margin products. Sure, banks are likely to be pressured by higher non-performing loans and narrower net interest margins, which could see analysts cut earnings estimates, but Liu says valuations for Chinese banks are primarily driven by perceptions of risk and not earnings. A more subdued outlook for risk could lead to a re-rating of bank stocks, argues Liu.

China is in the fifth year of an economic slowdown as Beijing reorients growth towards consumption. Nomura recently cut its GDP growth forecast for the world's second largest economy to 6.8 per cent for 2015 and 5.8 per cent for 2016. But the going may not be as bad as it looks. Sure, gauges of industrial activity have plunged but it “overshadows solid service sectors,” notes Nomura's Liu. Consumption growth has been steady, with retail sales growing at a 10.8 per cent year-on-year pace in August compared to a 10.5 per cent pace in July. Clothing giant Fast Retailing (9983.JP), which owns the Uniqlo brand, posted a 66 per cent jump in third quarter operating profits from China compared to a year ago. Meanwhile, China's companies have been boosting research and development spending over the past five years as they seek to move up the value chain. “We believe the market's current pessimism is overdone,” argues HSBC economist Qu Hongbin.

Beijing also hasn't been shying away from easing policy to cushion the slowdown. The People's Bank of China has cut interest rates by 1.4 percentage points and the reserve ratio requirement (RRR) for banks by two percentage points since embarking on an easing cycle last November. And there's more to come. With real, or inflation adjusted, interest rates remaining high and the RRR still elevated compared to historic levels, the central bank has leeway to ease policy further. HSBC's Qu expects the PBOC to cut the RRR by another 1.5 percentage points in the fourth quarter and by 2 percentage points in the first half of 2016. Qu has pencilled in a half percentage point of interest rate cuts by the end of next year. Looser monetary conditions would be a boon for financial stocks and help relieve stress in bank's loan books.

The yuan remains a focus for many investors after Beijing's surprise devaluation. Intervention by Beijing has stabilised the yuan at levels around 6.35 to the US dollar over the past two weeks after the PBOC engineered a 3 per cent weakening of the currency and sparked an aggressive outflow of funds. Nomura expects the yuan to finish 2015 in the vicinity of current levels, at 6.5 against the greenback. Beijing has emphasised there is no basis for “sustained depreciation” and with foreign reserves that are still large by international standards albeit slightly depleted, as Nomura's Liu puts it, it has the means to save face.

This piece has been reproduced with permission from Barron's.