Stop dipping into super savings

Australians are increasingly dipping into their superannuation to pay off their mortgages and cover medical and funeral expenses. At the same time, independent Senator Nick Xenophon continues to push his plan to allow first home buyers access to their superannuation to pay for a housing deposit. Have we become too cavalier about our retirement?

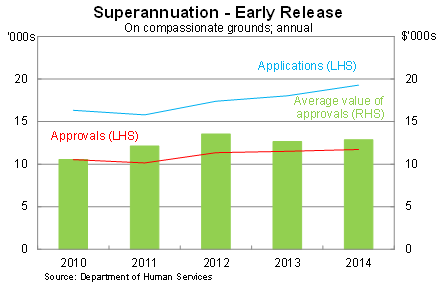

New figures from the Department of Human Services paint a fairly bleak picture. The number of Australians who applied for early access to their superannuation increased by 7 per cent in the 2013-14 financial year. Around three-fifths of those applications were approved.

According to the Department of Human Services, the early release of superannuation benefits program “allows eligible people to draw on their superannuation benefits under specified compassionate grounds in a time of need.”

The release of funds is, however, relatively limited and provides assistance in areas such as medical treatment, home and vehicle modifications to accommodate a severe disability and palliative care. Assistance can also be granted to help an applicant meet their mortgage costs when there is an imminent threat of default.

As a result, early release of superannuation appears to be a relatively reliable measure of hardship in the Australian economy. Naturally some applications will reflect unfortunate or unavoidable events but, on other occasions, funds are released to address economic issues such as mortgage stress.

That might seem innocuous, but it begs the question: are we becoming complacent about our superannuation and the vital role that it plays in our retirement system?

The early release of superannuation benefits program released a total of $150 million to account holders in the 2013-14 financial year -- or $12,874 per person. The amount is small in terms of the broader economy at just 0.01 per cent of nominal GDP, but the amount released has increased by 36 per cent in just the last four years.

It's fair to say that this isn't an important issue on a macroeconomic basis -- at least not yet -- but it's pretty important for individual households with vast implications for their future well-being.

The recent period has been a difficult one for many Australians. The mining sector has boomed but conditions have been much weaker for the household sector as a whole. The unemployment rate has generally trended upwards and increasingly job creation has been concentrated in part-time roles.

Realistically, we should expect this trend to continue. Interest rates are not at historical lows levels because the Reserve Bank is generous, they reflect domestic demand and conditions in the labour market. Furthermore, the property market has experienced a boom period and is widely expected to ease in the next couple of years.

We also shouldn't ignore the fact that our superannuation holdings are rising year-after-year providing greater incentives to access funds early.

But I'd also say that dipping into our superannuation savings remains undesirable. Sure, large parts of the superannuation system are run by fraudsters who create no additional value, but overall it remains the cornerstone of our retirement system and shouldn't be compromised -- particularly to pay for hardship that could be more easily managed through insurance.

Nevertheless, that hasn't stopped calls to compromise the system further.

Recently, Senator Nick Xenophon put forward a plan to allow younger Australians access to their meagre superannuation savings to fund their housing deposit. It's an appalling idea which will do nothing to improve affordability or increase homeownership (A worrisome debt trap for first-home buyers, July 29). The only people who will benefit are investors who, like Xenophon, own extensive property portfolios.

Perhaps more disturbingly, many younger Australians are all for the scheme. I have no doubt that they fail to grasp the intricacies of Xenophon's plan or the fact that it would operate in a similar vein to the first home owner grant -- a policy that has failed time and time again to improve affordability.

Unfortunately, it highlights the low value that many Australians place on their retirement.

At least for now that policy appears dead in the water. Finance Minister Mathias Cormann came out strongly against the scheme, noting that “pumping more money into the housing market by letting people access their superannuation savings more freely will not bring down the cost of housing.”

But who is to say that he and the Coalition won't change their mind if the property market starts to tank? They certainly have a lot of skin in the game (The conflict of interest killing housing reform, August 6).

The superannuation system remains the cornerstone of Australia's retirement system but every exception or irregularity -- good intentioned or not -- erodes the systems credibility and its usefulness as a vehicle to fund our retirement.

The early release of superannuation benefits program fulfils a valuable role and yet most households could better manage hardship through insurance rather than compromising their superannuation holdings.

Twelve or thirteen thousand dollars might not seem like much, but to lower-income earners -- who are overwhelmingly more likely to experience hardship -- it accounts for a large share of their superannuation holdings.

In the long-term, it could prove the difference between financial independence and relying on the aged pension. Households cannot ignore the fact that the demands placed on the government are increasing and it is far from certain that a generation from now the aged pension will bear any resemblance to the system currently in place.