Stay with the yield play

| Summary: The next big investment call has already been made, as some fund managers move their capital out of defensive yield stocks into those with a strong growth outlook. But should small investors pull the yield pin now? While they’re more expensive, there’s still money in our banks and other big yielders. |

| Key take-out: The relative attractiveness of yield stocks is unlikely to change too much over the next six to 12 months. |

| Key beneficiaries: General investors. Category: Shares. |

With the Federal Reserve Bank expected to taper its Quantitative Easing program this week, and if not this week at some stage this year, there’s been a natural tendency for analysts to recommend a switch out of yield stocks.

It seems that regardless of timing, the taper (end to money printing) will be a feature of the market for some time ahead. Indeed the Federal Reserve’s stated intent, if current economic projections turn out as expected, is to end QE for good by the middle of 2014. With that in mind, the arguments presented are logical and intuitive.

Yield stocks, even in Australia, got a boost from QE and the exceptionally low global interest rate environment this brought about. In turn, its looming demise has seen global bond yields surge. To add to this case, there have been reports of US hedge funds marking Australian banks as a sell – again – because they are overvalued. Moreover, the common wisdom now isn’t about if you should switch, but what you should switch into. And that’s how much analysis reads – it’s taken as a matter of fact.

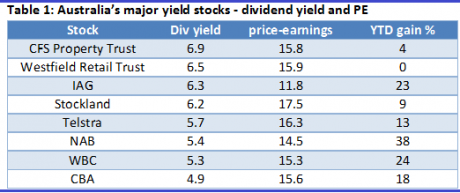

But I don’t think it’s quite so black and white. For me, the decision to switch, or not, comes down to one question. Are there any reasons to continue to pay a premium for these stocks? Certainly many of them are trading at a premium – on paper hedge funds are right about banks, they are expensive. You can see this for some of them in table 1. Telstra, for instance is at a trailing PE of 16 – a 1 year forward PE of around 15. The historical average is closer to 11. It’s the same for our big banks as well – CBA, for instance, is on a trailing PE of nearly 15.6 – a 1 year forward PE of 14.6, which compares to an actual historical average closer to 13.

So the argument is that with bond yields rising and yield stocks already expensive, there is little point in paying the premium now.

Notwithstanding this, and despite the ongoing concerns raised by foreign hedge funds, I still think there are some very good reasons why they are still worth the premium. Consequently, I think the relative attractiveness of yield stocks isn’t going to change too much over the next six to 12 months. Here’s why:

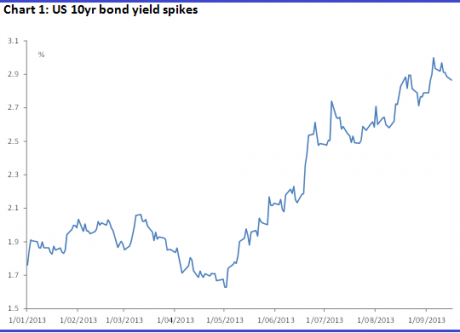

1. I appreciate that global bond yields have surged. The US 10-year yield has shot up 128 basis points (or 1.28% from 1.61% to 2.89%) since May, dragging bond yields around the world up with it. The Australian 10-year bond has gone from about 3% to almost 4% over the same period.

Yet concerns about this spike overlook the fact that these bond yields are still extremely low by historical standards. Even after that increase, there is no comparison between a bond yield of 4% – if you hold it till maturity – and a grossed-up dividend yield of 7-8% (that our banks pay) or even higher.

More to the point, and as I discussed in my July 26 piece, Bond yields no curve ball, there is probably a limit as to how high bond yields will go anyway. Even with a taper, the Fed will still be buying most bond issuance (indirectly) for the next financial year. Additional buying will probably come from global income funds incentivised to switch out of lower European and Japanese yields.

2. As a ‘taper’ is not a tightening in monetary policy, it should have limited impact on the short end of the rates curve. A QE taper, or even its complete cessation, will have little impact on short-term rates because the Fed isn’t buying short-term debt and will continue to provide cash to the system (if needed) to keep its short-term target of about 0%. Indeed, so far this cycle, the lift in short-term rates has been modest. For instance, the US 2-year bond rate is up 20bp and yields 0.43%. The Aussie 3-year bond is at 2.84% and little changed for the year so far – well beneath any dividend yield of the banks. More to the point, the RBA still has an easing bias and this will keep short-end rates – and deposit rates – low.

3. Points 1 and 2 strongly suggest that any concerns that rising bond yields might dampen loan growth (for the banks) are wide of the mark. Interest rates are still very low and will be low for some time to come.

4. More generally, bond yields might be rising, but they are still one of the riskiest investments in the market. The extreme capital risk if there is a rout makes them very unattractive to retail investors and a very poor substitute for high yield stocks, which, in the current environment, are subject to less capital risk.

5. Some high-yielding stocks may be expensive based on past earnings, but whether they are expensive on a 12-month view depends on your view of the earnings trajectory. I’ve mentioned banks in the past and while people talk of them as a yield play, I think focusing only on that misses the growth story. Remember that system credit growth is extremely low right now – with record low interest rates the only way is up. To expect credit growth to remain this low, you have to believe that monetary policy doesn’t work and that credit growth will even remain below incomes growth. Fortunately, recent data shows a lift in new lending. For me, current earnings estimates of between 5-7% on average for our banks over the next couple of years is too low. Viewed in that light, yield stocks like our banks are not expensive or overvalued.

6. Also viewed in that light, current payout ratios – of our banks – are sustainable. The ratios may not lift further but payout ratios aren’t stretched to begin with. CBA’s is around average, same with NAB, and while some individual banks may have higher ratios that isn’t by itself a reason to offload an entire sector. It’s against the backdrop that APRA’s concerns about banks depleting capital by paying dividends is imply absurd

Conclusion

To conclude then, American fears regarding rising bond yields are just not applicable here. Our banks pay high, sustainable dividends, which are and will remain well above bond yields for some time. Therefore, Australian banks and other yield stocks are not as vulnerable as they might be in the US. I certainly don’t see any compelling reason, based on the fundamentals, for retail investors to switch.