Stand by for a post-election small caps rally

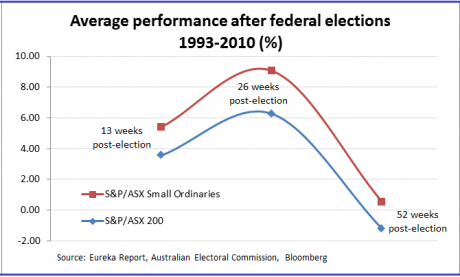

| Summary: If history is any guide, there’s a strong chance that the small caps sector will rally after the September 14 federal election. That’s because smaller stocks are heavily geared to potential changes in government policy. Since 1993, the S&P/ASX Small Ordinaries Index has gained an average 5.4% in the 13 weeks after a federal election, and 9.1% after 26 weeks. |

| Key take-out: The biggest beneficiaries are likely to be in the non-mining sectors, including transport, housing, healthcare and consumer discretionary. |

| Key beneficiaries: General investors. Category: Growth. |

Politicians aren’t the only ones that should be getting pumped up for the federal election. If anything, equity investors should be more excited, particularly those in small caps.

This perception is based on the optimistic belief many people have about improved market conditions once the current political uncertainty is resolved.

I’ll put this theory to the test, but I stress this isn’t a call on which political party is better for our market. A number of studies done here and in the US show that neither left- nor right-leaning politicians have much statistical impact on performance.

The argument is that it is the stability and predictability of government policies that companies and markets crave, and Australia will get that (at least on a relative basis) once the election is over, and no matter who becomes Prime Minister.

The chief executive of travel agency chain Flight Centre, Graham Turner, was the latest business leader to comment on the election when he said he expected consumer confidence to rebound after September (based on a September 14 federal election).

The theory makes sense, but where the rubber meets the road is the question of whether investors should be holding their breath for an after-election party.

Looking at elections over the past two decades, the answer seems to be a definitive “yes”. In fact, the post-election rally is one of the most predictable events on equity markets – even rivalling the popular “Santa Rally” (which is a market phenomenon where stocks outperform in the weeks before Christmas and into January).

There’s only one federal election in the past 20 years where the S&P/ASX Small Ordinaries Index did not generate a positive return in the three- and six-month period after the ballots were counted, and that was because any potential rally was rear-ended by the Global Financial Crisis following the 2007 “Kevin 07” campaign win.

Unless another global shock strikes out of left field, the September 14 election is likely to trigger a “further for longer” run in small cap stocks over their bigger rivals.

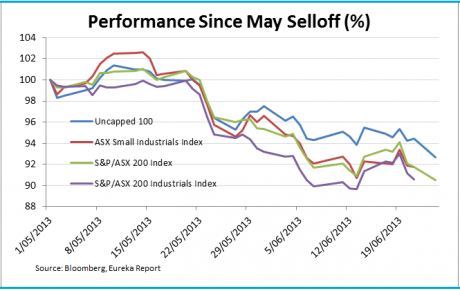

It may surprise you, but the Uncapped 100 stocks have been quietly outperforming the large caps since the sell-off in May. The broader small cap index has too, if you exclude deeply out-of-favour junior resource stocks (I’ve outlined some reasons for the outperformance in my recent Small caps on a winter run article).

While any post-election rally will also see large cap stocks run hard for up to six months, their performance has historically paled in comparison to small caps.

Since 1993, the S&P/ASX 200 Index has gained an average 3.6% in the 13 weeks after a federal election, and 6.3% after 26 weeks.

In contrast, the S&P/ASX Small Ordinaries Index has jumped 5.4% and 9.1% over the same periods, respectively.

The average 26-week performance for the small ordinaries during non-election years is 0.3%, while the average for the top 200 stock benchmark is 2.2%.

The greater exposure small caps have to the domestic economy is one key driver for the sector’s stronger historical performance, notes George Boubouras, the chief investment officer for Equity Trustees.

“Small caps by their very nature are heavily geared to potential change in government policy,” says Boubouras.

He cites medical services providers and gaming companies as examples of industries whose fortunes are heavily dictated by the government of the day.

It is also worth noting that the post-election effect is not confined to Australia. US equities also register robust above average gains in the few months following a presidential election.

However, the post-election goodwill boost to Australian shares tends to fade pretty quickly after the six-month mark, and it’s not possible to accurately quantify the impact of the post-election effect as there are always a number of forces driving the market at any given time.

Some will also question if the small ordinaries can manage a rally this time given the deep disdain many have towards small resource stocks, which make up a significant proportion of the small ordinaries index.

I can’t remember a time when junior miners and energy plays were this out of favour, as sentiment towards the group is far worse than during the GFC.

Add in worries about market withdrawal symptoms from the tapering of quantitative easing (QE – the printing of money by the US central bank) and cracks in the Chinese growth story from the recent liquidity crunch, and suddenly the prospect of a market recovery might seem somewhat laughable.

But, on balance, I think there are more reasons to be an optimist than a pessimist. For one, no-one believes that the Chinese authorities would allow their centrally controlled banking system and economy to fall over, regardless of the rhetoric.

Further, we will either keep getting the QE injection or a decent pick-up in growth from the US late this year or in the first-half of 2014. Both outcomes are positive for our sharemarket (in the short term at least); and if we do get a US economic and dollar recovery, this can only be good news for China.

Lastly, I think we will see junior resources register faint signs of life in the final quarter of this year if the US economy gains more momentum. Even if this doesn’t happen, I don’t think it will stop small industrial stocks from running ahead because the post-election effect is not the only tailwind supporting equities.

“Coincidentally, we have a lower [interest] rate environment and the recent fall in the Aussie dollar is also wonderfully timed,” says Boubouras.

“This combination with the post-election cycle will be very positive for the non-mining sectors in Australia.”

This is why he is urging investors to be overweight on transport, housing, healthcare and consumer discretionary sectors of the market.

I have written about some potential winners and grinners in the Uncapped 100 from the latest government budget, and these policies remain supportive no matter who gets into government.

As we get closer to the election, I will highlight other stocks in the Uncapped 100 that are likely to do well in the months after the election.

There aren’t many things investors can thank politicians for. Hopefully, the post-election rally will be one; and if this controversial point isn’t enough, ask yourself this: will we get a mother of Santa Rallies this year due to the confluence of the tailwinds listed above?

I think I just shuddered.